Credit-card bill: What it does, what it doesn't do

Loading...

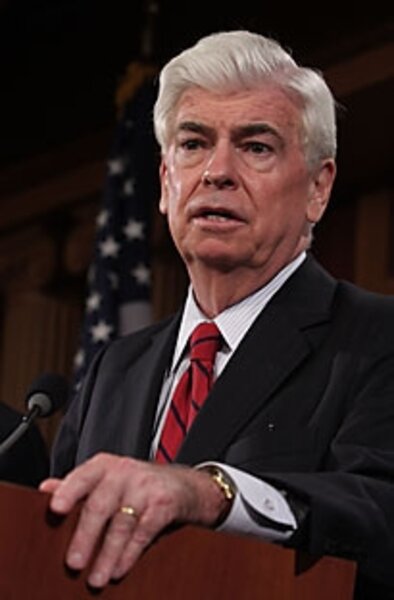

| Washington

In a rare rebuff to financial interests, the Senate voted 90 to 5 to impose new terms and limits on the credit-card industry.

It is a comprehensive measure that “fundamentally changes the entire business model of credit cards,” says the American Bankers Association, which opposed the bill. They say it will raise costs to consumers and limit access to credit.

Consumers groups also say the legislation will significantly change the relationship between Americans and their credit-card companies. But that, they say, is all to the good.

For months, members of Congress have been deluged with calls from constituents angry at surprise fees and rate increases – especially from those financial institutions also accepting taxpayer bailouts.

“You could no find a more popular piece of legislation than that that just passed the Senate,” said Senate majority leader Harry Reid, after Tuesday’s midday vote.

Lawmakers expect the bill to pass the House and be signed by President Obama by Memorial Day. The Senate bill will take effect nine months after the law is enacted.

Among the things it does:

-Hidden fees. It bans arbitrary interest-rate increases and hidden fees, such as charges for paying off a credit-card bill over the telephone.

-Full disclosure. It requires clear disclosure of the terms of credit-card agreements and any changes made to them.

-Universal default. It bans the practice of “universal default,” which allows companies to dramatically raise interest rates on a credit card if the consumer is more than 30 days late on any other payment.

-Freeze on rate increases. It prohibits companies from increasing rates on a cardholder in the first year and requires promotional rates to last at least six months. Rate increases must be periodically reviewed and decreased if the cardholder pays the minimum balance on time for six months.

-Delays in payment. It prohibits companies from assessing late fees if the card issuer has delayed crediting the payment.

-Same-day payments at local banks. It stipulates that payments made at local branches must be credited the same day.

-Credit-limit fees. It bans credit-card companies from charging fees when users exceed their credit limits, unless the cardholder has specifically agreed to allow over-limit transactions. In this case, all penalty fees must be reasonable and proportional to the overcharge – that is, no huge rate increases for a purchase that barely tipped the credit limit. If the cardholder has not agreed to allow over-limit transactions, they would simply be rejected.

-Early-morning deadlines. It prohibits issuers from setting early-morning deadline for credit-card payments.

-Statements and notifications. It stipulates that credit-card statements must be mailed 21 days before the bill is due. Previously, the requirement was 14 days. Consumers must now be given 45 days notice of any fee, rate, or penalty increases.

-Application of overpayments. It mandates that payments over the minimum be applied first to the credit-card balance with the highest rate of interest. Card-companies typically apply extra payments to balances with the lowest rate of interest.

-Fair disclosure. It requires issuers to disclose the time and total interest costs it would take to pay off credit card balances, if consumers pay only the required minimum.

-Protections for young cardholders. It provides special protections for consumers under the age of 21. These applicants must have a co-signer who is willing to accept responsibility for payment or proof that he or she has means to repay any credit extended. In cases of joint liability, the co-signer must approve in writing any increase in the credit limit.

Among the things the legislation does not do:

-No cap on interest rates or fees. It does not put a maximum on the interest rates or fees that credit-card companies can charge consumers.

-Disputes don’t go to court. It does not do away with the requirement that consumers with a dispute against their credit card companies take it to arbitration, rather than to the courts. Arbitration decisions typically favor credit-card companies, consumer groups say.

-Interchange fees. The highly controversial issue of “interchange fees” was deferred to a study by the US Government Accountability Office. Retailers wanted Congress to regulate the fees charged to merchants every time a consumer uses a credit card for payment, eating into their profits.

These omissions signal that “the banks still have residual power on Capitol Hill,” says Ed Mierzwinski, a consumer advocate with US PIRG in Washington. “Those are things we’ll need to do in the future. It’s still a great bill, though.”

But banking groups say that the bill will raise costs to consumers and limit access to credit among people who need it.

“We are concerned that the Senate bill will have a dramatic impact on the ability of consumers, students, and small businesses to obtain and use credit cards,” said Edward Yingling, president and CEO of the American Bankers Association, in a statement after the Senate vote.

If the big banks and credit-card issuers raise their rates, smaller banks could benefit.

“Our banks are going to learn to live with the restrictions,” said Steve Verdier, director of congressional relations at Independent Community Bankers of America, after the vote. “But if the big banks make their products even less friendly than they already are, I’m hoping that consumers will rediscover the value of getting credit cards from community banks.