Which GOP flat tax plan is fairest of them all?

Loading...

Three Republican presidential candidates have put forward flat tax plans so far, but their proposals would not affect US taxpayers in the same way. All, however, would probably lead to less revenue for the US government, analysts say, meaning spending cuts of a sizable magnitude would be in order.

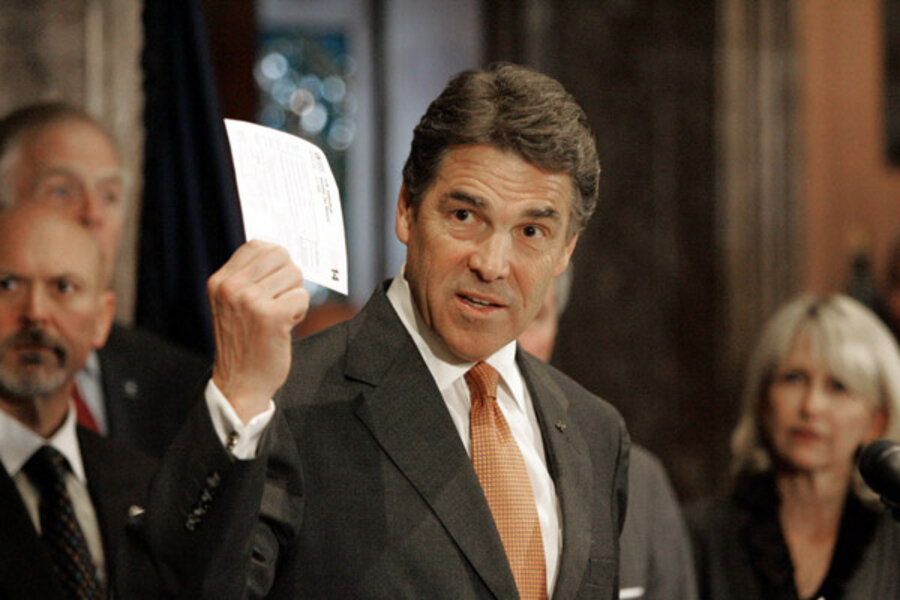

Businessman Herman Cain’s "9-9-9" plan – a 9 percent income tax, 9 percent sales tax, and 9 percent corporate tax rate – is perhaps best known. But Texas Gov. Rick Perry has now introduced his own vision for a 20 percent flat tax on income and a 20 percent tax rate on corporations. Moreover, Newt Gingrich, now running third or fourth in some polls, has proposed an optional 15 percent flat tax on personal income.

What would these various flat tax plans mean for you? What would they do to the nation’s budget deficit?

Tax experts are struggling to answer those questions, noting that the candidates, except for Mr. Perry, have not spelled out their plans in detail. For example, Mr. Cain has already changed his 9-9-9 proposal to exempt people below the poverty line from paying taxes, but he hasn't said exactly how that will happen.

“Anybody who is in the tax world will say the devil is in the details,” says Michael Graetz, a professor at Columbia University in New York and an expert on taxation. “None of the candidates want to get too detailed.”

Nonetheless, from what is known, here is how some tax experts view the three plans.

The Perry proposal

Governor Perry would allow individuals to choose between his flat 20 percent income tax and the current tax code. As a result, no one would be worse off, says Ted Gayer, a senior fellow at the Brookings Institution in Washington. “You are pretty much capping how much you would pay at 20 percent and anyone paying less than 20 percent would stick to that,” says Mr. Gayer.

However, under the Perry plan, low-income wage earners who currently qualify for the Earned Income Tax Credit and the child care tax credit would lose them. Thus, according to the Urban-Brookings Tax Policy Center, a married couple earning $31,000 a year with two children would get back $5,147 under 2011 tax law. Under Perry’s proposal, they would owe nothing but get nothing back.

“The Perry plan would not help people who currently benefit from refundable tax credits and are mainly moderate to low income,” says Roberton Williams, a senior fellow at the Tax Policy Center.

If the same four-member household were middle-income, earning $69,800, they would come out $1,140 ahead under the Perry plan. If they made $136,000 a year, they would benefit by $11,980. A very wealthy couple making $424,900 would have an extra $46,400 in their bank account.

Although Perry maintains his plan would not widen the US budget deficit, independent experts suggest that it would. Tax revenue would fall for the federal government as tax rates dropped. However, Perry maintains government revenues would increase as the economy grew faster. “That’s highly unrealistic,” says Mr. Williams. “He is still going to have to cut spending a lot.”

The Gingrich plan

Mr. Gingrich’s plan has a lower tax rate than Perry's, but it does not give taxpayers credit for paying state and local taxes, as does Perry. “The Gingrich plan might be worse for people in high-income-tax states like California and New York,” says Mr. Graetz, “since they would lose the deduction for state income taxes.”

Under Gingrich, middle-income, high-income, and very-high-income individuals would benefit from the flat 15 percent tax rate.

“People who make $1 million and above [would] have an effective tax rate of 24 percent,” says David Cay Johnston, who teaches at Syracuse University and who wrote two best-selling books on the tax code. “He would be cutting their taxes by 37.5 percent,” says Mr. Johnston, also a blogger for Thomson Reuters.

Under the Gingrich plan, the budget deficit would grow, estimates Williams at the Tax Policy Center. “You would have about three-quarters of the revenue you would have under Perry, so you have a much bigger revenue hole,” he says.

The Cain calculus

To calculate taxes under the Cain plan, the Tax Policy Center added up all three taxes totaling the equivalent of a 25.38 percent national sales tax.

Using that calculation, taxes for the wealthy would drop considerably under Cain’s proposal. The Tax Policy Center projects in 2013, the first year the Cain plan could be enacted, 95 percent of people making $1 million or more would get a tax cut that averaged $487,300.

By way of comparison, only 16 percent of people making between $50,000 and $75,000 a year would get a tax cut, averaging $1,959. At least 70 percent of people in this middle-income category would see their average federal taxes rise by $4,326.

Until Cain decided to give poor Americans protection from his tax plan, the Tax Policy Center had decided his plan would not affect the federal budget deficit. However, with that change, the Cain plan will mean loss of revenue and the government would have to cut spending to make up for it, Williams says.