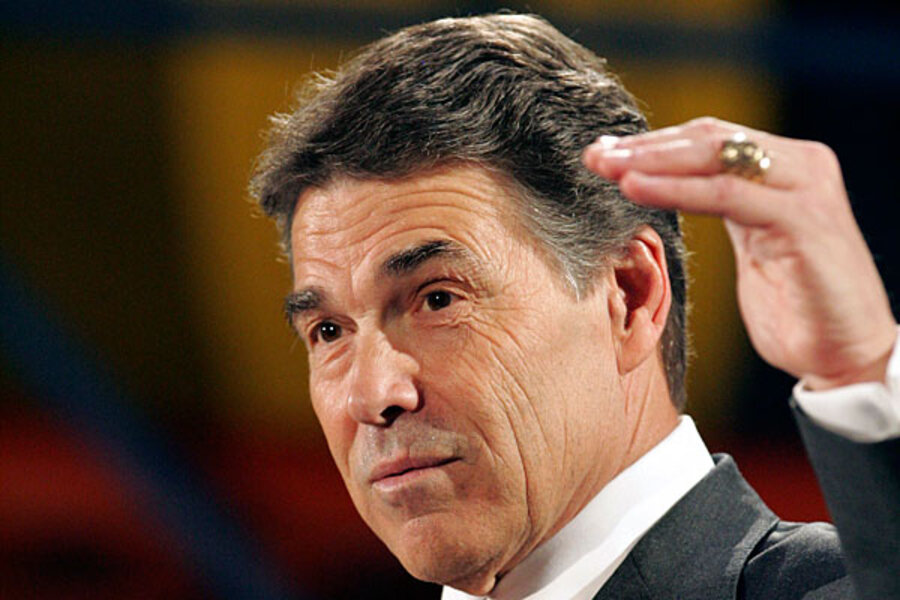

Rick Perry's flat tax plan: Would you have to do your taxes twice?

Loading...

Republican presidential candidate Rick Perry has entered the flat tax sweepstakes.

Mr. Perry is hoping his 20-20 flat tax rate will resonate as widely as Herman Cain’s "9-9-9" tax plan, which features a 9 percent sales tax, 9 percent personal income tax, and 9 percent corporate income tax.

“This is a change election, and I offer a plan that changes the way Washington does business,” the Texas governor said Tuesday at an event in Gray Court, S.C.

But on his way to simplifying the tax code, Perry says, he wants to let Americans choose their tax rate: A taxpayer can opt for the 20 percent flat tax – with certain deductions – or stick with whatever rate he or she is currently paying. To quote a well-known ad jingle, “have it your way.”

For people who opt for the flat tax, says Perry, filing will be as simple as mailing in a postcard, saving a collective $483 billion in costs associated with complying with the federal tax code.

On the postcard is room for deductions for home-mortgage interest, charitable giving, and state and local taxes, for those making less than $500,000 a year. At the same time, the standard individual exemption would jump from $3,600 to $12,500.

That means the 20 percent tax rate actually might be quite a bit lower, especially for people who borrowed a lot of money to buy a house, paid high property taxes, and gave a lot of money to charity.

At the same time, businesses would pay a 20 percent rate on profits, down from today's top rate of 35 percent. Multinationals would get a break in the form of a low 5.2 percent tax rate for $1.4 trillion currently parked overseas.

Some outside experts say Perry’s attempt at simplicity will have the opposite effect on taxpayers.

“It will force some to do taxes twice to see which way they come out ahead,” says Bruce Bartlett, a former domestic adviser to President Ronald Reagan and a former Treasury official in President George H.W. Bush’s administration. “It adds complexity to an already complex system.”

Some commentators ask whether taxpayers might be tempted to “game” the system by figuring out how to structure their income and deductions to maximize whatever side of the coin they want to come out on.

“You still have to use TurboTax [software] to figure out which is better,” quips Ted Gayer, a senior fellow at the Brookings Institution in Washington. “If you can jump back and forth between tax systems in different years, you might want to structure your deductions to fit the tax code.”

Even some who are not opposed to flat taxes have doubts about the Perry plan. “The reason to do a flat tax is to get rid of the sham deductions out there,” says economist Joel Naroff of Naroff Economic Advisors in Holland, Pa. “If you keep a lot of them in there, you are missing the whole point of the flat tax.”

Mr. Naroff says that once one deduction is allowed – for example, the deduction for mortgage interest – it is easier for other groups to lobby for their own deductions. “You open the door to recreate the current structure,” he says.

The way Naroff sees it, Perry is trying to prevent any group from being worse off because of his proposed tax changes. “That’s a little hokey,” he says.

Perry’s plan comes amid public distrust of politicians and their promises about taxes. According to a Clarus poll released Tuesday, 55 percent of 1,000 registered voters say Obama’s tax plan will raise their taxes and 41 percent say Cain’s 9-9-9 plan will, as well.

“Many voters don’t believe what politicians from either party tell them about raising, reforming, or cutting taxes,” says Ron Faucheux, president of Clarus. “This surprising data explains why the president is having such a hard time selling his jobs package.”

The Perry plan might result in a massive tax cut for the wealthy and higher taxes for those who currently use tax credits such as the child tax credit or the Earned Income Tax Credit, says Mr. Bartlett. For example, under the Earned Income Tax Credit, low-income Americans who do not pay any federal income taxes still receive money back when they file their taxes. “When you go from a negative income tax to zero, that’s a big tax increase,” says Bartlett.

However, it’s not a given that the rich would get a big tax cut under the Perry plan, says Naroff. For example, billionaire Warren Buffet has said that his effective tax rate is 17.4 percent. Under the Perry flat tax, he and other billionaires might actually pay more taxes, says Naroff.

It appears that Perry would retain the payroll tax, though he did not mention it Tuesday, says Bartlett. The payroll tax currently funds Social Security and Medicare, two entitlement programs for seniors. Under the Cain plan, the payroll tax is eliminated.

“The problem with eliminating the payroll tax is that under Social Security it gives an earnings history for benefits,” says Bartlett. “If you eliminate payroll taxes, there is no data to calculate the benefits paid out unless you move to privatize the system.”

Perry has said he does indeed want to privatize Social Security, a proposal that got no traction during the administration of President George W. Bush. And, notes Bartlett, “there is still the problem of people who have been grandfathered in.”

How would the Perry plan affect the US budget deficit?

That verdict is not yet in, although the personal deductions his plan would allow are costly. The mortgage interest deduction cost the US Treasury $94 billion in 2011, state and local income tax deductions cost it $50 billion, and charitable deductions reduced government revenue by $35 billion, according to Congress's Joint Committee on Taxation.

Gayer’s critique is that Perry’s tax plan is “heavy on dessert and light on spinach."

On the spending side, Perry calls for holding federal expenditures to the equivalent of 18 percent of gross domestic product – about where they are today. In the future, however, the budget deficit as a percentage of GDP is expected to rise sharply, according to the nonpartisan Congressional Budget Office.

To cut government spending, Perry says he will ban earmarks (congressional "pork-barrel" spending), freeze federal salaries for eight years or more, and pass a balanced budget amendment to the US Constitution.

He also said he wants to let younger workers to “opt out” of Social Security. In the past, the Texas governor has called Social Security a "Ponzi scheme." He also indicated he favors raising the age for collecting Social Security and Medicare.

Predictably, Democratic officials lambasted Perry's plan. Speaking on CNBC, Rep. Debbie Wasserman Schultz (D) of Florida said the Perry flat tax “overwhelmingly blows a hole in the budget.”

Gayer strikes a more tempered tone. “Any serious attempt to look at tax reform needs to be coupled with reform on the spending side, especially Medicare,” he says. “The Perry plan is not revenue neutral, for sure.”