The week's biggest financial news

Loading...

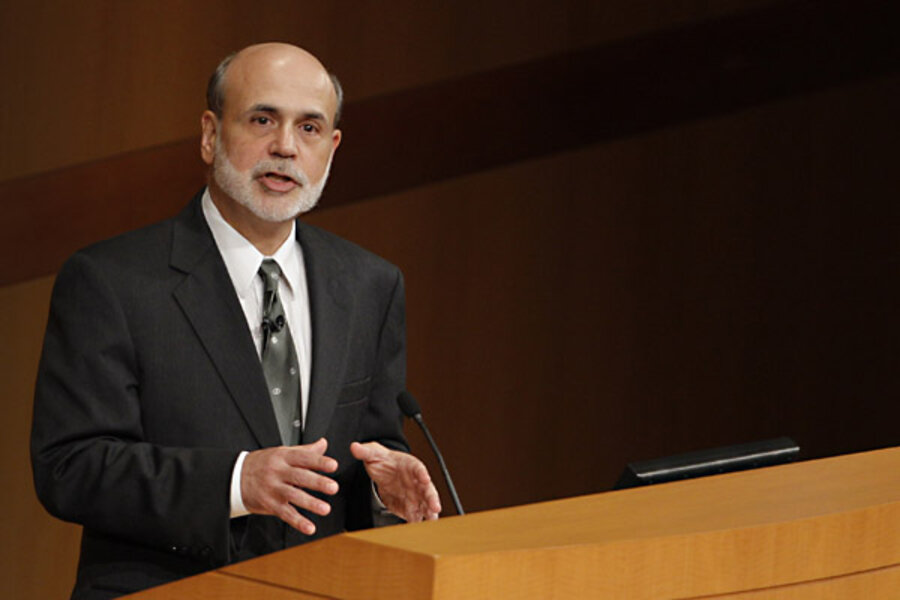

The Wall Street Journal Friday noted the lack of prescience at the Federal Reserve prior to the crisis: “…But Mr. Bernanke described the cooling of the housing boom as a ‘healthy thing.’

‘So far we are seeing, at worst, an orderly decline in the housing market,’ he said.”

Fannie Mae’s CEO, Michael Williams, resigned this week. Said Williams: “I am extremely proud of what we have achieved together, and I am confident that they will continue to make a positive difference.” Freddie Mac’s CEO is also on the way out, by the way.

The Obama Administration announced this week that it wants to convert foreclosed properties to rentals. It is ” a pilot program to sell government-owned foreclosures in bulk to investors as rentals.” Since this is a partnership with government-owned corporations Fannie and Freddie, this program is likely to manifest itself as yet another investment opportunity only for massive, politically-connected enterprises. Small investors will very likely need not apply.

US Senator Jim DeMint declares in South Carolina: “If You Don’t Listen To Ron Paul…The Federal Reserve Is Gonna Destroy Our Monetary System”