The effect of QE3 on mortgages

Loading...

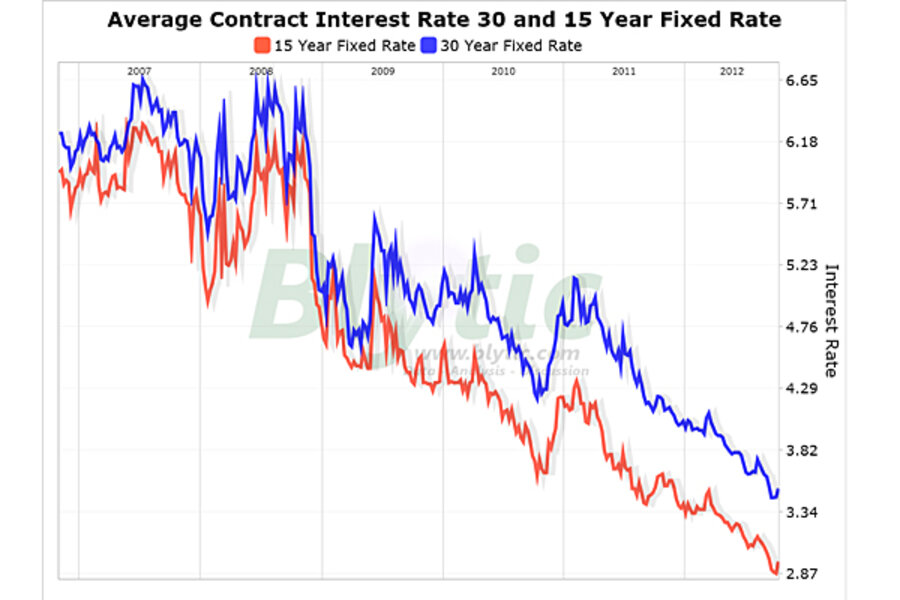

The Mortgage Bankers Association (MBA) publishes the results of a weekly applications survey that covers roughly 50 percent of all residential mortgage originations and tracks the average interest rate for 30 year and 15 year fixed rate mortgages as well as the volume of both purchase and refinance applications.

The purchase application index has been highlighted as a particularly important data series as it very broadly captures the demand side of residential real estate for both new and existing home purchases.

The latest data is showing that the average rate for a 30 year fixed rate mortgage (from FHA and conforming GSE data) went increased 6 basis points to 3.52% since last week while the purchase application volume declined 8% and the refinance application volume declined 13% over the same period.

Clearly, the Federal Reserve's QE3 announcement and implementation has had a notable effect on mortgage rates in recent weeks continuing to lift refinance application activity and possibly helping to establish a base of sorts to purchase applications.

The question is though, if the Fed is stimulating this activity by forcing artificially low rates, what would these trends look like if prevailing rates were based on a more fundamental market function?