Retail sales are up 4.8 percent from last year

Loading...

Today, the U.S. Census Bureau released its latest nominal read of retail sales showing a 0.4% increase from December and an increase of 5.8% on a year-over-year basis on an aggregate of all items including food, fuel and healthcare services.

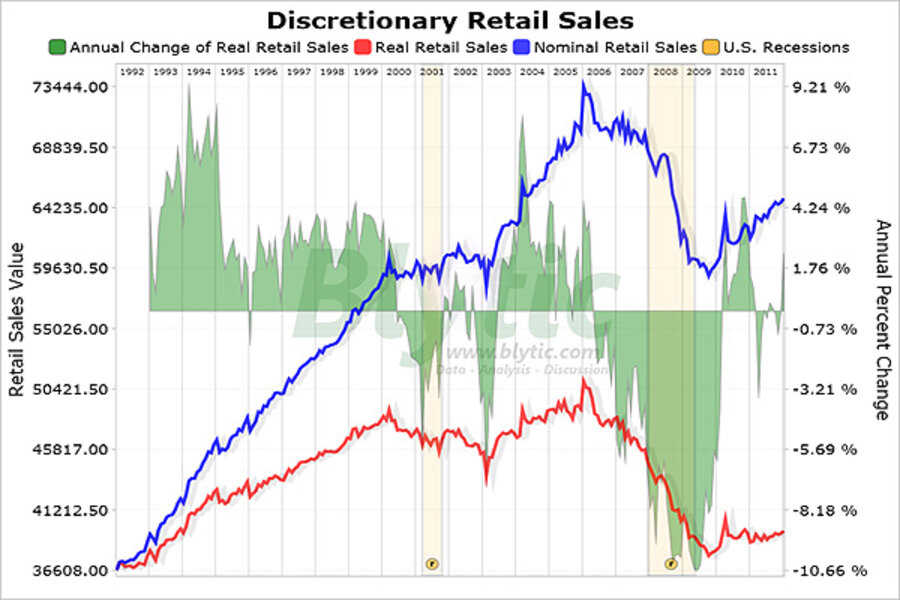

Nominal "discretionary" retail sales including home furnishings, home garden and building materials, consumer electronics and department store sales increased 0.47% from December and increased 4.86% above the level seen in January 2011 while, adjusting for inflation, “real” discretionary retail sales increased 2.23% over the same period.

On a “nominal” basis, there had appeared to be “rough correlation” between strong home value appreciation and strong retail spending preceding the housing bust and an even stronger correlation when home values started to decline.

The following chart shows the year-over-year change to nominal discretionary retail sales and the year-over-year change to nominal the S&P/Case-Shiller Composite home price index since 1993 and since 2000.

As you can see there is, at the very least, a coincidental change to home values and consumer spending during the boom and then the bust, but as home values have continued to decline, retail spending has remained low but has not continued to consistently contract.

Looking at the chart below (click for full-screen dynamic version), adjusted for inflation (CPI for retail sales, CPI “less shelter” for S&P/Case-Shiller Composite) the “rough correlation” between the year-over-year change to the “discretionary” retail sales series and the year-over-year S&P/Case-Shiller Composite series seems now even more significant.