Behind the Senate deal on housing relief

Loading...

| Washington

It took the Federal Reserve just 96 hours to react to the collapse of investment bank Bear Stearns. It's that rescue on Wall Street that's driving momentum on Capitol Hill for quick relief for the housing crisis on Main Street.

Senators got an earful from constituents over a two-week break, especially the disconnect between the Fed's $29 billion plan to facilitate the sale of Bear Stearns and the lack of meaningful relief for financially stressed homeowners. Within hours of a return to Washington, Senate leaders on both sides of the aisle put a stalled housing relief bill on the fast track, dropping cherished positions to do so.

The $15 billion housing package includes billions in tax breaks for home builders, block grants and tax breaks for the purchase of foreclosed properties, and $100 million in counseling for homeowners facing foreclosure.

"A month ago, you couldn't even get to a debate on the housing crisis," said Sen. Christopher Dodd (D) of Connecticut, who shuttled between the Senate floor and his banking panel's grilling of federal regulators and corporate executives over Bear Stearns.

What changed, he added, is that senators went home and heard from their constituents and watched what happened on Wall Street."

Last month, a vote to begin Senate debate over housing relief failed 48 to 46. The main sticking point was a provision – dropped in this week's bipartisan plan – that would have allowed bankruptcy judges to restructure primary home mortgages, including lowering the principal and interest rates.

Critics decry compromise

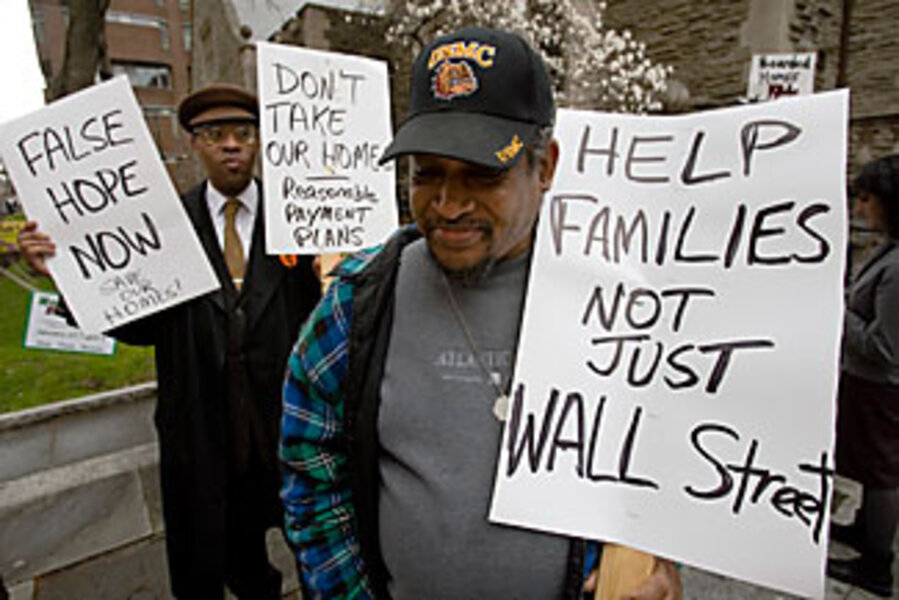

Consumer groups, unions, and civil rights groups cried foul as details of the bipartisan deal surfaced Wednesday night. Critics charge that the subprime mortgage industry marketed many of its loans to African-Americans and Latinos, including those with solid credit ratings. Under current law, bankruptcy judges can restructure loans for a yacht or vacation home, but can't touch primary residences.

"Both parties are trying to tout this bill as a major victory for homeowners, but it's largely a placebo in the absence of the bankruptcy provision," says Wade Henderson, president and CEO of the Leadership Conference on Civil Rights.

"Only by giving bankruptcy judges the discretion to look at the individual circumstances of each borrower can they really discern the degree to which the home owner has been treated fairly. Now, foreclosure proceedings move so quickly that, without the individualized review that a judge can provide, most homeowners are at the mercy of the accuracy of the material the lenders provide," he adds.

The broad civil rights community is scrambling to push to restore this provision to the housing bill, he says.

"At a time when 20,000 families are losing their homes each week, we can no longer rely on voluntary measures to stop record high foreclosures that have been caused by abusive lending practices," says Josh Nassar, vice president for federal affairs for the Center for Responsible Lending in Washington.

Bankruptcy provision contentious

In the run-up to this week's bipartisan deal, business and banking groups lobbied hard against the bankruptcy provision, and President Bush signaled that he would veto a bill that included it. The White House and banking industry groups say that any provision allowing a judge to rewrite mortgages on primary homes would increase costs for all homeowners, as lenders increase rates to cover expected higher risk.

"With veto threats on the bankruptcy provisions, the majority leadership had to decide: Do they want to make a political statement or do they want to enact a law?" says Bruce Josten, executive vice president for government affairs at the US Chamber of Commerce, which lobbied against the provision.

Senate leaders on both sides of the aisle called the deal a good start to the debate. Democrats hope to extend more direct help to families facing foreclosure; Republicans want to see more tax breaks for the housing industry.

Both sides of the aisle expect a lively debate with the House over whether costs for the housing bill must be offset this year by cuts to other programs. House Democrats have a policy to respect so-called pay-go provisions, but have backed down in recent clashes with the Senate on this point.

Sen. Richard Durbin (D) of Illinois, the lead sponsor of the bankruptcy provision, said that he could have used Senate rules to derail the housing bill over this point. But "there was a genuine effort and undertaking to finding common ground between Democrats and Republicans," he said on Wednesday morning. Had he used his rights as a senator to stop this bill, the net result would be "an elongated Senate process and a lot of wasted time," he said. In return, he said he wanted a standalone vote on the provision, a request that was still pending at press time.

"There's widespread feeling on both sides of the bill that we need an accomplishment on a bipartisan basis," said Republican leader Mitch McConnell.