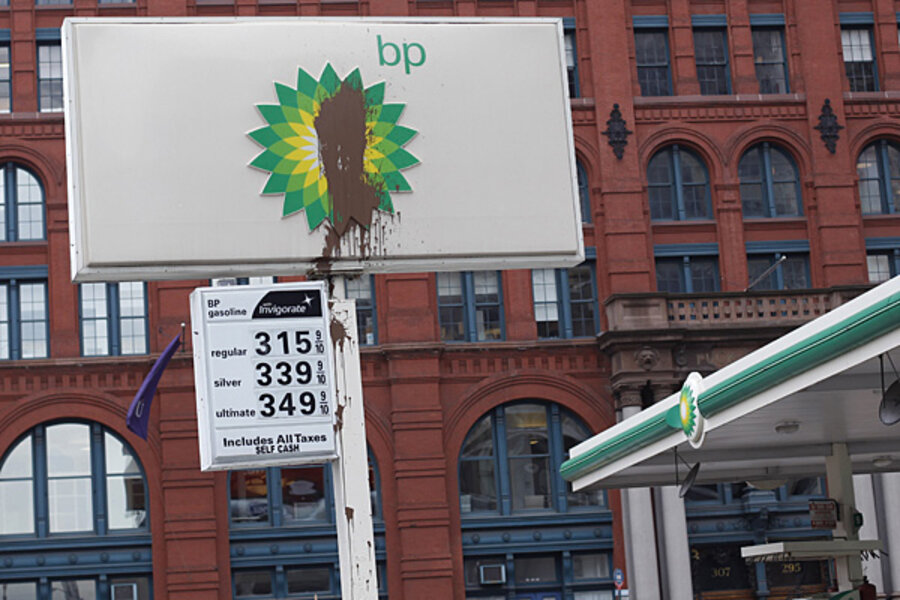

Could Gulf oil spill bankrupt BP?

Loading...

| New York

Though the BP oil spill continues unabated, it is too early to write BP's corporate obituary, say industry analysts.

Yes, the company’s value in the stock market has shrunk by $70 billion since the incident. On Tuesday alone, the company’s stock sank by $19 billion.

But the company has some of the deepest pockets in the world. And the greatest concern to BP – the possible litigation – might stretch on for decades, defraying the costs, as happened in the Exxon Valdez oil spill.

“Talking about the demise of BP is premature,” says Phil Flynn, director of research at PFH Best Research in Chicago. “Yes, this is larger than the Exxon Valdez but it’s premature to say this will put BP out of business.”

Although any civil or criminal liabilities could be huge, analysts point out that BP has significant financial wherewithal. In 2009, a bad year for the company, it had revenue of $239.8 billion and had a net profit of $16.5 billion.

“BP in terms of its balance sheet is fairly strong,” says Matti Teittinen, senior equity analyst at IHS Herold in Boston. “They have made $8 billion in acquisitions in 2010 so far, so I don’t think the prospect of spending $5 billion on the clean-up is something that really scares them.”

BP's costs now $40 million a day

On Tuesday morning, BP said it has spent $990 million, including the cost of the spill response, containment, relief well drilling, grants to the Gulf states, some 15,000 claims paid, and federal costs. According to BP, 1,600 vessels are involved in the response effort. Some 20,000 people are directly working on either the containment or the cleanup, the White House says.

The costs are rising so quickly that on Tuesday, Houston-based energy analyst Pavel Molchanov of Raymond James & Associates tripled his assessment of the spill's out-of-pocket cost to BP in 2010. Originally, Mr. Molchanov had estimated it would cost BP $1.6 billion, now he estimates it will be $5.2 billion. For 2011, Mr. Molchanov estimates it will cost the company $2.3 billion as the cleanup continues.

BP's daily out of pocket cost in early May was $8 million. Now, it is $40 million per day, he notes.

Biggest threat to BP: not a consumer boycott

But Mr. Molchanov says the “big question mark” is the potential costs of any civil and criminal liability. On Tuesday, for example, US Attorney General Eric Holder was in the Gulf region meeting with other law enforcement officials regarding potential criminal charges in the spill. The Justice Department has begun a preliminary criminal investigation, it said Tuesday.

The damage to BP's reputation is also a threat – though it is investors, not consumers, who will concern BP more.

“Why own BP when you can own Chevron without all those problems?” asks Mr. Teittinen. “That is probably the biggest impact.”

This has prompted some observers to wonder if another company might want to buy BP. But any major oil company would run into “serious” anti-trust issues in the US and European Union if it made a bid, says Molchanov. “But, the bigger roadblock is why on earth anyone would want to take on the liability that BP will have to deal with?" he adds.

Although many US motorists may decide they don’t want to use BP gas stations, that would have less of an impact on the company because the stations are leased to independent owners. “In this country a boycott would not have a huge impact,” says Teittinen.

Related: