Do deficits matter? Trump says no, Clinton says yes (sort of).

Loading...

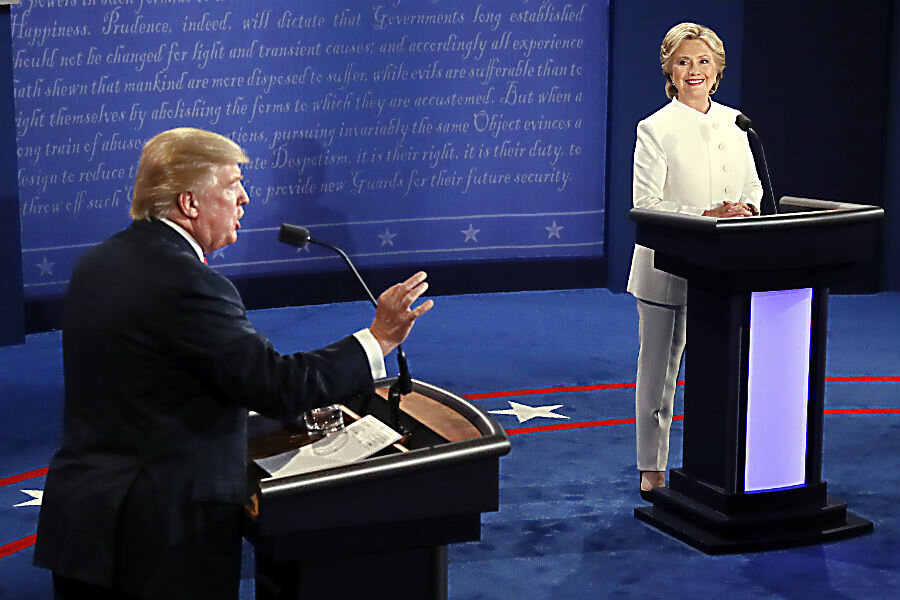

The fiscal policy debate in the 2016 presidential election (yes, Virginia, there is a policy debate, even if you can’t hear it through the noise) has come down to a familiar question: Do deficits matter?

Donald Trump and his policy proposals argue strongly that they do not while Hillary Clinton appears to believe that they do—sort of.

Let’s start with Clinton. While she has proposed a long list of new tax subsidies and spending programs for everything from child care and education to caring for aging parents, she has carefully offset her new programs with tax increases on high-income households. The result: A modestly ambitious domestic agenda that largely pays for itself. However, it does nothing to reduce the existing $14 trillion public debt or shrink the ratio of debt to Gross Domestic Product, according to estimates by the Committee for a Responsible Federal Budget (CRFB).

Thus Clinton appears to acknowledge that deficits do matter, at least to the extent she is careful to not make them worse. As she said repeatedly in last night’s debate, her fiscal plan“will not add a penny to the debt.”

Trump’s tax plan, by contrast, would make deficits worse. Much worse. He’s proposing a tax cut of historic proportions without putting forward spending reductions to offset those lower revenues. CRFB, using its own estimates of his spending plans and TPC’s projections of the size of his tax cuts, figures Trump would add $5.3 trillion to the debt over the next decade and increase the ratio of debt to GDP in 2026 from 86 percent to 105 percent.

Trump justifies his plan with three somewhat contradictory arguments:

The supply-side case: Once you consider the positive effects of a tax cut, a stronger economy will generate more income and, in turn, more tax revenue. As he said last night, “We will create a tremendous economic machine” that, he said, could generate “5 or 6 percent” economic growth.

But even Trump campaign aides appear to concede that his tax plan won’t pay for itself—even when taking into account its effect on the overall economy. That’s supported by recent analyses by the Tax Policy Center, the Penn Wharton Budget Model (PWBM), and the Tax Foundation. TPC and Wharton found that Trump’s tax plan would add about $7 trillion to the debt over the next 10 years (including macroeconomic effects and added interest costs), and the Tax Foundation estimated it would add between $2.6 trillion and $3.9 trillion over the next 10 years (including macro effects but excluding added interest). These scores included taxes but not spending or other economic proposals.

Trade and regulatory relief: Even if the tax plan won’t generate enough growth to finance on its own, Trump says other elements of his economic agenda would. These include his plans to slash regulation and encourage production of carbon-based fuels. But the real key, the campaign insists, is Trump’s aggressive trade policy aimed at limiting foreign imports into the US. While Trump insists this strategy would boost the economy and help pay for tax cuts, the argument runs counter to both experience and decades of mainstream economic theory, as my TPC colleague Eric Toder explains here. Another TPC colleague, Len Burman, explains why Trump’s budget deficits are likely to increase trade deficits, regardless of his trade policies.

Foreign investment: Even if both theories turn out to be false, Trump’s advisers insist that enough foreign money would flow into the US to finance both private investment and a large government deficit without any increase in interest rates. The argument that large deficits crowd out private investment is “silly,” Trump adviser Peter Navarro said at the Tax Policy Center discussion on the candidate tax plans last week.

Navarro’s argument might apply to a small open economy. For instance, New Zealand might be able to finance both large budget deficits and private investment. But the US, with the largest economy in the world, has enormous capital requirements. This year, gross private investment is approaching $3 trillion, with net borrowing of about $540 billion. And the federal government will borrow $544 billion.

Currently, debt held by the public is about $14 trillion, with $6.2 trillion held by foreign investors. Next year alone, TPC and Wharton estimate that Trump’s tax plan would increase the deficit by another $300 billion, even after accounting for the short-term economic growth it might generate. That’s a lot of borrowing and it is hard to imagine it could continue over a long period of time without driving up interest rates.

But just look at recent history, Trump aides say. Over the past decade, the federal government ran huge deficits with no concurrent rise in interest rates. But that was during a period of recession and low growth when private demand for capital slowed markedly. In 2009, for example, private investment in the US (adjusted for inflation) fell to levels not seen since 1997. It has since recovered, but only to pre-recession 2006 levels.

Trump seems not entirely unaware of the risks of big deficits. After all, he did scale back by about one-third his 2015 tax cut plan. And he pledges to not only finance his tax cuts, but balance the budget—which means offsetting the additional deficits already built into current law.

Yet, while Clinton seems worried enough about deficits to carefully calibrate her tax and spending plans to avoid adding to the debt, Trump appears comfortable with a fiscal plan that would, according to standard economic analysis, sharply increase the debt.

This story originally appeared on TaxVox.