Can the European Union survive the debt crisis?

Loading...

| London

Its origin is rooted in the idea of building a Europe that wouldn't go to war with itself – of easing French fears of German troops storming across the Rhine and, later, of preventing Soviet tanks from rolling into West Berlin. More recently, the organization that became the European Union (EU) overcame national differences to create one of the world's most potent economic blocs.

Now, as the debt crisis gnaws at Europe's balance sheets, the EU faces another test of its cohesiveness: stabilize the Continent's economies and prevent the disintegration of the 11-year-old euro currency – perhaps the Union's crowning achievement.

By all accounts, Europe today stands at a crossroads. The enduring fragility of several nations' treasuries could end up pulling members of the EU closer together. But if the fiscal problems continue to require bailouts and major economic reforms – as experts say they will – it will more likely lead to a fracturing of one of Europe's boldest attempts at unity.

"Essentially, you can't have a single currency without a single economy," says Simon Tilford, chief economist at the Centre for European Reform, a London-based think tank. "For it to work, there needs to be much greater political and economic integration."

The hope of the unifiers is that crisis breeds comity. Inside the 27-country EU, some believe the need to surmount a debt problem that threatens not only the survival of 16 members of the eurozone, but also the social-welfare model that has been an integral part of Europe's economic identity, will draw the disparate states together.

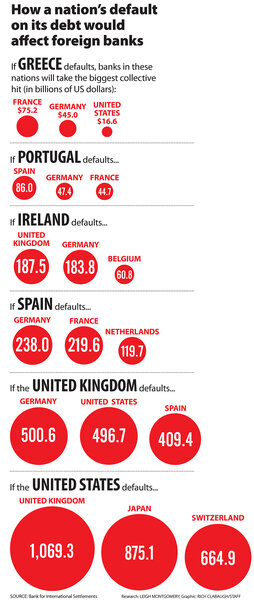

Reluctantly, they took common action to rescue Greece and contain the crisis with a 750 billion euro fund, though that was as much out of necessity as choice. The fear was, and still is, that a default by Athens could topple the other debt-laden members of the eurozone "Piigs" club – Portugal, Ireland, Italy, and Spain.

In the wake of the Greek crisis, European governments have been taking action to live within their means. Spain and Portugal, for instance, have cut public-sector wages and welfare subsidies, setting up the next battles with labor unions.

Where the EU goes from here will be crucial for Europe's future. One option is for increased fiscal discipline among eurozone members and tighter economic unity. Greater coordination is backed by France and EU technocrats. Yet it won't be an easy sell. Listen to what Sweden's prime minister, Fredrik Reinfeldt, said the day after an EU executive suggested that union members could coordinate national budgets.

"We are a shining exception with good public finances and don't even come close to the limits [under eurozone rules] one is not permitted to surpass," he said. "It is not fair to treat us the same way [as some other countries]."

Under one scenario, more coordination would mean granting one state the right to have oversight of another state's budget to deter supposedly profligate spenders like Greece. But among sovereign nations that would be like letting your friends see your bank account on Facebook.

"It would mean two things," says Robert Hancke, a Belgian expert on the European economy at the London School of Economics. "The government of Country A would have the right to check the books of Country B, despite the fact that it is not elected by the citizens of Country B. Equally, the logic is that taxes from Country A could be used for [some] purpose in Country B. That is not going to happen anytime soon."

Alternatively, Europe could continue to move forward as it is, with each nation trying to balance its own finances and the community coming together when calamity arises. Yet no state wants to bail out another that it doesn't think is fiscally responsible. Witness the rising resistance in Germany – a pivotal player in the Greek bailout plan.

It doesn't help that the debt crisis in Greece has triggered a reflowering of national self-interest in a number of European nations. In simplified terms, richer and supposedly more fiscally prudent northern states are reluctant to surrender sovereignty because of the perceived spendthrift ways of their southern neighbors. In response, more dispassionate observers point out that the frugal north is prospering largely because its exported goods are flooding south.

The yawning differences help explain why the eurozone could be headed for a permanent divide. In order to detach the debt-stricken south, momentum is building for mainly northern states to form a smaller currency union around Germany. The idea is for two zones, each with its own currency, which wags jokingly say could be the northern "neuro" and the southern "pseudo."

As many experts point out, however, the consequences of such a split would be huge: By one estimate, the living standards of inhabitants of the poorer zone would drop by 30 to 45 percent.

Still, the EU is not going to vanish anytime soon. "It will survive for quite a long time on the great force of inertia," predicted Timothy Garton Ash, a British historian, in a recent BBC Radio discussion. "Remember that the Holy Roman Empire lasted as a framework, as a shell, until Napoleon delivered the deathblow. The EU is not going to end tomorrow."

Related: