Congressional oversight committee will not seek Trump's tax returns

Loading...

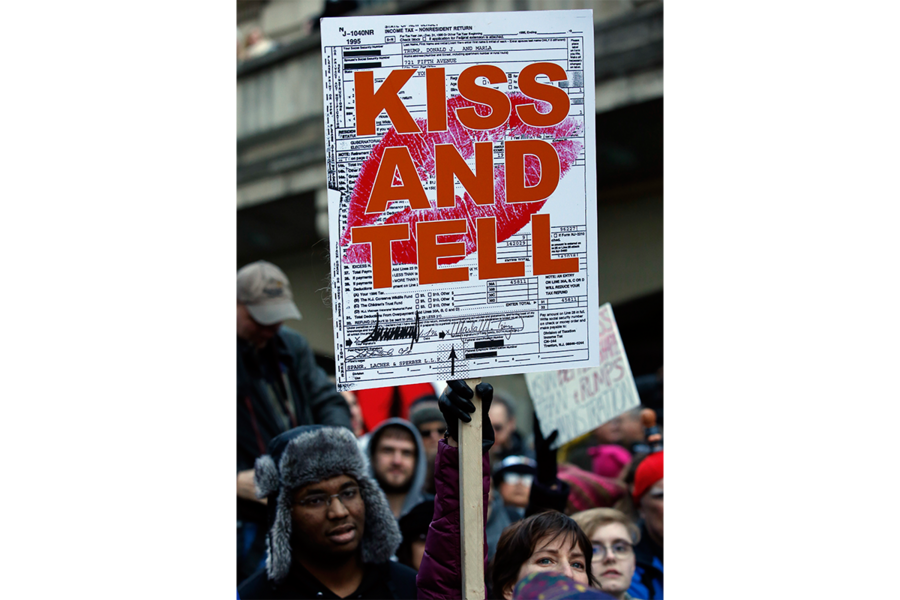

President Trump’s tax returns may not become public anytime soon.

Kevin Brady (R) of Texas, chairman of a congressional committee responsible for setting tax policy, has refused a letter from fellow committee member Bill Pascrell (D) of New Jersey asking that the House Ways and Means Committee use an obscure law to review the Mr. Trump's tax returns.

The law would allow Ways and Means to order the Internal Revenue Service to hand over the president’s tax returns, after which the committee would decide by a vote whether to make them public if they discovered any relevant conflicts of interest.

But Representative Brady said such a move would represent government overreach. "If Congress begins to use its powers to rummage around in the tax returns of the president, what prevents Congress from doing the same to average Americans?" he told reporters.

Originally enacted in response to a scandal over the non-competitive awarding of oil exploration leases known as Teapot Dome in 1924, Congress has since used the law twice: once to review former President Richard Nixon’s tax returns and again during a 2014 investigation into the IRS’s improper targeting of tea party groups applying for tax-exempt status.

Brady said that the 2014 situation, during which the committee suggested the potential prosecution of IRS official Lois Lerner to the Justice Department, was incomparable with Trump’s.

Breaking with decades of precedent, Trump makes the first Republican presidential candidate not to release his tax returns, or at least a detailed summary, since Richard Nixon.

Democrats have been demanding their release ever since the primaries, raising concerns that they could conceal conflicts of interest or even violations of the constitution's “emoluments clause,” which bans government officials from accepting gifts from foreign governments.

Representative Pascrell’s letter raised fears that Trump’s real estate empire, known to involve state-sponsored enterprises in countries including Russia, China, and Saudi Arabia, could damage the president’s ability to make unbiased decisions with the best interests of the United States at heart.

"It is imperative for the public to know and understand his ... financial positions in domestic and foreign companies," Pascrell wrote.

Trump said during his presidential campaign that he would not release his tax returns because he was under audit, despite the IRS saying there was no prohibition on doing so. More recently, the White House has said that he would not be sharing the returns because his electoral win indicated the “people didn’t care,” before abruptly reversing course days later.

“On taxes, answers (& repeated questions) are same from campaign: POTUS is under audit and will not release until that is completed,” White House counselor Kellyanne Conway tweeted the following week.

As of Monday, more than 750,000 people have signed a petition on government website “We the people” asking for the immediate release of the president's full tax returns. The White House has traditionally responded to petitions garnering more than 100,000 signatures.

One University of Virginia law professor suggests that congressional committee may be the most effective option.

"I would not expect it to occur immediately, but I do see a couple of ways it might arise," George Yin told USA Today. "When you talk about integrity, about government transparency, those are issues of bipartisan concern. Indeed you can find many, many statements by both Democrats and Republicans supporting the basic principle of eliminating and avoiding conflicts of interest."

“This is something that’s already in the law, so obviously the president has no ability to veto it,” Mr. Yin continued, before pointing out that any of the three tax committees can act independently, without winning approval from both houses.

The head of the other two panels, Senator Orrin Hatch (R) of Utah, dismissed the idea of asking for Trump’s returns last week, according to Reuters.

Rep. Jason Chaffetz (R) of Utah, chairman of the House Oversight Committee, agrees that while the situation isn’t ideal, it isn’t the government’s place to step in, telling a packed town hall that he wishes Trump had released his tax returns, but it is not required under the law.

Ultimately, Brady frames the conflict as a rights issue, saying Pascrell's letter “misrepresents the legislative intent of that provision, which in fact creates confidentiality and privacy for Americans in their tax returns.”

This report includes material from the Associated Press and Reuters.