Congress prepared to work quickly on administration financial rescue plan

Loading...

Washington – With faith in government at an all-time low, congressional leaders have agreed to move urgently on a sweeping Bush administration plan to revive US financial markets.

At the heart of the plan are new powers for the federal government to spend hundreds of billions of dollars to buy up bad assets, mainly mortgage-backed financial instruments, and provide help to homeowners facing foreclosure. The new moves, expected to be the most extensive government intervention in US markets since President Roosevelt’s New Deal, were greeted on Capitol Hill with the resolve to move quickly toward a bipartisan solution.

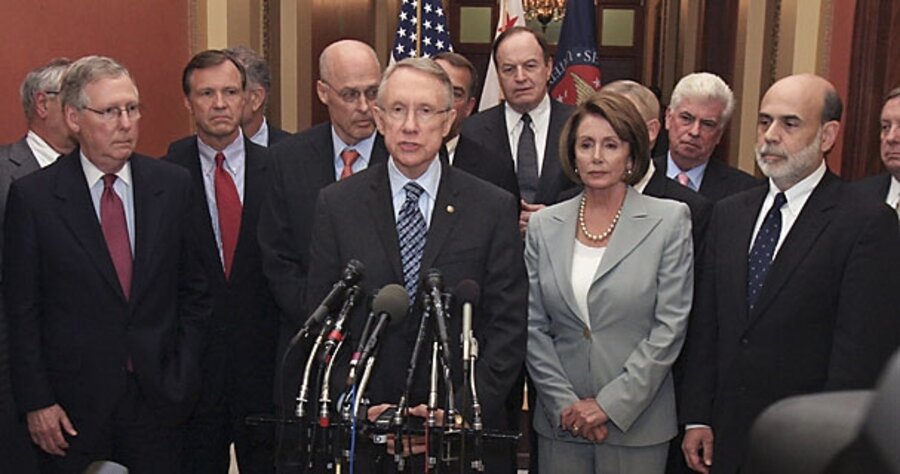

“We all understand the stakes, we have all committed to working with the administration, and we are all anxious to see their proposal within a matter of hours, not days,” said Senate majority leader Harry Reid, after a hastily arranged meeting of congressional leaders with US Treasury Secretary Henry Paulson, Federal Reserve Chairman Ben Bernanke, and Securities and Exchange Commission Chairman Christopher Cox Thursday night.

House Speaker Nancy Pelosi credited the administration’s initiative with aiming to resolve the nation’s financial crisis. “Our purpose is to do that and in doing so, to insulate Main Street from Wall Street and recognize our responsibility to the taxpayer, to the consumer, and to the people all across the country,” she said.

Republican leaders also struck a conciliatory tone. “We reached a bipartisan agreement to work together to try to solve this problem, and to do it in an expeditious manner,” added Senate Republican leader Mitch McConnell.

Such conciliatory language represents a sharp break with the highly partisan tone only a day earlier.

Informed – but not consulted – about the Federal Reserve’s decisions to bail out American International Group but not storied brokerage Lehman Brothers and to pour some $255 billion into financial markets Wednesday, Congress wanted to know how the Bush administration was navigating the crisis: On what basis was one firm saved and another left to market forces? What future liabilities would US taxpayers be forced to cover? And what was the plan for resolving the crisis?

In response, Secretary Paulson, Mr. Bernanke, and Mr. Cox agreed to meet with congressional leaders to get their support for an administration plan that is expected to be presented to them over the weekend.

“I believe many members of Congress share my conviction” of the need to act speedily, Paulson said in a press conference Friday. Several key members of Congress are echoing the tone.

“We want to have an unconstrained discussion on what we do now,” said Rep. Barney Frank (D) of Massachusetts, who chairs the House Financial Services Committee, in comments before Thursday’s meeting.

“Now is not the time to seek political leverage or a quid pro quo. Too much is at stake for our families, workers, small businesses, and our economy,” said House Republican leader John Boehner.

Not everyone is on board, however.

Even before details of the plan were released, GOP conservatives signaled concerns about the impact of a massive federal intervention on free markets and the long-term liability for taxpayers. So far, they are the most prominent opponents of bailouts in Congress. Had it not been for the bad decisions of regulators, the Great Depression of the 1930s might have been a blip, they say. Moreover, taxpayers face “massive losses.”

“The last time I looked, the taxpayers lost about $150 billion the last time we had a Resolution Trust Corporation,” said Rep. Jeb Hensarling (R) of Texas, chairman of the conservative Republican Study Committee. The RTC, created to liquidate the assets of failing savings-and-loans companies in the 1980s, is one of the models for a new federal intervention in financial markets.

“Somebody has to speak up for the taxpayer, and enough is enough,” he added. “I’m not saying no to any solution that is on the table.... We’re looking at a lot of lousy options, but at this point in time that strikes me as a particularly lousy one.”

Sen. Jim DeMint (R) of South Carolina also registered his concerns about a possible deal in a statement Thursday: “I’m deeply troubled by this plan. What is missing from it and from the recent string of bailouts is a commitment to return to a free enterprise economy.”

“The federal government caused this problem by using taxpayer dollars to implicitly guarantee millions of mortgages, which have been sold as securities around the world,” he added. “This socialization of risk removed market accountability and has now set off a chain of events that is threatening our entire economy. What we need now is not what could be nearly a trillion dollars in new taxpayer bailouts, but pro-growth policies that allow our markets to correct and start growing again,” he adds.