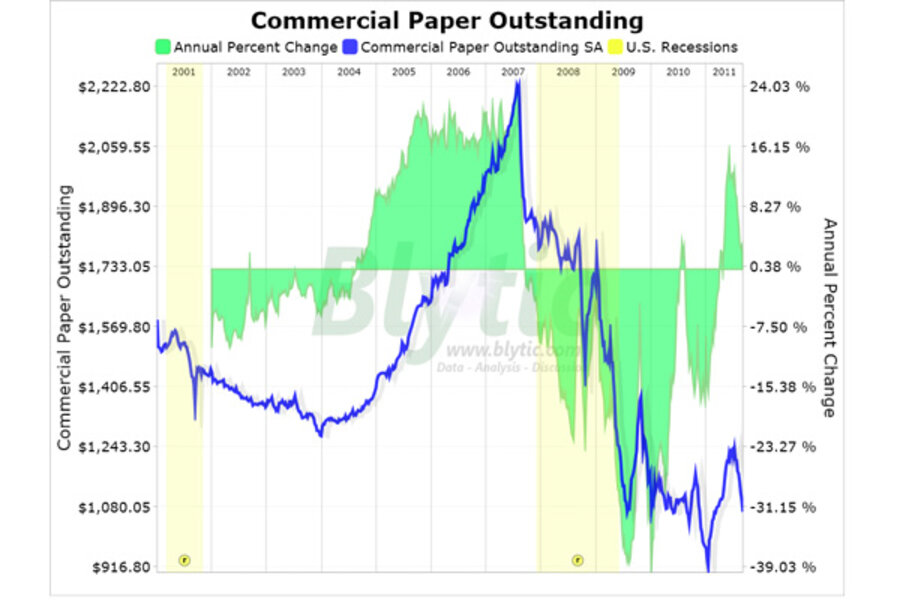

Commercial paper outstanding: August 2011

Loading...

The Commercial Paper (CP) market is essentially a private debt market used by corporations as a generally cheaper means of funding typical recurring operations than drawing on a line of bank credit.

Commercial paper, as financial instrument, is by no means a recent innovation and, in fact, you can read about how the CP market was affected by the many historic financial shocks experienced by the U.S. (read Panic on Wall Street: A History of America’s Financial Disasters).

Although the Federal Reserve was able to artificially bring CP rates down significantly since the shocking 615 basis point spread blowout (A2/P2 spread) of late 2008, they had not been successful in preventing an overall contraction in the CP market.

The Federal Reserve calculates and published the total amount of CP outstanding every week and for August commercial paper outstanding presented a serious pullback dropping from a recent high set back in July and expanding at a meager rate of 3.16% on a year-over-year basis to $1097.80 billion, a level that is still notably lower than even the worst periods of the last two recessions.