Financial reform: why the GOP strategy is risky

Loading...

Senate Democrats are pushing for a pivotal vote on financial reform Monday afternoon, a strategy that puts Republicans at risk of being labeled obstructionists if they prevent the bill from moving forward.

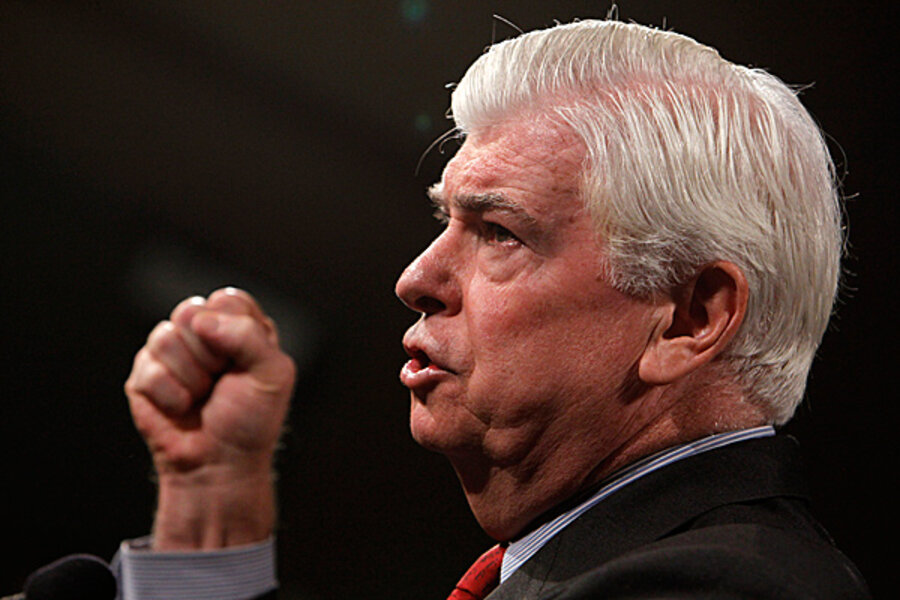

Democrats say it's time to pass legislation to impose tighter regulation on Wall Street, aimed at preventing a repeat of the financial crisis and the ensuing bank bailouts. But to move forward in the Senate, the so-called Dodd bill would have to gather at least one Republican vote, which would enable floor debate on the bill to be finished without a filibuster threat.

Republican leaders said over the weekend that all 41 GOP senators will close ranks and vote to stall the start of debate. Their goal is to continue negotiations with Democrats over the shape of the bill, before it moves on to the Senate floor. Republicans say they want to tighten the bill, maintaining it now allows for future bailouts.

Politically, though, Republicans could find themselves on the losing side of this vote, if they appear to be obstructing legislation more than shaping it. The fear of such an outcome – with hotly contested congressional elections coming up this fall – could very well drive at least one GOP senator to vote with Democrats.

So the expected Senate vote is turning into a high-stakes game of chicken.

Polls show public support for financial reform legislation. One survey released a week ago, by the Pew Research Center, found Americans have an even more negative view of bankers than they do of politicians. Some 69 percent said banks and financial institutions are having a negative effect "on the way things are going in the country." By comparison, 65 percent of the public labeled Congress and "the federal government" as negative.

A Pew poll in March found that 61 percent of the public supports stricter regulation of financial companies. Other polls have found more voters favoring than opposing the reforms under consideration.

Senators from both major parties have accepted lots of campaign donations from banks and other financial companies. Critics have accused both parties of working too closely with Wall Street as the legislation has inched forward over the past year.

But in recent days, senators have moved to tighten one key element of the reforms, despite objections by banks: Stepped-up restrictions on the complex investments known as derivatives came from Blanche Lincoln (D) of Arkansas. In a sign that some Republicans also want to be tough on Wall Street, Charles Grassley (R) of Iowa supported the proposal as well.

Related: