Interest rates will likely remain at historic lows

Loading...

| New York

Stocks edged higher Monday as investors avoided big bets before the Federal Reserve's meeting this week.

The Dow Jones industrial average rose 6 points in early morning trading. Broader indexes were mixed.

Investors are waiting for the Fed's latest assessment of the economy that will be issued at the close of the central bank's meeting on Tuesday. They also want to know if the Fed will restart some of its stimulus programs to help the recovery regain momentum.

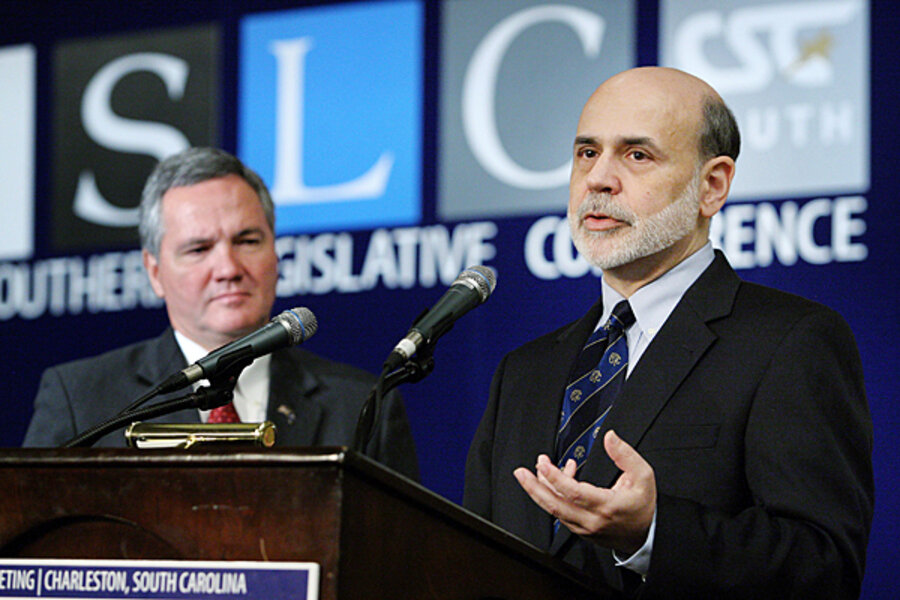

The market's growing concern about the economy has added to the importance of the Fed meeting. Recent economic reports have shown that the recovery is slowing. And Fed Chairman Ben Bernanke just a few weeks ago said the forecast for the recovery remains "unusually uncertain."

The Fed will likely leave interest rates at historic lows, but could signal plans to restart some stimulus programs, such as its purchase of mortgage-backed securities. Those programs ended earlier this year when it appeared the recovery was proceeding well. The Fed could say Tuesday that it is ready to start new programs to encourage bank lending even if it doesn't implement them immediately.

Hewlett-Packard Co. shares sank Monday after its CEO was forced to resign Friday. However, the company's problems didn't appear to be affecting the rest of the market.

McDonald's Corp. rose after it reported strong July sales, including its biggest jump in U.S. sales in more than a year.

European markets jumped after German exports reached their highest levels since late 2008, indicating the country's economy is recovering much faster than previously thought. There were concerns this spring that mounting government debt in countries like Greece, Spain and Portugal would stagnate Europe's economy. The German exports report was the latest data from the continent that showed the pace of growth is speeding up rather than slowing down.

In morning trading, the Dow Jones industrial average rose 25.66, or 0.2 percent, to 10,679.67 The Standard & Poor's 500 index rose 2.26, or 0.2 percent, to 1,123.90, and the Nasdaq composite index rose 8.72, or 0.4 percent, to 2,297.13.

About three stocks rose for every two that fell on the New York Stock Exchange, where volume came to 125 million shares.

Bond prices traded in a narrow range Monday. The yield on the benchmark 10-year Treasury note, which moves opposite its price, rose to 2.83 percent from 2.82 percent late Friday.

Hewlett-Packard CEO Mark Hurd was forced to resign after a sexual harassment claim led to the discovery he falsified expense reports. HP shares dropped $3.28, or 7.1 percent, to $43.02.

McDonald's jumped $1.58, or 2.2 percent, to $73.32 after it said July sales jumped 7 percent worldwide and U.S. sales rose 5.7 percent.

Stocks slid Friday, but closed the day well off their lows after the Labor Department said the unemployment rate remained at 9.5 percent in July and private employers hired fewer people than forecast last month. The disappointing report was the latest in a line that showed the economy continues to grow, but at a slower rate than earlier in the year.