On Tuesday New Jersey's new Democratic governor, Phil Murphy, broke sharply with President Trump and Congress on taxes. He used his first budget address to propose a hefty tax hike on millionaires.

In other high-tax states, Democratic politicians are emphasizing a different way to go anti-Trump. New York Gov. Andrew Cuomo, for example, is proposing workaround schemes so that upper-income residents won’t be hit so hard by one particular provision in the president’s tax-cut law – the cap on the amount of state or local taxes that can be deducted from federal returns.

Here are two Democratic leaders in two liberal states, and one is calling to tax the rich more while the other is worried about how to shelter those same taxpayers.

The two aren’t actually that far apart, but the apparent rift is noteworthy. It points toward a challenge for blue states that are poles apart from Trump politically: They want progressive tax codes and yet, as high-spending states, they’re also worried about retaining the “geese” that lay golden eggs. Politicians like Mr. Cuomo seem anxious about a tipping point where, if taxed too much, wealthy and upwardly mobile taxpayers may flee to other states.

“The cap [on deductions] is not going to immediately impact state revenues, but it does put pressure on the states,” says Frank Sammartino, a senior fellow at the Tax Policy Center, a research group in Washington. “People will feel they're no longer getting relief from some portion of their state income taxes, so there might be pressure on the states to reduce taxes and particularly taxes on higher incomes.”

Or at least not raise them too high. There used to be no cap for the state and local tax (SALT) deduction. Starting this year, a tax filer will only be able to deduct up to $10,000 per year in those taxes. If the income tax on millionaires rises in New Jersey, the federal government is no longer cushioning the blow by reducing the amount of federal tax that individual will owe.

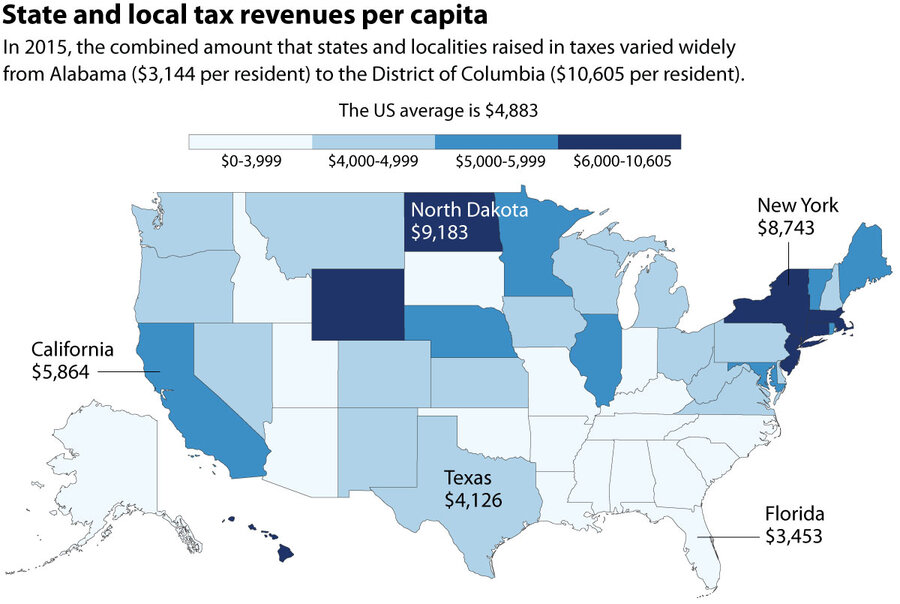

At a minimum, the federal tax law is casting a red-blue divide in state fiscal policy into sharper relief. Where some Republican-dominated states like Florida and Texas tout low taxes as a selling point to lure businesses and new residents, Democratic-leaning states in the Northeast or Pacific regions have both high taxes and some fiscal challenges like budget shortfalls.

High tax anxiety

“We are absolutely in a crisis mode right now,” Tom Bracken, president of the New Jersey Chamber of Commerce, said in a news conference last fall as Republicans were prepping the federal tax cuts. He welcomed the GOP goal of reducing business taxes (which the law did) but warned that New Jersey and a few other states faced adverse effects from the legislation.

“We are the highest tax state in the country,” he said, also pointing to figures showing significant outmigration. “The thing we cannot afford right now is to become less affordable, to become less competitive, and to continue to give people the incentive to leave this state or not to be attracted to this state.”

The upset that governors like Cuomo and others are voicing is understandable, says Meg Wiehe, deputy director of the Institute on Taxation and Economic Policy, a left-leaning research group. These states see they’re getting the short end of the stick from the federal law, and they suspect that Republican motives were at least partly political. (In a bill that largely showered tax cuts on individuals and businesses, the SALT deduction was one of the few moves designed to add some offsetting federal revenue. And it’s a deduction that most affects these blue states with high income and property taxes.) Cuomo of New York has called it an attack on his state.

At the same time, Ms. Wiehe sees irony and perhaps confusion in the Democratic response. The highest-earning taxpayers already will be big beneficiaries of the Trump tax cuts – even if they live in states like New Jersey – and now state-level Democrats are jumping through hoops trying to help them even more.

Cuomo voices worry as New York suddenly compares less favorably with other states as a place to reside. He’s proposing ways for the state to collect less of its revenue from income taxes and more in the form of payroll taxes, as well as making it possible and tax-deductible for residents to fund state government through charitable contributions.

Marginal impact?

But his concerns about migration may be overblown. Wiehe says job opportunities like those on Wall Street and in Silicon Valley will keep a big supply of high-earners in states like New York and California. And she points to academic research suggesting that few people migrate due to tax rates.

With taxes going down at the federal level, perhaps Governor Murphy’s proposed millionaire’s tax wouldn't sting so much.

“We are standing for fairness and fiscal responsibility by asking those with taxable incomes in excess of $1 million to pay a little more,” said Murphy Tuesday. “The irrefutable fact is that we have a thousand more millionaires today than we did at our pre-recession peak, and I’m sure none of them are here for the low taxes.”

Murphy, who took office two months ago, said the state needs the added revenue to cover rising needs in education and infrastructure.

His budget plan also called for some measures designed to offset the reduced SALT deduction.

Not all Democrats in the state are on board with his proposal. Since the federal law passed in December, state Senate President Stephen Sweeney has been calling tax surcharge on millionaires a “last resort,” even though he has supported such measures in the past. He’s urging a hike in business taxes instead.

As Wiehe notes, there’s considerable debate over how big a role taxes play in causing people and businesses to move from one state to another. Economists generally say a host of other factors are more important.

As Amazon ponders where to site a second headquarters – in other words, where to best locate to attract and retain an estimated 50,000 well-educated workers – it’s notable that its finalist cities include not just Austin and Nashville but also high-tax areas like New York, Chicago, and Montgomery County, Md., just outside Washington, D.C.

Still, taxes are a piece of the puzzle. New Jersey’s income ledger took a noticeable hit in 2016 because just one resident, billionaire hedge fund manager David Tepper, moved himself and his business to Florida.

Tax hit for lower incomes

It’s not just rich people who may move. It’s also people like CarmenMarie Mangiola of Rochester, N.Y. After being a stay-at-home mom and then working for years as a school teacher, she’s already downsized once, selling one home for a smaller one as costs, including taxes, got too high.

Now she’s planning to move to Virginia, because the taxes on her $100,000 home are more than $5,000 a year and rising. Now in her 60s, she’s living on a Social Security disability payment as she prepares to retire.

“It’s fine that we protect the next generation by creating good schools” and services, she says. But state and local taxes “are quite high” and “lots of people are fleeing New York.”

The squeeze of high taxes and high costs for government services affect a range of states, including four – Connecticut, New York, New Jersey, and Maryland – that are planning a lawsuit seeking to thwart the cap on SALT deductions.

The federal law “has put the ball in their court,” says Eileen Norcross at George Mason University’s Mercatus Center.

And in Maryland, the fact that a liberal-leaning electorate voted for Republican Larry Hogan as governor in 2014 symbolizes how, even without any nudge from federal policies, many blue-state voters and politicians have a wary eye on taxes and public spending levels.

In the upscale Maryland city of Bethesda, Chad Lieberman doesn't have any plans to call a moving van because of high taxes. As the proprietor of a small web-development business, he’s happy that state and local agencies provide strong schools, nice parks, and other public services.

But Mr. Lieberman is also watching to see what federal or local tax changes will mean for him. And as a self-described "small-government conservative" on fiscal issues, he says that high taxes may signal room for belt-tightening in public-sector budgets.