Why credit unions and small businesses are beating out big banks

Loading...

| Oakland, Calif.

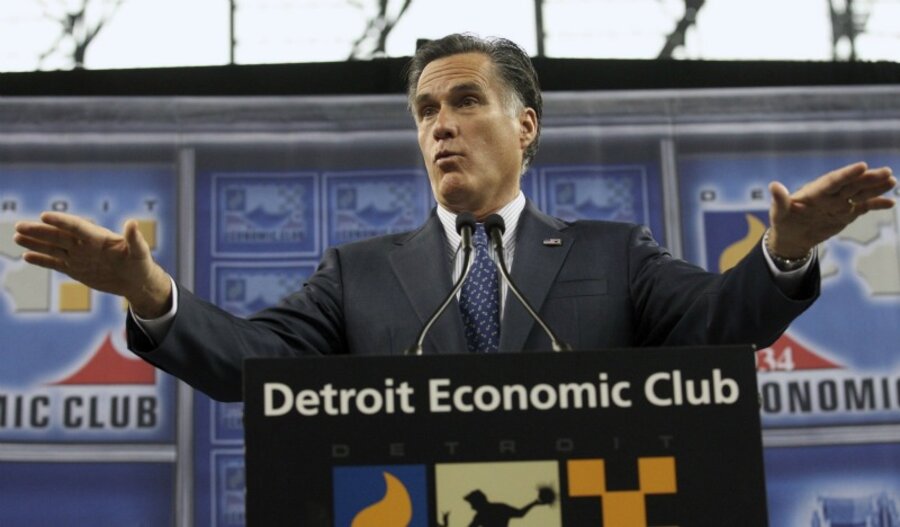

As Republican presidential candidates campaign in states with high unemployment rates like Florida, Michigan, and soon, Ohio, it’s a fair question to ask what business is doing to us as well as for us. Rising inequality and unemployment above 8 percent have left Americans frustrated, wondering whether capitalism is capable of supplying the jobs we need along with the community concern that we want.

The answer to both is yes. A new economy is emerging, a kind of constructive capitalism that offers an exciting new model for American prosperity and a way out of the current economic morass. Constructive Capitalism is shareable, local, and sustainable. Examples abound.

Let’s start with the State Bank of North Dakota. Formed in 1919 during an earlier populist revolt by farmers across the northern plains, it’s now the destination for cringing Wall Street bankers eager to discover how it was able to earn record profits during the financial crisis as its private-sector corollaries lost billions. The answer – that the bank invests its deposits in programs designed to spur North Dakota’s economy – must come as a shocker to the Wall Street crowd accustomed to investing in what are often planet-killing projects or companies that send jobs overseas.

North Dakota may have America’s only state-owned bank, but it is far from being the only community bank to flourish despite the financial crisis. Community banks and credit unions all over the country are growing their market share and doing it in a way that benefits the communities they serve. In just the last few months, more than 650,000 people opened new credit union accounts, depositing some $60 billion.

The recent growth could cause the credit union system to have more than $1 trillion in total assets, according to the Credit Union National Association chief economist Bill Hampel. Investment banks still have important roles to play in the economy, but we can look to more community-based models for economy growth. And big banks may follow suit.

In Cleveland, Ohio, the Evergreen Cooperative, a group of worker-owned green businesses, includes a laundry business that services the big schools and hospitals in the city, a solar installation and energy efficiency company, and a commercial greenhouse that will produce 5-6 million heads of lettuce and 300,000 pounds of herbs each year.

Finally, in Oakland (where I live), there’s a company called Sungevity that has helped thousands of people nationwide put solar panels on their roofs at no upfront cost through an innovation called a “solar lease.”

Similar to leasing car lease, Sungevity owns the panels and rents them to homeowners at a low monthly rate. Sungevity’s customers save money from the day the solar panels are installed, and collectively have saved tens of millions of dollars on their utility bills. Sungevity hired over 200 people in Oakland last year. Solar is the fastest growing industry in America and already employs more than 100,000 men and women, more than US steel production and more than US coal mining.

Surprisingly, even in the partisan gridlock of Washington, the House recently passed the Entrepreneur Access to Capital Act to make it much easier for businesses to raise money. Since the financial meltdown, the traditional means of financing have become inaccessible to most businesses, with banks refusing to lend, credit card interest rates soaring, and private capital unavailable.

This bill creates a legal framework for “Crowdfund Investing” to allow regular Americans to invest small amounts of money to start and grow businesses in their communities. SEC filing and appropriate disclosures would still be required to protect investors. The amount businesses could raise would be capped at $1 million, and individuals would be limited to $10,000 or 10 percent of their adjusted gross income, whichever is lower. The Senate has introduced two similar bills and should pass them quickly.

Americans need all these elements to rebuild their economy and their communities. But most of all, they need to take responsibility for building this new economy from the bottom up. Americans can’t afford to wait for the change to come to us; we must proactively be part of it.

The deepest, most profound changes in our country have always come from the people, not from Congress, Wall Street, K Street, or even Pennsylvania Avenue. The metamorphosis from the nation’s current fossil-fuel and big-bank dominated economy to a sustainable, broadly shared, and prosperous economy is already underway on Main Streets across America.

If you have an idea for a business that can provide real value to people, it may soon be a lot easier for you to raise the money you need to get it off the ground. If you’re still parking your money in a savings account at a big bank earning no interest, take a look at a credit union near you. And if you want healthier and tastier food or to save money by going solar, chances are help is only a few clicks away.

Billy Parish is president of Solar Mosaic, a solar investment platform, and the author of “Making Good: Finding Meaning, Money, and Community in a Changing World.”