With US debt, two clocks are ticking

Loading...

This week the US debt clock turned over and reached a new record: $13 trillion. That's too high – and one reason it's too high is that another clock is ticking.

America is getting older.

Cutting debt is hard enough. Cutting it when the demographic clock is running against you is much, much harder. That's the conclusion of a sobering March report from the Bank for International Settlements (BIS).

"Drastic measures are necessary to check the rapid growth of current and future liabilities of governments," the report concludes.

Here's the challenge: Advanced economies have run up such debts to fight recession that their current welfare systems don't look sustainable over the next 30 years. Their economies can't grow enough to cover the rapidly rising costs of the surge of people drawing retirement benefits and using subsidized medical care.

Scary projections

If nothing is done, the debt ratios look truly scary.

Historically, nations start to experience growth slowdowns once their debts reach about 90 percent of their gross domestic product (GDP) or annual output. Many advanced economies are hovering around that level now.

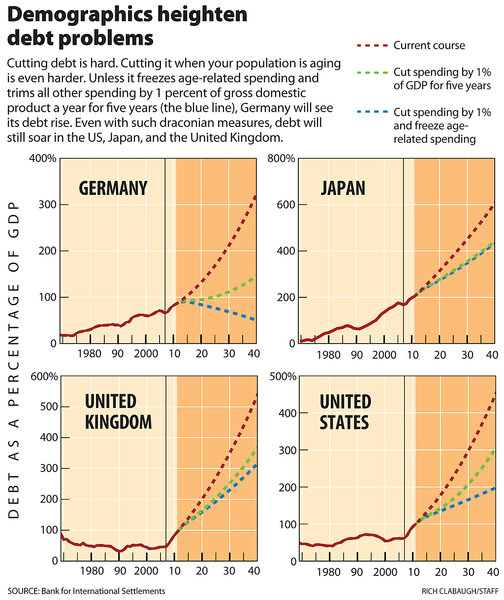

If they don't change course, nations like Austria, Germany, Ireland, and Spain would see their debt-to-GDP ratios move to 300 percent, according to the BIS report. The United States and the United Kingdom would hit 450 percent. Japan would reach 600 percent. (Click on the chart above.)

Nations are already making cuts to avoid that future. The problem is that budget cuts alone won't do it for most nations. If in 2012, the US were to cut its deficit by 1 percent of GDP per year for five years (it's currently at a cyclically adjusted 9.2 percent), its debt-to-asset ratio would still balloon to 300 percent.

Of the 12 nations in the BIS study, only Italy would see its debt fall simply through budget cuts, thanks to a budget that's nearly in balance.

The rest of the advanced economies will have to trim their long-term obligations if they want to trim debt. They can do some things without making outright cuts, such as raising the age before people qualify for retirement benefits. But they'll have to take draconian measures to tackle the debt, such as freezing age-related spending, the report says.

That's very tough to do politically. Imagine trying to spread today's Medicare dollars among a much larger pool of Medicare recipients in 2040.

Debts fall for some

If, somehow, governments can do this, then debt would begin to fall in nations such as Austria, Germany, and the Netherlands. Even Greece, Portugal, and Spain would see their debt stabilize.

That's the good news.

The bad news is that even after all those cuts in spending and services, debt would still go up in France, Ireland, Japan, the UK, and the US. Instead of a debt-to-GDP ratio of about 90 percent, Americans would be struggling with a 200 percent ratio, the report calculates.

That's not necessarily disastrous. Nations have a long history of surviving debt crises.

But for several developed countries living beyond their means in this era, the future looks like a long hard slog of high debt, slowed growth, and continued budget cutting.