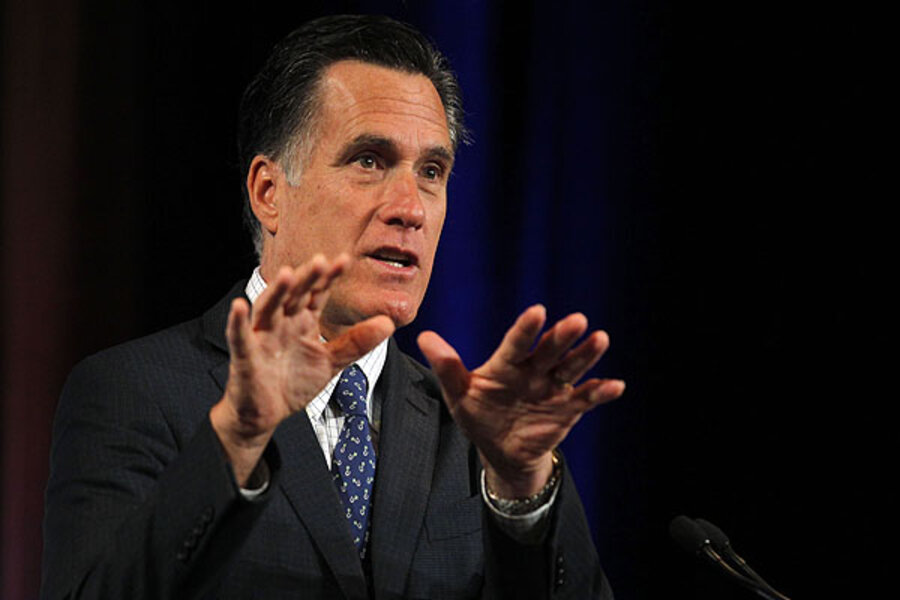

Romney's policy dead-end

Loading...

Mitt Romney has added a new plank to his campaign tax platform: Cut all ordinary tax rates by a fifth. That would bring the top individual income tax rate down to 28 percent and cut federal revenue by perhaps $200 billion a year. Romney says that a combination of economic growth and base broadening would make up that revenue loss.

But he’s put a few pretty big hurdles in the way of making sure his plan does not add to the deficit. He would repeal the alternative minimum tax (AMT) and thus eliminate a major backstop against revenue losses from his rate cuts. He’d retain the current 15 percent top tax rate on long-term capital gains and qualified dividends and do away entirely with taxes on that income for households making less than $200,000. And he promises not to increase the share of income tax paid by low- and middle-income households. That means any tax increases would have to fall entirely on the rich.

Assuming no other changes, the 20-percent cut in rates reduces taxes most at the top of the income distribution. The top rate would come down 7 percentage points, compared with just 3 percentage points for the 15 percent tax bracket. As a result, maintaining the tax share paid by the rich requires trimming their tax preferences much more than those of other households.

What could Romney target? The rich benefit disproportionately from three tax preferences: the reduced rates on gains and dividends, exclusions from income, and itemized deductions.

Romney has already taken the first off the table and it’s big—75 percent of the tax savings from low rates on capital gains and dividends go to the top 1 percent, cutting their tax bills by nearly a quarter. As for exclusions, the biggest are employer-paid health insurance premiums and retirement savings, which benefit most taxpayers—only a small fraction goes to high-income households. And Romney says he’d keep major deductions and won’t accept provisions limiting their value for the rich.

That leaves Romney trapped in a policy dead-end. After promising to retain lots of tax preferences, Romney has no clear way to recoup the revenue he loses by cutting rates. So he offers no specific proposals to broaden the tax base—promising those will come later.

Economists generally favor the principles behind Romney’s plan: Lowering rates and broadening the base is good policy. But a plan that cuts rates and only promises unidentified future base-broadening? Not so much.