Fourteen of the coolest sayings about investing

Loading...

To many of us, the world of investing might seem big and scary.

The good news is that many of the pros are willing to share their financial wisdom with the rest of us. From Benjamin Franklin to Warren Buffett, several successful investors have uttered down-to-earth phrases that can teach us worlds about investing. Here are 14 of these coolest sayings.

Warren Buffett

It isn't a coincidence that we start off this list with pearls of financial wisdom from Warren Buffett. The Oracle of Omaha is well known for his charming way of explaining the world of finance and his no-nonsense investment style.

1. "Rule No.1: Never lose money. Rule No.2: Never forget rule No.1."

When making investments, Buffett stresses the importance of doing your homework. You should never approach an investment as if it were a slot machine. Buffett only invests in companies that he has thoroughly researched — and so should you.

2. "Someone's sitting in the shade today because someone planted a tree a long time ago."

The most powerful weapon in any investor's arsenal is time. The earlier that you start saving for retirement, paying down debt, and building an emergency fund, the more likely you are to achieve your financial goals.

3. "Our favorite holding period is forever."

Buffett is absolutely right in suggesting to hold stocks for a long time. Several studies conclude that the historical average U.S. stock market return is about 8.5%. However, you can only achieve that kind of investment return by resisting the urge to sell your stocks during slumps. Stay the course and hold your stocks for the long term.

4. "When promised quick profits, respond with a quick 'No.'"

Despite his outstanding performance, Buffett insists that investing is difficult. Buffett points out that even the pros have a hard time beating the market. His advice is to ignore empty promises of a quick buck and to stick with safer investments, such as low-cost index funds, certain to perform reasonably well over time.

Peter Lynch

There are very few investors with better returns than Warren Buffett. One of them is the legendary investor and financial author, Peter Lynch. If you had invested $1,000 on the first day that Lynch took over Fidelity's Magellan Fund, your money would have earned $28,000 by the end of Lynch's 13-year tenure.

5. "Go for a business that any idiot can run — because sooner or later, any idiot probably is going to run it."

CEOs come and go, but truly great companies stick around for a long time.

6. "Although it's easy to forget sometimes, a share is not a lottery ticket... it's part ownership of a business."

Unlike buying a lottery ticket, making an investment is an ongoing process. For example, when you buy shares of a company or mutual fund, you will start receiving prospectuses, annual reports, and proxy forms. Read those documents to inform yourself about your investments and, when applicable, cast your vote to support initiatives that you agree with.

7. "Know what you own, and know why you own it."

Whether it's a real estate property, a retirement account, or a stock share, you have to keep an inventory of that investment and be able to explain you own it. Remember that there are plenty of sneaky investment fees to watch for.

8. "Never invest in any idea you can't illustrate with a crayon."

And the "why you own it" should be a quick one or two-sentence statement, not a 500-word essay.

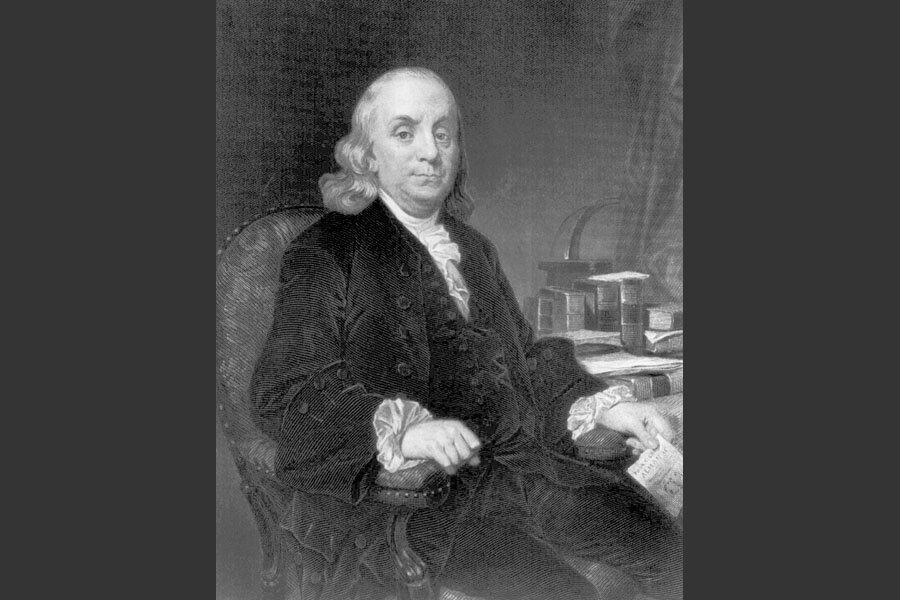

Benjamin Franklin

American Founding Father Benjamin Franklin epitomised the concepts of frugality and prudence when it came to saving and investing.

9. "An investment in knowledge pays the best interest."

As many as 74% of Americans see having a postsecondary degree or credential as a pathway to a better quality of life. And for good reason. Recipients of a bachelor's degree earn about $1 million more in their lifetimes than individuals with only a high school diploma. Additionally, studies have shown that people with higher education have lower rates ofmany chronic diseases compared to those with less education. (See also:5 Expensive Life Essentials Worth Investing In)

10. "Rather go to bed without dinner than to rise in debt."

Buy more of what you want, and you will have less to buy what you actually need.

11. "In this world nothing can be said to be certain, except death and taxes."

So, plan accordingly. Two key foundations for any investment strategy are to have a clear will and to secure the wellbeing of all of your financial dependents. If you're the main or sole breadwinner of your household, buying life insurance is a must for protecting your dependents. (See also:Make These 7 Money Moves Now or You'll Regret It in 20 Years)

And taxes? Well, they happen every year, so you need to plan ahead. By increasing your contributions to retirement accounts and taking advantage of applicable deductions, you can effectively reduce your tax bill.

Sir John Templeton

An investor and mutual fund pioneer, Sir John Templeton created one of the world's largest and most successful international investment funds.

12. "The four most dangerous words in investing are 'This time it's different.'"

Learn from investment mistakes of the past and apply those lessons to your future investments. There is nothing worse than a blind person that doesn't want to see.

13. "Invest at the point of maximum pessimism."

You may know this better by the investing maxim of "buy low, sell high."

But when are those times when you can buy low? Sir Templeton answers, "at the point of maximum pessimism." During the Great Depression of the 1930s, Sir Templeton purchased 100 shares of each company listed in the New York Stock Exchange spending less than a $1 per share and, many years later, he sold those shares for a huge profit.

Paul Samuelson

The first American to win the Nobel Memorial Prize in Economic Sciences, Paul Samuelson provides one of top of the coolest sayings about investing.

14. "Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas."

Buffett, Lynch, Franklin, and Sir Templeton would all have agreed with this statement by Samuelson. All successful investors agree that consistency is the key to make it in the world of investing.

"Watching paint dry" may not sound that sexy, but... heck, watching your money grow surely is!