Mortgage rates fall to 4.17 percent

Loading...

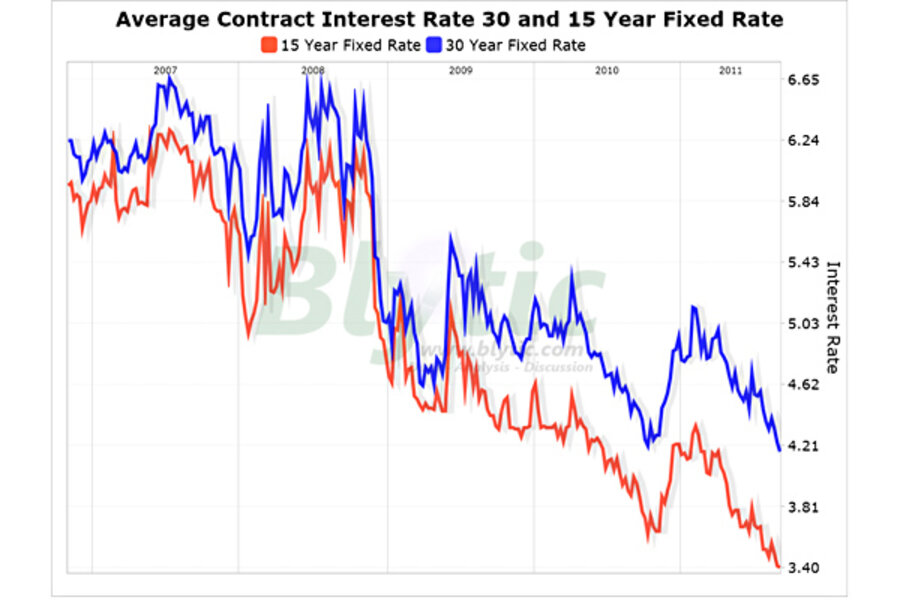

The Mortgage Bankers Association (MBA) publishes the results of a weekly applications survey that covers roughly 50 percent of all residential mortgage originations and tracks the average interest rate for 30 year and 15 year fixed rate mortgages as well as the volume of both purchase and refinance applications.

The purchase application index has been highlighted as a particularly important data series as it very broadly captures the demand side of residential real estate for both new and existing home purchases.

The latest data is showing that the average rate for a 30 year fixed rate mortgage declined 6 basis points to 4.17% since last week while the purchase application volume increased 7.0% and the refinance application volume increased 6.0% over the same period.

With rates at or near generational lows (including the 10-year T-Bill) and the FOMC members becoming more dovish by the day, it will be interesting to see where rates will go once clear details of QE3, purported to be focused more on long term rates, are revealed.

The following chart shows the average interest rate for 30 year and 15 year fixed rate mortgages since 2006 as well as the purchase, refinance and composite loan volumes (click for larger dynamic full-screen version).