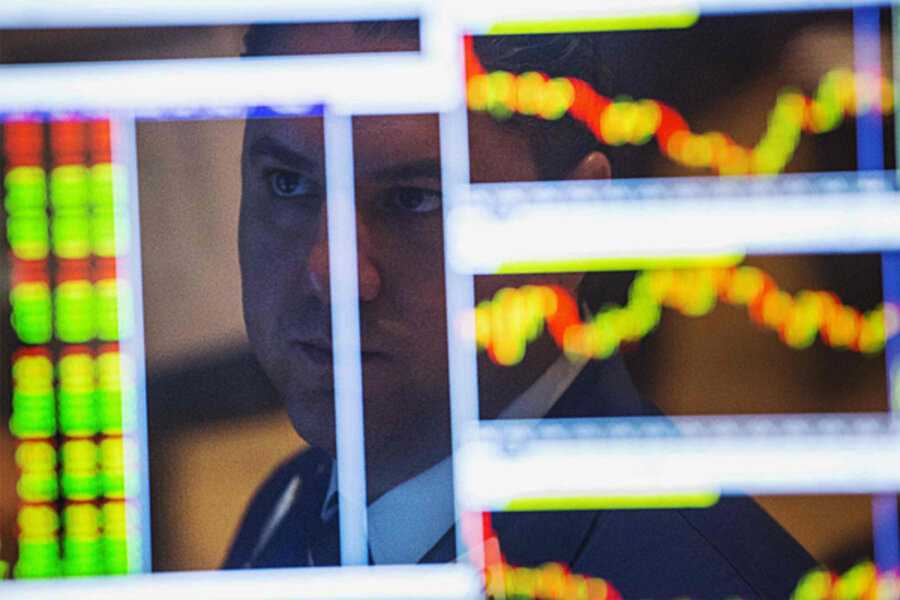

Stocks up on strong US auto sales

Loading...

| New York

A jump in U.S. auto sales and other good news on the economy helped drive the stock market higher Wednesday.

General Motors and other carmakers surged after posting strong sales in August, giving the industry its best month in six years.

"Car sales were really impressive," said Peter Cardillo, chief market economist at Rockwell Global Capital in New York. They're important for what they suggest about the larger economy: solid consumer spending and increased manufacturing. "It means the economy is holding up," Cardillo said.

The Standard & Poor's 500 index rose 13.31 points, or 0.8 percent, to 1,653.08.

The Dow Jones industrial average gained 96.91 points, or 0.7 percent, to close at 14,930.87 and the Nasdaq composite rose 36.43 points, or 1 percent, to 3,649.04.

Jim Russell, a senior equity strategist at U.S. Bank Wealth Management in Cincinnati, said recent economic reports have drawn a brighter picture of the global economy, even as concerns over a U.S. strike on Syria have claimed much of the public's attention.

A trade group said Tuesday that U.S. factories increased production last month at the fastest pace since June 2011, propelled by a sharp rise in new orders. Separate reports out Monday showed stronger manufacturing in Europe and China.

"All of these add up to better economic growth on a global scale," Russell said.

On Wednesday, General Motors said its sales rose 15 percent last month, while Chrysler and Ford each reported 12 percent gains. Toyota posted the biggest increase as sales rose nearly 23 percent since August of last year.

GM climbed $1.71, or 5 percent, to $35.85, one of the biggest gains in the S&P 500 index. Ford rose 57 cents, or 3 percent, to $16.91.

The Nasdaq Stock Market ran into technical problems for the second time in two weeks. The exchange reported that its system for disseminating prices had a brief outage, from 11:35 a.m. to 11:41 a.m., but said trading was not affected.

On Aug. 22, all trading in Nasdaq-listed stocks was halted for three hours because of a problem with the same quote-disseminating system.

Investors were also looking ahead to Friday, when the August jobs report will be released. Economists expect that the U.S. created 177,000 jobs last month and that the unemployment rate held steady at 7.4 percent, according to the data provider FactSet.

Friday's jobs report is the last major piece of economic data the Federal Reserve will have to work with before the central bank decides whether or not to pull back on its massive bond-buying program. That program has kept interest rates abnormally low. While most investors believe the Fed will begin to pull back, the question has become when and how much.

"Even if the August employment figures were weaker than expected, we think the odds would likely still favor a September (pullback), just of a smaller magnitude," economists with the investment bank RBS wrote in a note to clients.

The yield on the 10-year Treasury note edged up to 2.89 percent from 2.86 percent late Tuesday. The price of crude oil fell $1.31, or 1 percent, to close at $107.23 a barrel on the New York Mercantile Exchange. Gold fell $22, or 2 percent, to $1,390 an ounce.

Among other stocks making big moves:

— Dollar General jumped $2.51, or 5 percent, to $56.39 after the discount store chain reported profits that narrowly beat Wall Street analysts' estimates. In contrast to some of its competitors, Dollar General said sales at stores open more than a year climbed.

— Francesca's Holdings, which operates the francesca's line of retail stores, plunged after reporting results that fell short of Wall Street's estimates. The company cut its forecast for full-year earnings, citing poor customer traffic. Its stock sank $6.23, or 26 percent, to $17.79.

— Ciena surged $2.86, or 14 percent, to $23.54. The developer of high-speed networking technology reported adjusted earnings that were far higher than Wall Street analysts expected, a result of higher revenue and lower costs.