Curious how systemic racism works? Check out your neighborhood.

Loading...

| Boston

The 1930s brought new opportunities for homeownership in the United States, including government-backed loans. But Black Americans and other people of color were prevented from receiving these loans through a practice now called “redlining.”

A federal agency created color-coded maps designating green and blue neighborhoods (occupied by whites) as “safe” for lenders to invest in, while yellow and red neighborhoods (where nonwhite people lived) were considered high-risk. As a result, for nearly 30 years, 98% of government-insured loans went to white families, enabling them to own a home and pass on that investment to future generations.

Why We Wrote This

Like most self-perpetuating systems, systemic racism masquerades as the norm. But as the history of housing discrimination illustrates, it’s a human-made system, not a natural one.

Redlining was outlawed in 1968. But its consequences persist, beyond the loss in generational wealth. Previously redlined neighborhoods often lack easy access to fresh food, banks, good public transportation, and well-funded public schools.

“I really think the separate and unequal neighborhoods we built intentionally are at the root of just about every other inequity and injustice,” says Margery Turner, a fellow at the Urban Institute.

The federal government is undergoing an equity assessment to address its role in housing discrimination. But Soni Gupta, director of Neighborhoods and Housing at The Boston Foundation, says a broader understanding is needed. “I wish more people could connect the dots, because we would really benefit from everyone understanding how we got here,” she notes.

Becoming a first-generation homebuyer was a meaningful step for Erin. Her parents came to the United States from Cape Verde and had never been able to purchase a house. She was excited for the stability it would provide and the financial investment in her future.

But as a 40-year-old Black woman in the Boston area, Erin, who didn’t want to be named for employment reasons, faced a lot of barriers. As she went to banks to get a mortgage, she began to feel that the color of her skin was affecting the opportunities available to her, despite having a stable financial situation and steady work.

“It was hard. [There was] a lot of profiling, a lot of lenders and realtors and people telling you that you can’t do it if you want to stay in Boston,” she says.

Why We Wrote This

Like most self-perpetuating systems, systemic racism masquerades as the norm. But as the history of housing discrimination illustrates, it’s a human-made system, not a natural one.

One bank was especially bad. “The lender herself was extremely rude, extremely demeaning,” Erin says. “I told her that I wasn’t a child, because of the way she was talking to me, and she just kept saying degrading things.”

Erin is just one individual experiencing housing discrimination, but her experience is not unique. The roots of this issue are deep, and point to a history of systematic, legalized racism in the U.S. The term “systemic racism” refers to the ways in which institutions – including the government – have adopted racially motivated policies, sometimes codified as law.

Today, such policies – especially in housing – are illegal. But as Erin’s experience shows, the systems they created continue to perpetuate themselves. Historical practices such as redlining demonstrate not only the long-term effect of racist policies on would-be homebuyers but the add-on effect in education and other areas.

Symone Crawford, the director of Saving Toward Affordable Sustainable Homeownership (STASH), a matched-savings program that helps first-time homebuyers in Massachusetts, especially Boston, save money for a down payment, says there are many ways that “institutional and systemic racism rears its ugly, ugly head.” A full 97% of STASH participants are people of color, with 73% being Black. Ms. Crawford says that’s no coincidence. “While the discriminations are most times not blatant, they are there,” she says.

To help explain systemic racism in the U.S., we’ll focus on one example: housing discrimination in Boston.

For the last 100 years or so, what factors have influenced where people live?

The 1930s ushered in the era of 30-year mortgages, low fixed-interest rates, and government-backed lending through the Home Owners’ Loan Corp. (HOLC) and the Federal Housing Administration (FHA). The hope was to reinvigorate the middle class through unprecedented access to homeownership and wealth building. By insuring loans, the government provided a safety net for banks to fall back on during hard economic times.

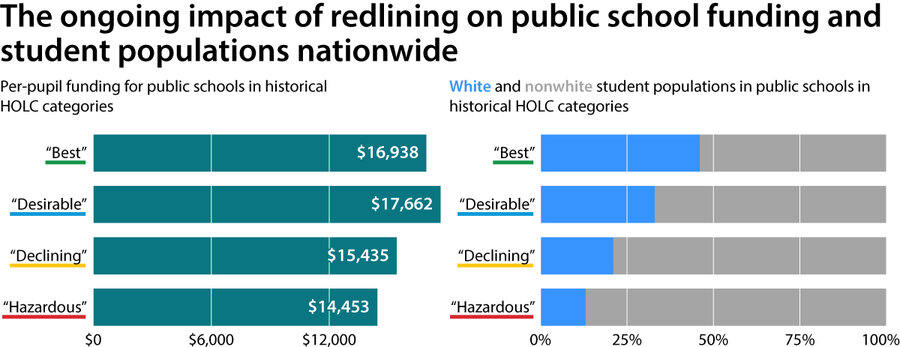

But these homeownership opportunities were limited to white Americans. Black Americans, other people of color, and some immigrant groups were prevented from receiving government-backed loans through a practice now referred to as “redlining.” The HOLC created color-coded maps to indicate which neighborhoods were “safe” for banks to invest in. Green and blue neighborhoods (occupied by whites) were marked as “best” or “desirable” – worthy of investment and insurance. By contrast, yellow and red neighborhoods (where Black people and other people of color lived) were deemed “declining” or “hazardous” – full of high-risk, low-value real estate.

Due largely to this color-coding, between 1934 and 1962, 98% of FHA-insured loans went to white families, many of whom fled cities for the growing suburbs. This enabled them to own a home and pass on that investment to future generations. That opportunity was not afforded to Black people or other people of color.

“That history, it’s real and it’s deep,” says a senior official at the U.S. Department of Housing and Urban Development (HUD). “So when we talk about systemic racism in our history, we have to really think about federal policies, state and local policies as well, that were fundamental to the way that our nation was built up.”

Is housing discrimination still going on?

Redlining was outlawed with the passing of the Fair Housing Act in 1968. But 30 years of state-sponsored discrimination had consequences that have gone on to affect generations of Black families in particular.

“When you build housing and neighborhoods, they last for a long time,” says Margery Turner, a fellow at the Urban Institute in Washington. “We built separate and unequal neighborhoods. And the legacy of that ‘separate and unequal’ is really hard to overcome.”

A 2018 study found that, nationwide, homes in neighborhoods that are 50% Black are valued at roughly half the price, compared with neighborhoods with no Black residents. Even when you take comparable homes in comparable communities, homes in majority-Black neighborhoods are valued at 23% less. That averages out to about $48,000 per home, resulting in cumulative losses of $156 billion across the country.

An earlier study from 2004 shows that home-purchase loan applications for Black residents in the Greater Boston metropolitan area were denied at more than 2.5 times the rate of white applicants, with the denial rate increasing for higher-income Black applicants. Black borrowers refinancing their homes were three times more likely to receive subprime loans, which have higher interest rates. In fact, upper-income Black homeowners were more than twice as likely to receive these loans as low-income white people. This discrimination in lending contributes to the disparity in homeownership levels according to race in the Boston area, where Black homeownership rates hover around 35%, at roughly half the rate of white households.

“It’s just a perpetuation and a constant cycle of poverty and a lack of wealth-building opportunities,” says Soni Gupta, the director of Neighborhoods and Housing at The Boston Foundation. “What we’re trying to do here is really peel the layers of the onion so that you can focus on correcting the racial disparities.”

Housing discrimination even persists in rental markets. In 2020, Suffolk University Law School’s Housing Discrimination Testing Program (HDTP) found that for prospective renters in Boston, 71% of individuals were discriminated against because of their race. The study sent Black and white testers with equal qualifications – age, income, gender, family size, credit score – to seek housing in the Boston metro area. Black renters on average were shown only 48% of the apartments they asked to see, compared with white renters being shown 80% of those they requested to see.

“We found very, very high rates of discrimination in the Boston area,” said Kelly Vieira, an attorney who works with HDTP. “There aren’t as many ramifications or consequences [for discriminating] as there should be.”

What are the lasting effects of housing discrimination?

Ms. Turner, from the Urban Institute, says discriminatory housing practices made the segregation that already existed even worse. And that segregation led to self-perpetuating cycles of racial disparities.

“I really think the separate and unequal neighborhoods we built intentionally are at the root of just about every other inequity and injustice,” she says.

While homeownership doesn’t guarantee wealth generation, having a stable investment that can be passed through generations and gain value over time is a key way for families to break the cycle of poverty. But even homeownership itself operates unequally, depending on the racial makeup of the neighborhood. In Boston, median home values today are much lower in historically redlined neighborhoods than in those that benefited from favorable lending policies.

What’s more, housing discrimination doesn’t operate in a vacuum; it impacts many aspects of everyday life. Formerly redlined neighborhoods often lack easy access to fresh, healthy food; full-service banks; and good public transportation. Most notably, educational opportunities are affected by housing discrimination. In many areas nationwide, public schools are funded primarily by property taxes, so if property values in a neighborhood are low, school funding is also low. A Harvard University study found that the performance gap between schools in previously redlined areas and nonredlined areas is still widening.

In the city of Boston, each school is funded according to students enrolled, regardless of tax revenues in the neighborhood. Yet the persistent segregation in Boston’s historically redlined neighborhoods continues to have adverse effects on the students of color who primarily attend them.

How do we address it?

For many Black families trying to buy a home, they simply have to be undaunted. That was true for Erin, who, with the help of STASH, the matched-savings program, purchased a home last year in the Boston neighborhood of Hyde Park.

Ms. Crawford, STASH’s director, says the program itself and the classes provided by its parent organization, Massachusetts Affordable Housing Alliance, are preparing more and more people for the rigors of finding and financing a home for the first time, including the possibility of facing some of the challenges Erin experienced. About 800 people graduated from the first homebuyer class in 2018. This year, 3,000 people are poised to graduate.

But training people to work through housing and mortgage processes laden with decades of discrimination doesn’t get at the root of the problem. There’s widespread agreement that systemic racism needs to be addressed on a systemic, not individual, basis.

The federal government is acknowledging not only the lasting effects of discriminatory housing practices but also its own role in creating them. “We are undergoing a massive equity assessment within our own walls and in our own policies,” says the HUD official.

And, recently, Evanston, Illinois, became the first city to redress past housing discrimination through a reparations program.

However, local efforts and federal policy changes are only part of the solution. A broader understanding of the situation is needed, especially since neighborhood demographics have shifted. The Brookings Institution found that in many previously redlined areas, including some of those in Boston, the neighborhoods are now majority-minority but not necessarily majority-Black. On the one hand, that may mean policy solutions will need to be tailored to the mix of residents now experiencing the effects of a long-term lack of investment in their neighborhood. On the other, targeting assistance to formerly redlined areas alone won’t reach the Black and other minority families no longer living in these neighborhoods whose opportunities to accumulate wealth, attend strong public schools, and so on were circumscribed for generations by the redlining maps of the 1930s.

The history of housing discrimination is an important part of the conversation, but so is understanding that its knock-on effects extend across decades and go beyond the neighborhood boundaries once outlined in red.

“I wish more people could connect the dots because we would really benefit from everyone understanding how we got here,” says Ms. Gupta, from The Boston Foundation. “For [many, there’s] still the belief that people are doing this to themselves.”

But gaining that understanding can be unnerving for some.

“I think a lot of white people, when they start to look at our racial history, … the only outcome that they can imagine is other people doing to them what white people collectively have done to people of color,” says Louise Seamster, an assistant professor of sociology and African American studies at the University of Iowa. “That’s not what anybody is calling for. But that emotional response means that they don’t have room to hear what is actually being discussed.”

For Ms. Vieira, the attorney with HDTP and a member of the Black community, the point is not to dwell on what happened in the past, but to ensure that we don’t repeat the same racist patterns of the mid-20th century.

“I think you have to lean into the discomfort and know that past the discomfort is change,” she says.