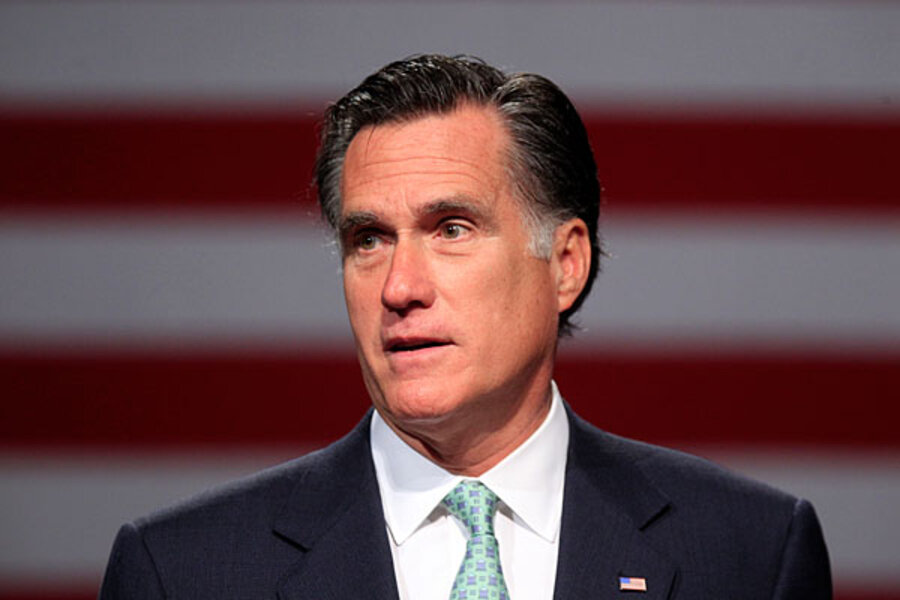

Mitt Romney's Bain problem: private equity has bad rap with public

Loading...

Mitt Romney bills his business background as a major selling point for his presidential candidacy, but a recent attack ad by President Obama exposes a challenge for the Republican: Mr. Romney's background wasn't in any old form of business, but in a type of investment activity that isn't very popular with the American public.

The Obama campaign ad features former steel workers saying that Romney's firm bought their company, GST Steel in Kansas City, Mo., loaded it up with debt, and ran it into the ground while turning a profit as the owner.

The saga is intended to show that Romney was not a job creator, and that his firm's "private equity" activities in fact cost many Americans their jobs.

Fairly or not, many Americans have a skeptical view of private equity firms like Bain Capital, which Romney helped found in 1984. And they had this view well before Obama launched the recent ad.

A March poll by Bloomberg News asked the question, "Do you think private equity practices, which include investing money to take over companies with a plan to sell them later, are mostly good or mostly bad for the economy?" Some 52 percent of Americans said "mostly bad," while just 27 percent said "mostly good," and the rest were uncertain.

That could be a problem for the presumptive Republican nominee as he seeks blue-collar swing votes in what promises to be a hard-fought general election campaign. At the very least, the polling result suggests that marketing yourself as the founder of Bain Capital isn't an automatic vote getter.

At the same time, it's important not to read too much into any one polling statistic, especially on an issue as narrow as the role private equity plays in the economy. American workers and voters take a fairly balanced approach to economic issues that isn't wholly in one political camp. And since the Obama "steel" ad came out in mid-May, the president and Romney have remained essentially tied in daily Gallup polls.

The Bloomberg poll confirms that the public isn't enamored of high finance. Private equity firms like Bain Capital are just one example. (For the record, in addition to buyouts of existing companies using private capital, Bain under Romney was also involved in "venture capital" financing of young firms.)

Big banks and big corporations also don't score big in polls on favorability. In a 2010 Gallup poll they ranked down near the bottom (not far above Congress) when Americans were asked how much confidence they had in major institutions. Romney might be an easier sell with voters if his background had been in small business, which ranked at the top of the public-confidence list, second only to the military.

At the same time, Obama's attack strategy has pitfalls. His presidency has faced a drumbeat of criticism as allegedly antibusiness – with a knee-jerk penchant for deriding Wall Street and the wealthy. Polls suggest that this message resonates – the public is against bank bailouts and for higher taxes on the rich, for instance but only up to a point.

Another 2010 Gallup poll found most Americans have a positive image not just of small business (with 95 percent citing a positive view) but also of free enterprise (86 percent), entrepreneurs (84 percent), and capitalism (61 percent). Big business got a neutral score, while the public reported a negative image of the federal government and of socialism.

Similarly, where the public is not unsympathetic to the former steel-union workers who are quoted in Obama's ad, Americans don't view organized labor as having a recipe for job growth. A Gallup survey last August found Americans on balance favoring less influence for labor unions, not more.

Journalists for the fact-checking group Politifact.com have labeled Obama's basic claims about Bain's investment in GST Steel as "mostly true." Obama's team said Romney and his partners loaded the company with with debt, closed the Kansas City plant, "and walked away with a healthy profit, leaving hundreds of employees out of work with their pensions in jeopardy."

What Obama's ad didn't say was that the firm was struggling because of a tough climate of global competition in the industry, not because Bain Capital set out to close the plant.

Some economists argue that private equity firms play a useful role in the economy, spurring uncompetitive firms to restructure and sometimes infusing struggling operations with new capital.

Others, however, have concluded that, in general, private equity firms don't manage businesses any better than managers of publicly traded firms.

RECOMMENDED: Mitt Romney's five biggest assets as GOP nominee