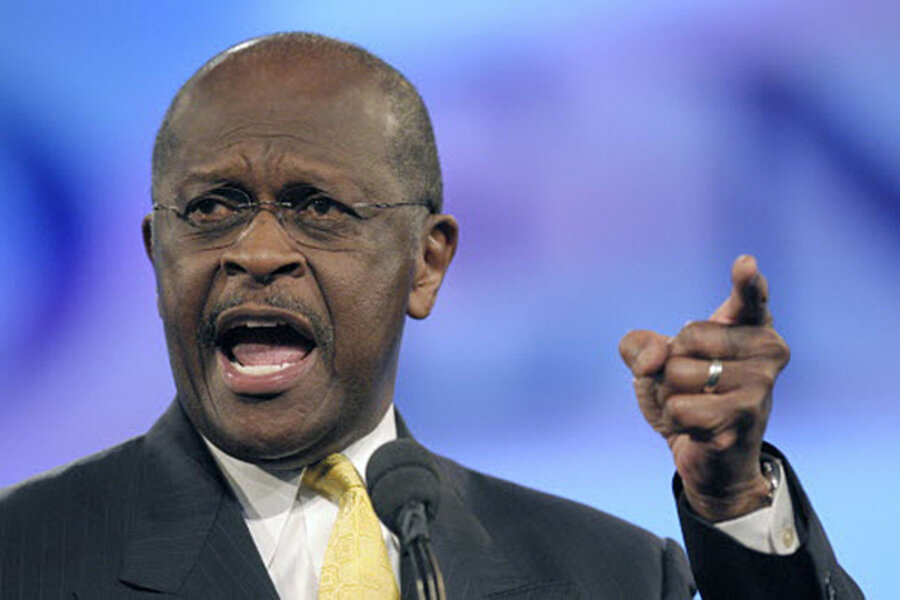

Herman Cain's '999 plan': long overdue tax reform or job killer?

Loading...

Herman Cain's political star is lately on the rise, thanks in no small part to the persistent marketing of his so-called 9-9-9 plan – the presidential candidate's blueprint for reforming what many see as a complex and unpopular US tax code.

But Mr. Cain, who won a Florida straw poll of the GOP faithful Saturday and who now is tied for third with Newt Gingrich among Republican presidential candidates in a recent average of three nationwide polls of Republicans, promises that 9-9-9 will do much more than simplify the tax code. Cain, the former chairman of Godfather’s Pizza says it represents "a bold solution" for reinvigorating the whole US economy.

The elements of the Cain plan are 9 percent flat tax on household income, a 9 percent corporate tax, and a 9 percent national sales tax. There are no deductions except for charity. It's a graspable concept – and one that increasingly has been getting bursts of applause during GOP presidential debates.

“This is an attempt to shift the tax burden away from production and towards consumption, to balance the load,” says Rich Lowrie, Cain’s Cleveland-based senior economic advisor. “This taxes everything once but nothing twice.”

Mr. Lowrie, who is not an economist, says by “ripping out a whole bunch of taxes” prices of goods will fall, US exports will be more competitive and business will thrive. He claims the plan will create 6 million new jobs as business becomes more competitive.

“In the price of things is the embedded cost of all taxes,” he says. “We will be exporting goods without the taxes built into them and hitting imports with the sales tax. It will level the playing field.”

Independent economists who have studied Cain's 9-9-9 plan say the plan would take the nation into uncharted waters. The US has never had a national sales tax except for gasoline. It’s not clear what would happen to state and local services. States and municipalities would be carrying a new burden since they would have to pay the tax too. And, economists say the plan would favor those with high incomes.

“I can understand how a presidential candidate may want to start out and go a different way,” says John Silvia, chief economist at Wells Fargo Securities in Charlotte, N.C. “But, we have to know how we’re going to get from here to there – there are a lot of implications for this.”

One of the major implications would be moving the nation away from consumption. That may not be so bad, says Mark Zandi, chief economist at Moody’s Analytics in West Chester, Pa. “The more we save and invest, the stronger our economy would be.” But, he quickly adds, “It’s not exactly what I would do, but I sympathize with the spirit.”

If you cut down on consumption, retailers fret it would cost them sales and the nation jobs.

“Every CEO says the reason they’re not hiring is because they’re not seeing demand,” says Rachelle Bernstein, a vice president and tax counsel at the National Retail Federation, a lobbying group, in Washington. "An additional tax on consumer spending will negatively impact that already weak demand."

Some economists worry the plan would result in national tax cheating since retailers might offer items for sale at two different prices: one with tax and one without tax for people paying with cash. “The incentive to cheat is huge,” says Nigel Gault, chief US economist for IHS Global Insight in Lexington, Mass.

Mr. Gault says this is the reason why most countries have enacted a Value Added Tax (VAT) that gets tacked on during the different phases of producing a product. As each tax gets added on, there is an incentive to pass it on.

Since Cain would eliminate the business deduction for labor but not investment, the plan would most likely cause distortions that might add to the unemployment rate, says Mr. Silvia. “This would favor heavy industries that use lots of capital and penalize companies where labor is significant and capital is small,” says Silvia. The entire service sector would be disadvantaged, he adds.

Mr. Lowrie says one of the goals is to make labor more productive. “Capital and labor – you can’t separate them,” he says. “It makes no sense to takes sides, one over the other.”

But probably the largest economic impact would be shifting the tax burden. “It's a huge tax reduction on the very top and a huge tax increase for moderate and low income people," says Michael Graetz, a professor at Columbia University who has testified before Congress on taxes.

For example, economists have a measure called marginal propensity to consume. Low income people tend to spend about 98 percent of their income, middle income people spend 97 percent and high income people spend 90 percent.

Thus, Cain’s proposal would result in an individual who makes $20,000 per year, paying $1,800 in income taxes, plus another $1,605 in sales taxes, assuming they spend 98 percent of their income. The combined income and sales taxes would amount to 17 percent of income.

By way of comparison, using today’s tax rates, that individual – married filing separately – would pay $2,575 in combined taxes or 12.8 percent of their income, according to the website moneychimp.com.

A middle income taxpayer that makes $55,000 per year would pay $9,319 in combined taxes, coming to 16.9 percent of their income. Today, that individual would pay $9,875 and would pay 17.95 percent of their income in taxes.

And, a high income earner who makes $300,000 per year would pay $49,113 in taxes, which would amount to 16.3 percent of their income. But, today, that individual would pay $83,897 or 27.97 percent of their income in taxes.

Along the way, Cain would jettison the payroll tax (think Social Security and Medicare taxes), the Estate Tax and all deductions such as the mortgage interest deduction. And, finally, if Cain were president, he would use his 9-9-9 plan as a way to move the nation towards the so-called “Fair Tax,” a 30 percent national sales tax that would ultimately replace the income tax and the corporate tax.

Gault, at IHS Global, thinks shifting policies would be especially difficult for people who had saved for retirement but just as they were set to retire, the income tax was virtually eliminated and a sizable sales tax was implemented. “This rewards future savings but punishes you if you have been saving” all along, he says.

Another major issue for the Cain plan is the effect on the budget deficit. Zandi thinks the 9 percent numbers seem low. Based on FY 2010 numbers, he calculates the 9-9-9 plan would generate about $2.2 trillion in revenue which is close to 15 percent of Gross Domestic Product—about what the US collects now.

However, the US is currently spending 23 percent of GDP.

“That would suggest some pretty draconian spending cuts,” says Zandi.

Lowrie, Cain's economic adviser, doesn’t disagree, but says, “That’s a spending problem.” He maintains that the Cain plan, as scored by Gary Robbins of the Conservative Heritage Foundation, would increase revenues by 15 percent.

In the near future, Lowrie says Cain will release his plan for low income areas which he terms “empowerment zones.” People living, working, and employing people in those areas would receive tax deductions.

In addition, Cain would eliminate Payroll taxes, which now go to fund Social Security and Medicare. That would mean both entitlement programs would be funded out of general revenue.

“This is one of the few taxes that works well,” says Bruce Bartlett, a former advisor to President Ronald Reagan and a Treasury official in the George W. Bush administration. “It becomes very dangerous once you break the line of contributions.”

But the money isn't in the Social Security trust fund for long before it gets used for other purposes, says Lowrie. So "why continue with the charade?"

Under the plan, state and local governments would also have to pay the 9 percent tax. In effect, the government would pay the tax to itself, notes Mr. Bartlett.