Five signs to measure economic recovery in 2010

Loading...

| New York

Economic recovery is in the air as America emerges from the longest – and worst – recession since World War II.

So what’s next for the US economy in 2010?

Perhaps most important, new jobs may be created. Also, home prices may inch up, and many Americans may feel a little better about the state of their pocketbook.

But unlike in past recoveries, the economy is not expected to snap back and bring smiles to everyone on Main Street. Instead, the unemployment rate is expected to stay uncomfortably high, businesses may remain timid about expanding, and some Americans are going to grumble that the recovery has not included them.

“It’s going to be a slog,” says Mark Zandi, chief economist at Moody’s Economy.com. “What we have been through is an abyss.”

Because the downturn has been so steep and so long, some are concerned that the recovery might falter, turning into the dreaded “double dip” recession. Under that scenario, the fragile economy runs out of steam as the fiscal stimulus measures end and consumers remain wary of spending much.

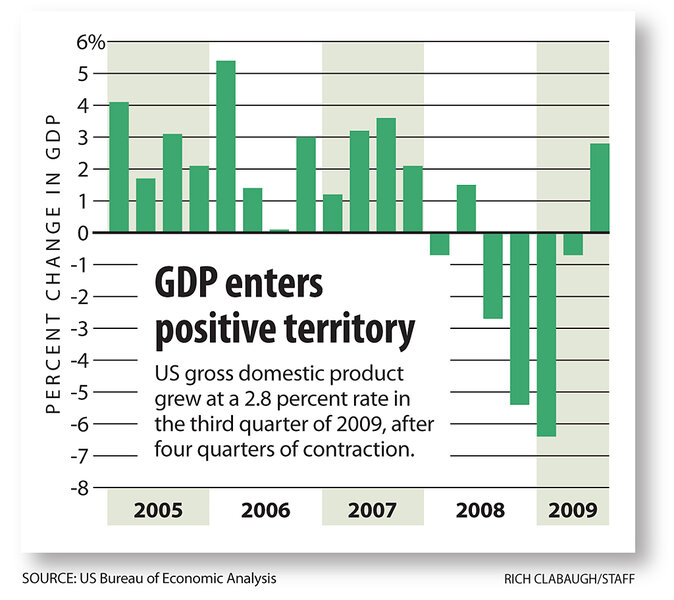

According to most economists, however, America’s gross domestic product could grow about 3 percent next year. In a normal year, that would be good. But given the shocks the economy has experienced, will it be enough to help reduce unemployment and ease other economic difficulties?

As the new year gets under way, here are five signs to watch for that would show the recovery is staying put:

1. The economy starts to produce jobs – and unemployment rises

By spring, corporations will begin adding jobs instead of reducing their payrolls, some economists say. But job growth will be agonizingly slow.

Joel Naroff of Naroff Economic Advisors in Holland, Pa., does not expect the economy to add 100,000 jobs a month until sometime after June. Although more jobs may be good news, it may mean that the unemployment rate rises – peaking between 10.2 and 10.5 percent, he estimates. That’s because people who had given up looking for a job will start searching again. (The unemployment rate includes only those people who are actively looking for jobs.)

“Strange as it may sound, it’s a good sign for the economy to have the unemployment rate rising if it means people are confident enough to look for work again,” Mr. Naroff says. “It’s one of the weirder things at this point in the cycle.”

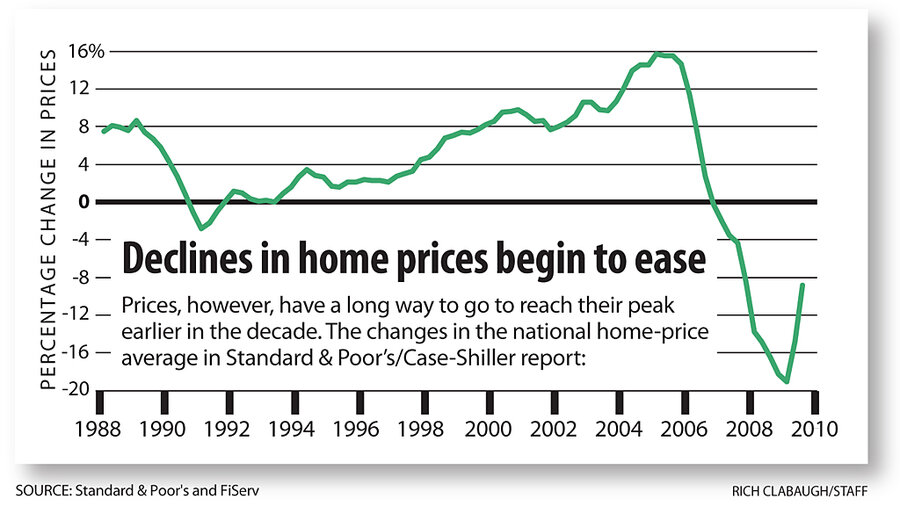

2. Value of homes starts to rise again

Housing is the most affordable it has been in 40 years because of the decline in prices and low mortgage rates, says Richard DeKaser of Woodley Park Research in Washington. As home prices stabilize, lenders will become more confident, says Mr. DeKaser, who is an expert on home prices. “The stringency of credit will diminish as lenders become more confident they are not at risk of losing their equity,” he says.

As a result, home prices will grow by 3.5 percent next year, he says.

It won’t hurt that Congress has extended and expanded the $8,000 tax credit for home buyers. The credit now includes existing property owners and applies to homes purchased by April 30 and closed on by June 30.

But in some markets, forced home sales will put downward pressure on prices. Foreclosures may worsen in 2010 because of the rising unemployment rate and an enormous backlog of delinquent loans, according to a November forecast by the Mortgage Bankers Association.

3. Consumers become more confident and even make some purchases on a whim

These days, consumers use credit cards less and instead put money under the mattress. Economists who watch spending patterns are hopeful that people will open their wallets a little more in 2010. That would help the economy.

“There is a changed attitude toward debt and spending,” says Dennis Jacobe, chief economist for the Gallup organization in Washington. “Consumers need to feel more secure financially.”

In 2009 surveys, Gallup found, self-reported discretionary spending fell 20 to 30 percent from 2008 levels. Mr. Jacobe expects discretionary spending to stay about the same for the first half of 2010 – bad news for many retailers.

Unfortunately, it won’t be any easier to get credit next year. “The threshold of good credit and excellent credit – those bars have been raised,” says Bill Hardekopf, CEO of LowCards.com and coauthor of “The Credit Card Guidebook.” “In 2009, credit was darn tight, and it will be just as tight in 2010.”

4. Small- and medium-sized businesses begin to expand again

With consumers watching their pocketbooks, small businesses such as restaurants, dry cleaners, and hardware stores do not have much reason to hire or expand. But in general, they provide most of the new jobs in the United States, so it’s important that they get back on track.

William Dunkelberg, chief economist for the National Federation of Independent Business (NFIB), expects 2010 to be a “subpar” year for small businesses. That means growth of less than 3 percent, he says.

“NFIB surveys [of its members] show hiring plans and capital-spending plans at 35-year lows,” he says. “With no customers, you don’t need inventory, you don’t need delivery trucks, you don’t need to add to the payroll.”

The outlook is even worse for the construction industry, which is typically made up of small businesses. Spending on construction will fall 5 percent in 2010, projects Ken Simonson, chief economist for the Associated General Contractors of America in Arlington, Va. That’s after construction spending shrank by as much as 7 percent this year. “I’m pretty pessimistic,” he says.

Although money from the 2009 stimulus package is still being funneled to contractors, it is not enough to make up for canceled contracts by states, municipalities, and commercial contractors, Mr. Simonson says. The only good news for 2010: The number of new homes being built is likely to grow after three down years.

5. Washington remains engaged in trying to help the economy

Many economists agree on that, but the process is likely to be contentious: Republicans are opposed to spending on new programs and would prefer tax cuts.

Congress will have about $200 billion in unexpected revenue because many banks have repaid their bailout loans early or have not needed the money. On Dec. 16, the House narrowly passed a $154 billion jobs bill that would draw on this money. The legislation would provide funding for job training and transportation projects. But the Senate is not expected to take up the package until early 2010 – and it’s not clear that Democrats have enough votes.

“Yes, they will pass a bill called a jobs bill,” Simonson predicts. But it may be limited in scope: “At a minimum, it will contain an extension of the Highway Trust Fund [construction money that would add jobs] at its current spending levels, additional unemployment benefits, and a COBRA [health insurance] subsidy.” But he doubts Congress will pass a big addition to the highway program or take other steps to create jobs.

If nothing passes in Washington, the outlook for 2010 and beyond could darken, warns Mr. Zandi of Moody’s Economy.com. “If there is not more aid to state governments and unemployed workers, the odds are the economy will slip again,” he says.

---

See also:

Economist Mark Zandi: chance of second recession 1 in 4

---

Follow us on Twitter: @CSMNational