Oil price tumbles on Saudi price cut. Big Oil feels a pinch.

Loading...

Oil prices continued on a steep decline Tuesday, barreling toward levels that threaten to curtail rising US output.

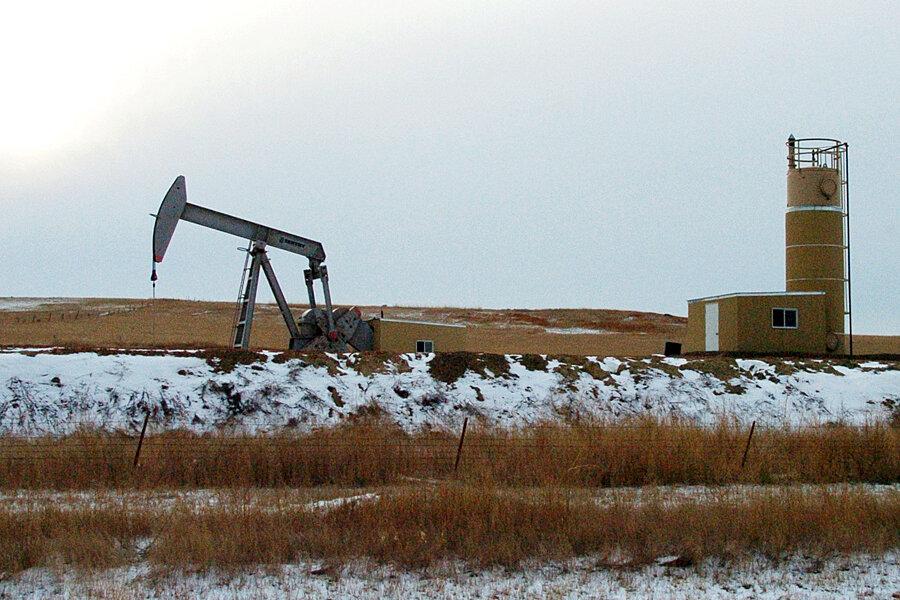

For much of October, oil prices hovered in the $80 range, a mark that most watchers say still makes it profitable to extract oil from stubborn shale plays across North Dakota, Texas, and elsewhere in the US. But some energy firms are already scaling back drilling, and this week oil prices dropped below the $80 floor.

That's good news for US drivers, who will continue to enjoy the lowest gas prices in years. It is also likely to drive down food prices – oil plays a major role in agriculture, and gasoline is used to transport food across the country. But a continued swoon is very bad news for a domestic oil boom that has helped the US economy slowly emerge from the Great Recession.

It's also a sign of waning influence among the Organization of Petroleum Exporting Countries, an oil cartel that has long wielded influence over global markets.

"A snowballing effect is what we are seeing in crude oil price today," Fawad Razaqzada, an analyst at Forex.com, told the Associated Press. "News that Saudi has cut its asking price to customers in the U.S. suggests even the largest OPEC producer is now worried about its market share. This does not bode well for the future of the cartel."

US crude oil prices were down $2.49 to $76.29 a barrel in midday trading Tuesday, after dropping as low as $75.84, on news of the Saudi price cut. Oil has dropped more than a quarter since its high in June. There are a variety of factors putting downward pressure on oil prices, but it is largely a matter of too much supply and not enough demand. US production is up, and output is stable in Libya, Iraq, and other more volatile producers. Meanwhile, demand in the US and Europe is largely flat, and growing Asian markets are not growing as quickly as many expected.

The glut is beginning to catch up with producers both in the US and abroad. The cost of fossil fuel extraction has increased as companies tap more complex oil and gas plays, so producers need higher prices to finance new projects. So far, US companies have buffered the drop in prices by finding innovative ways to get more for less at individual wells.

But some oil companies are already starting to feel the pinch. Last week, ConocoPhillips became the first major US oil company to slash spending amid collapsed oil prices. The company aims to keep oil exploration and production spending under $16 billion next year, Bloomberg Businessweek reports, down from what is likely to be about $16.7 billion this year. European firm Royal Dutch Shell told reporters last week it was in “no hurry” to invest in so-called unconventional oil plays in Texas and Canada due to cheap oil. Oil supermajors BP and Chevron have also said they would cut back on spending on pricey US projects. Overall the number of drilling rigs actively looking for oil in the US is falling. Last week, the Baker Hughes oil rig count dropped by 13 to 1,582.

It could be a sign of the market beginning to correct itself. If US production dips to a level more in line with current demand, that could reverse the downward trend in oil prices. That's why some in the industry aren't concerned about the current dip.

“Despite what people are thinking, demand is creeping up, albeit at a lower rate than it has been," Dave Lesar, chief executive of oilfield services firm Halliburton, told Bloomberg.

In the meantime, US drivers are in for a pleasant surprise at the gas pump these days. Today's national gas prices average was $2.97 a gallon, according to automotive group AAA. On Saturday, the national average fell below $3.00 for the first time since 2010.