Are high oil prices pushing us towards debt limits?

Loading...

If an economy is growing, it is easy to add debt. The additional growth in future years provides money both to pay back the debt and to cover the additional interest. Promotions are common and layoffs are few, so a debt such as a mortgage can easily be repaid.

The situation is fairly different if the economy is contracting. It is hard to find sufficient money for repaying the debt itself, not to mention the additional interest. Layoffs and business closings make repaying loans much more difficult.

If an economy is in a steady state, with no growth, debt still causes a problem. While there is theoretically enough money to repay the debt, interest costs are a drag on the economy. Interest payments tend to move money from debtors (who tend to be less wealthy) to creditors (who tend to be more wealthy). If the economy is growing, growth provides at least some additional funds offset to this loss of funds to debtors. Without growth, interest payments (or fees instead of interest) are a drain on debtors. Changing from interest payments to fees does not materially affect the outcome.

Recently, the growth of most types of US debt has stalled (Figure 3). The major exception is governmental debt, which is still growing rapidly. The purpose of sequestration is to slightly slow this growth in US debt.

The growth in government debt occurs because of a mismatch between income and expenditures. There is a cutback in government revenue because high oil prices make some goods using oil unaffordable, causing a cutback in production, and hence employment. The government is affected because unemployed workers don’t pay much in taxes. Government expenditures are still high because many unemployed workers are still collecting benefits.

What can we expect going forward? Will the debt situation get even worse?

I think we can expect that from here, the debt situation will deteriorate. One issue is rising oil prices. While there seems to be a large supply of oil available, it is at ever-higher cost of extraction, because of diminishing returns. (This is even true of tight oil, such as from the Bakken.) Furthermore, I recently showed that not only do high oil prices adversely affect government finances, they also adversely affect wages.1

If wages are low, the temptation is for governments to try to create more “spendable income” by increasing debt. This can’t really fix the situation, however. The real issue is increasingly high oil prices, which adversely affect both government finances and wages. Adding debt adds yet more interest payments, adding a further burden to wage earners, and creating a need for payback in the future, when wages are even lower.

Ultimately (which may not be very long from now), the debt system appears likely to collapse. The Quantitative Easing (QE) which a number of governments are now using to hold down interest rates and make more funds available to lend cannot continue forever. While there are claims that QE is a bridge to “when growth returns,” it is seriously doubtful that economic growth will ever return. Inexpensive oil is simply too essential to today’s economy. As oil prices rise, wages fall, and demand for oil is further constrained. Falling wages also reduce demand for debt, as payback becomes more difficult.

How Household Debt Adds to Spendable Income

One thing readers may have not thought about is that it is the increase in debt that adds to a person’s (or company’s) spendable income. For example, taking out a car loan allows a person to buy a car. Paying back the loan over a period of years tends to reduce spendable income. If, in the aggregate, the amount of debt outstanding starts decreasing each year, spendable income is actually reduced below the level of wages, because in total, the balance is being reduced.

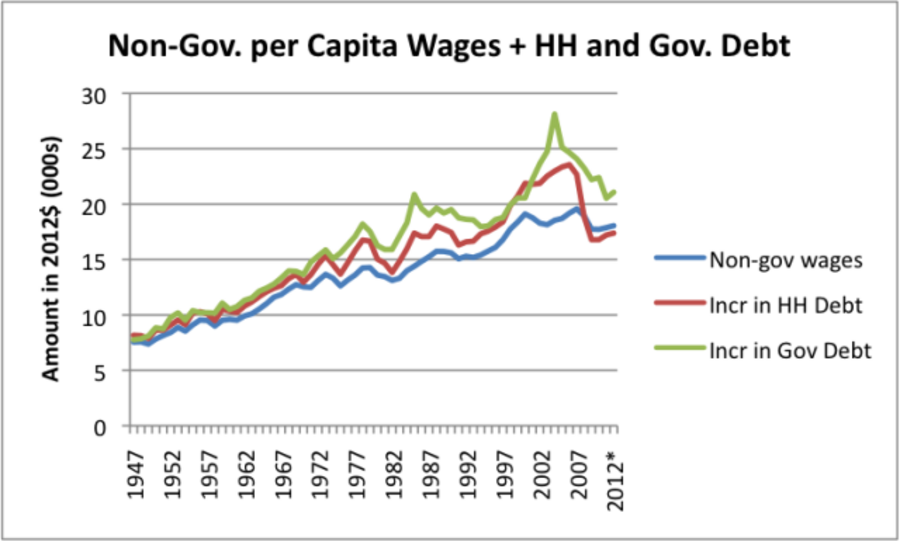

If we add the increase in household debt (mortgages, credit cards, student loans, car loans, etc.) to wages, this is the pattern we see historically. (The increase has been adjusted for inflation using CPI-Urban):

The pattern is very much what we would expect, given what we know about recent debt patterns. The amount of debt rose rapidly in the early 2000s, when interest rates were lowered and lending standards relaxed. Some people bought new homes. Home prices escalated, with the higher demand. Many homeowners were able to refinance at lower interest rates. In the process, homeowners were able to “pull out” funds that they could use for any purpose they liked–fixing up the house, buying a new car, or going on a vacation.

By 2008, the party was over. In fact, the amount that was added through debt started decreasing in 2006 and 2007, after the Fed Reserve raised interest rates, in an attempt to choke back inflation caused by high oil prices. I talk about this in Oil Supply Limits and the Continuing Financial Crisis, available here or here.

Increased Government Debt Can Also Add to Spendable Income

In Figure 5, we added the increase in household debt to wages, to get an estimate of spendable income, adjusted for debt. Theoretically, at least part of the increase in government debt might also be added to spendable income, since it is often used (in leu of increased taxes) for programs that benefit citizens. (Some of the increased debt is used for things like bailing out banks, which is of questionable value in raising the spendable income of individuals, so perhaps not all of the increase in government debt should be added in estimating spendable income. Also, increased interest costs related to higher debt amounts would tend to have a dampening effect on spending, if interest rates are not continually dropping, as they have been under QE.)

If we add the increase in government debt (all kinds, including state and local) to the amounts shown in Figure 5, this is what we get:

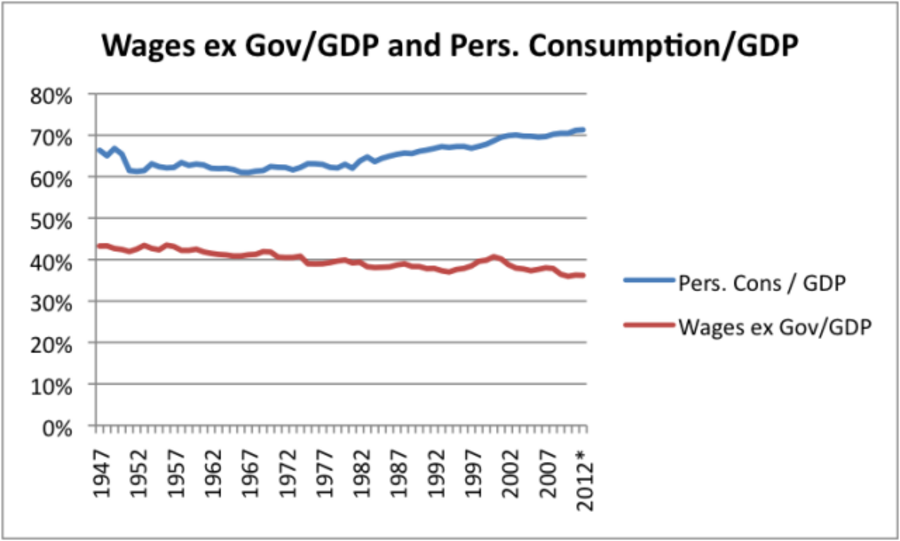

How much did citizens really spend? The Bureau of Economic Analysis tells us that as well, as an item calledPersonal Consumption Expenditures. We sometimes hear that in the United States, personal consumption of goods and services makes up more than 70% of GDP. In fact, this percentage has been growing since about 1950.

Strangely enough, wages excluding governmental wages have been falling as a percentage of GDP during the same period. How can wages be falling at the same time personal consumption is rising? I think that a large part of the answer may very well be “increasing debt.”

If we compare wages to personal consumption expenditures, we find that wages were about 2/3 of personal consumption expenditures at the beginning of the period graphed, but gradually fell to a lower and lower share of Personal Consumption Expenditures.3 If we add a line to Figure 6 showing 2/3 of personal consumption expenditures, the line comes out very close to where we might guess it would, if all of household debt increases, and part of government debt increases were acting to increase personal spending (Figure 8).

While there are too many variables to make this comparison exact, it does indicate that the increases in debt levels are of the right order of magnitude to explain what would otherwise be a very strange anomaly.

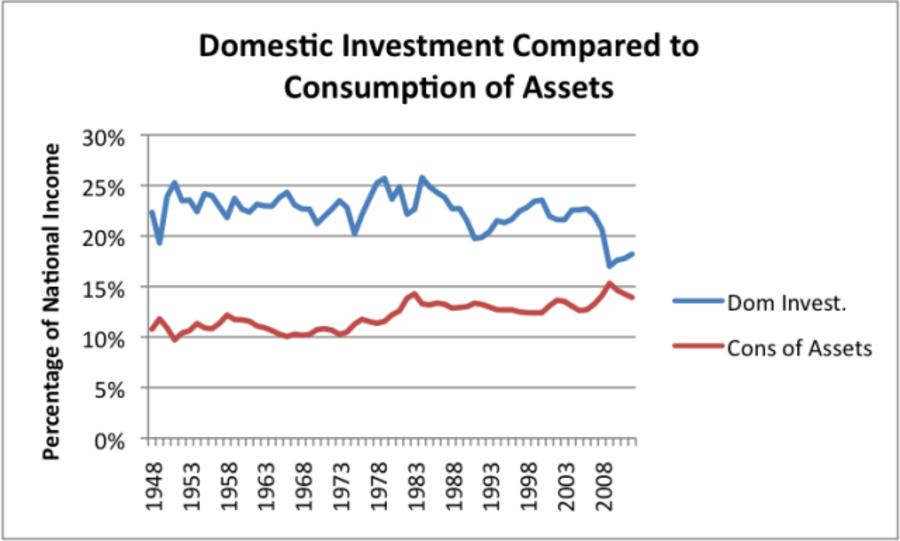

I might mention, too, that part of the reason that Personal Consumption Expenditures can be rising as a percentage of GDP is the fact that investment has been falling, as businesses move their manufacturing offshore, and as other changes take place. According to the American Society of Civil Engineers, we are allowing bridges, roads, and dams to deteriorate, and not adequately maintaining electrical transmission infrastructure. We are reaching limits on how far we can allow investment to drop, however. In fact, the time is coming when we will need to increase investment, or face loss of some of the infrastructure we take for granted.

Where Do Debt Limits Put Us

Even if all debt limits were to do is erase the beneficial impact of debt increases, based on Figure 8, it appears that spendable income (or Personal Consumption Expenditures) would decrease by about 23%, to bring it back to might be expected based on wages.

In fact, reaching debt limits is likely be a messy affair, with some type of change (such as increasing rising interest rates as QE fails, or the US dollar losing its reserve currency status, or huge changes in the Eurozone) leading to changes that affect governments and currencies around the world. It seems likely that trade might be disrupted. Some governments might be replaced, and the debt of prior governments repudiated by the new governments. It is not clear what would happen to personal and corporate debt. In many countries, reform governments have redistributed land and other property. In such a circumstance, neither prior land ownership nor prior debt would have much meaning.

In our current circumstances, we are reaching debt limits because of a specific resource limit — lack of inexpensive oil. Oil is used almost exclusively as a transportation fuel and in many other applications as well (such as construction, farming, pharmaceutical manufacturing, and synthetic fabrics). Expensive oil is not really a substitute, and neither is intermittent electricity. We are reaching other limits as well. Perhaps the most pressing of these is availability of fresh water. Fresh water can be obtained by desalination, but expensive water is not really a substitute for cheap water, for the same reason that expensive oil is not really a substitute for cheap oil. See my post, Our Investment Sinkhole Problem.

The situation of reaching debt limits because of resource limits is a worrisome one, because it is hard to see a way to fix the situation. People often say that our debt problem arises because we have a financial system in which money is loaned into existence, and as a result, requires growth to pay back debt with interest. I am not sure that this is really the problem.

We have been used to a financial system that “works” in a growing economy. In such a system, it makes sense to take out loans on new business ventures. In such a system, money is also a store of value. In a shrinking economy, relationships change. Some loans will still “make sense,” but such loans will be a shrinking proportion of current loans, with long-term loans being especially vulnerable. Money will either need to “expire,” or a high rate of inflation will need to be expected, making interest rates on loans very high. In a shrinking economy, businesses will fail much more often, and workers will more often lose their (fossil fuel supported) jobs.

Some have suggested that new local currencies will fix our problems. I am doubtful this will be the case. The problem may well be that all currencies start being more local in nature. What we may lose is interchangeability based on trust.

Notes:

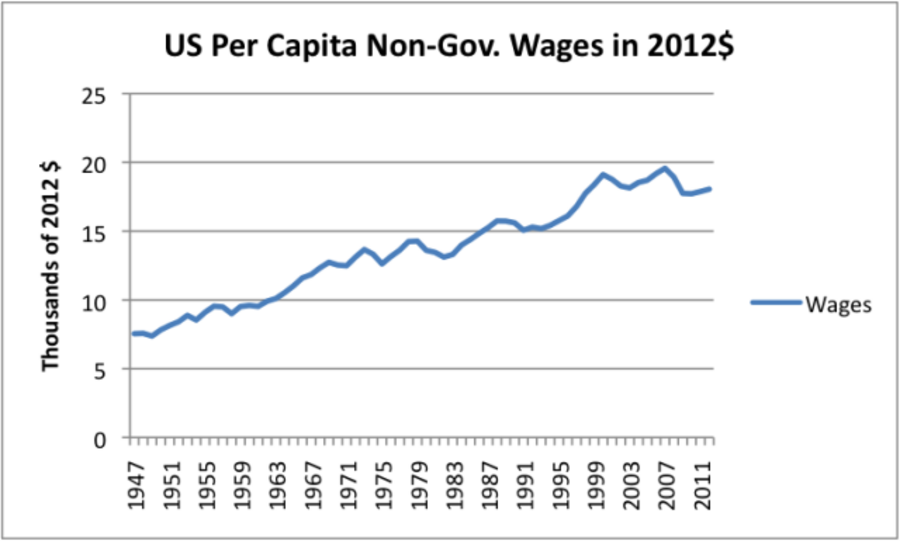

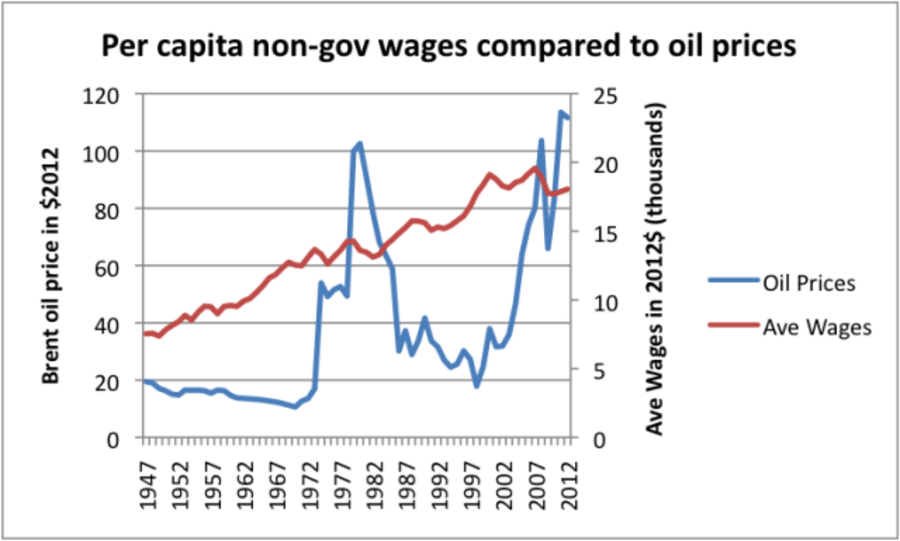

[1] As background for those who have not read my post The Connection of Depressed Wages to High Oil Prices and Limits to Growth, wages recently have been depressed, in part because fewer people are working. Figure 4 above, showing “Per Capita Non-Government Wages,” provides a measure of how wages have changed. This is calculated by taking wages for all US residents, subtracting wages of government workers, and dividing by the total US population (not just the number working). The average wage calculated in this manner is than adjusted to the 2012 price level based on the CPI-Urban price index. Government workers have been omitted because I am trying to get at the base from which other funding comes. Government wages are ultimately paid by taxes on workers in private companies.

The thing that is striking about Figure 4 is that a similar pattern occurs in the 1973 to 1983 period as the 2002 to 2012 period. Oil prices were high in both periods. (Figure 10, below). In fact, the vast majority of wage growth has occurred when oil prices were $30 or less in 2012$.

There are several reasons why rising oil prices can be expected to reduce the number of people working, or the hours they work:

(a) Discretionary sector layoffs. Consumers find that the price of food (which uses oil in its production and transport) and of commuting is rising. Prices of other goods are also rising. This forces consumers to cut back on discretionary spending. Employees in discretionary sectors get laid off, because of these impacts.

(b) General layoffs. Even outside discretionary sectors, employees may be laid off, if the cost of goods rises indirectly because of a rise in oil price. Often this will be because of higher transport cost, but it could because of another use of oil, such as by construction equipment, or as a raw material. With higher costs of delivered products, companies find that demand falls, if they raise prices sufficiently to maintain profit margins. (This falling demand occurs because some consumers can no longer afford their products.) Businesses find it necessary to scale back the size of their operations–lay off workers and close stores or other facilities. Alternatively, businesses can move operations to China or another low cost site of operation, to reduce costs, but this also leads to layoffs of US employees.

(c) Government layoffs. Eventually the government tax base is reduced, because of a smaller proportion of the population paying taxes. Governments also find a need to pay our more in direct costs–such as more for unemployment insurance, and more for asphalt (an oil product) for paving roads. Governments also find themselves laying off workers.

The effects outlined above can be mitigated to some extent by changes such as moving closer to work and more fuel efficient cars. But experience seems to suggest that even more what happens is that the effects shift from sector to sector over time, as businesses “fix” their problems, leaving them to with wage-earners and governments.

The high price oil situation was mostly resolved in the early 1980s, because other relatively inexpensive oil was available to drill, bringing the price down again. (The new price, at $30 barrel, was still 50% higher than the $20 barrel price prior to the crisis, though.) The availability of new low-priced supplies seems much less likely now, because we extracted the inexpensive-to-extract oil first. We are now reaching diminishing returns. While there seems to be plenty of oil available, it is high-priced oil. This is even true of the new “tight oil” supplies in the Bakken and several other areas.

[2] Government debt in this post refers to all types of government debt combined, including state and local debt. Within this debt, only debt classified as “Marketable” is included. As such, it does not include debt owed to the Social Security system (because contributions that were collected by the Social Security system were spent on something else, and are not available to pay Social Security recipients) or to other pre-funded government agencies. Such debt is a future liability, not affecting today’s spending, so I didn’t add it in. (The Federal Reserve Z1 report also does not include it.) There are, in fact, a huge number of government obligations that are not reflected, such as promises to bail out pension programs and FDIC coverage of bank accounts, because they are contingent in nature. Such programs can be expected to add to the problems we would have, if our debt system should fail.

[3] We would not expect non-government wages to equal Personal Consumption Expenditures, since for one thing, wages of non-government employees leave out expenditures by government employees. They also leave out various derivative amounts, such as expenditures by entrepreneurs, and expenditures of amounts that would be classified as rents and dividends. Changes in savings rates would also play a role.