An America self-sufficient in oil? Don't bet on it.

Loading...

The International Energy Agency (IEA) provides unrealistically high oil forecasts in its new 2012 World Energy Outlook (WEO). It claims, among other things, that the United States will become the world’s largest oil producer by 2020, and will become a net oil exporter by 2030.

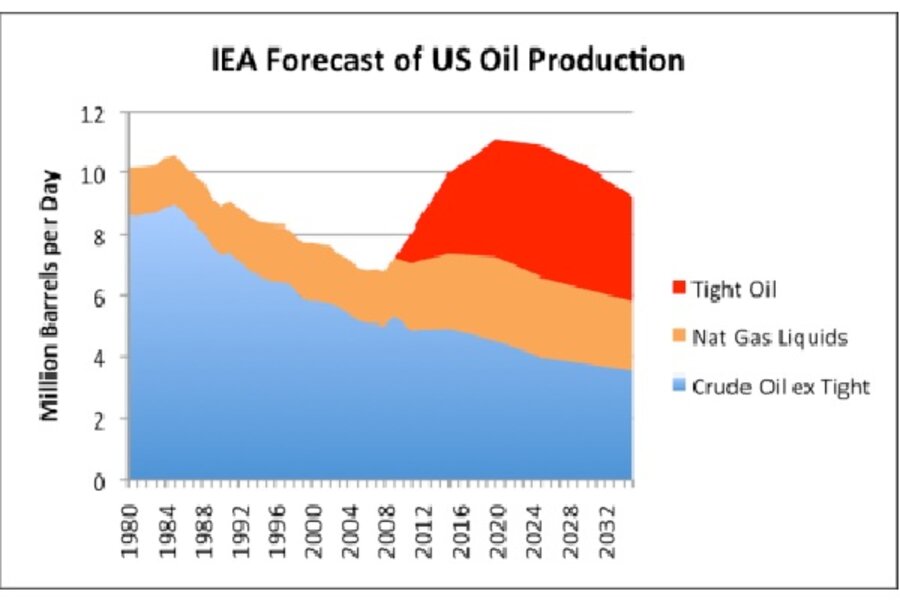

Figure 1 (above) shows that this increase comes solely from the expected rise in tight oil production and natural gas liquids. The idea that we will become an exporter in later years occurs despite falling production, because “demand” will drop so much.

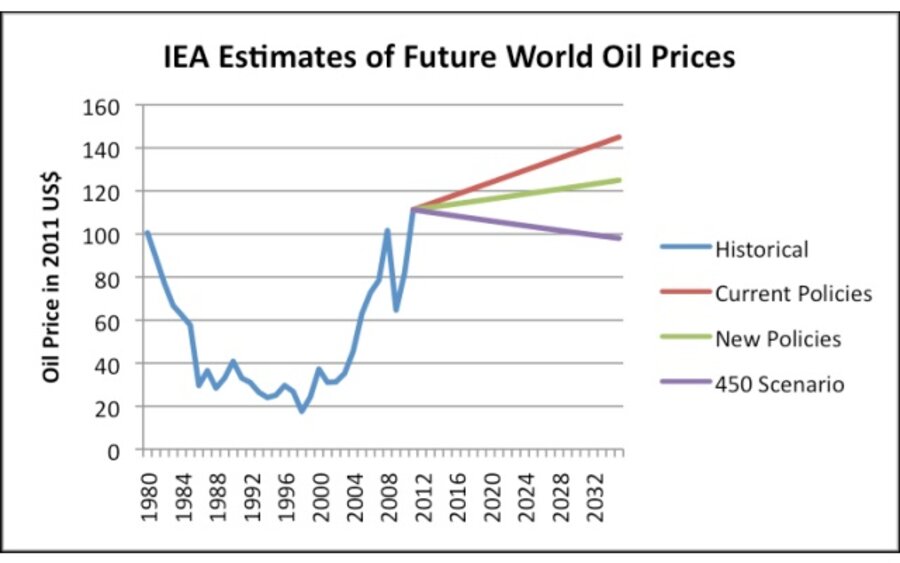

The oil price forecasts underlying these and other forecasts in the report are approximately as follows (see Figure 2, above left).

One reason the WEO 2012 estimates are unreasonable is because the oil prices shown are unrealistically low relative to the production amounts forecast in the report. This seems to occur because the IEA misses the problem of diminishing returns. As the easy-to-produce oil becomes more depleted, and we need to move to more difficult reservoirs, the cost of extraction increases.

In fact, there is evidence that the “tight” oil referenced in Exhibit 1 is already starting to reach production limits, at current prices. The only way these production limits might be reasonably overcome is with higher oil prices–much higher than the IEA is assuming in any of its forecasts.

Higher oil prices cause a huge problem because of their impact on the world economy. The IEA in fact mentions that current high oil prices are already acting as a brake on the global economy in its first slide for the press. Higher oil prices also mean that investment costs required to reach target production levels will be even higher than forecast by the IEA, adding another impediment to reaching its forecast production levels.

If higher prices put the economies of oil importing nations into recession, then oil prices will drop lower, reducing the incentive to invest in new oil production infrastructure. In fact, we could find ourselves reaching “peak oil” because of an economic dilemma: while there seems to be plenty of oil available, the cost of extracting it may be reaching a point where it is more expensive than consumers can afford. As a result, some oil that we know about, and have been counting as reserves, will have to be left in the ground.

The IMF has recently done modeling that is relevant to this issue in a working paper called “Oil and the World Economy: Some Possible Futures.” This analysis may provide some insight as to what the real situation will be.

The Problem of Diminishing Returns

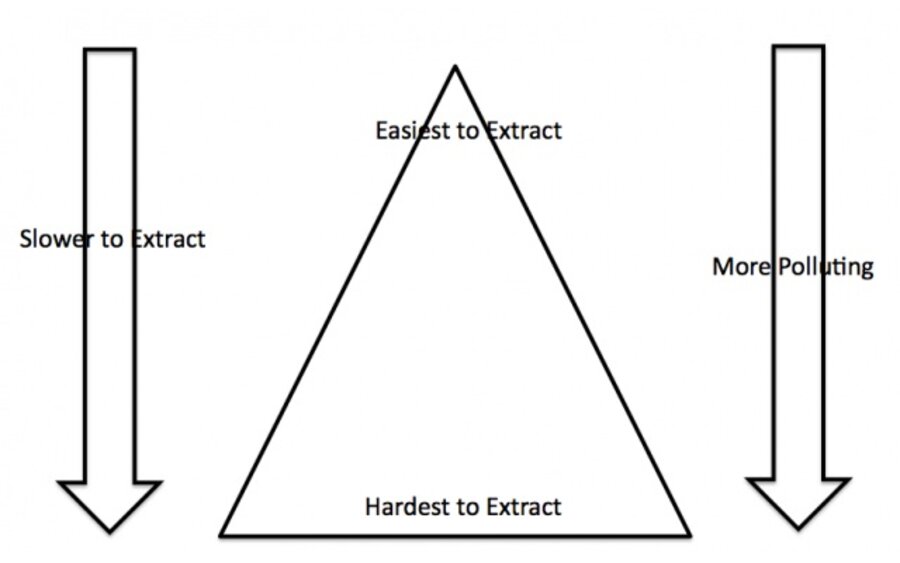

One issue that the IEA has not properly modeled is the issue of declining resource quality, leading to diminishing returns and a rising “real” (inflation adjusted) cost of production. This situation is often described as reflecting declining Energy Return on Energy Invested (EROEI).

The reason diminishing returns are a problem is because when a producer decides to extract oil, or gas or coal, the producer looks for the cheapest, easiest to extract, resource first. It is only when this resource is mostly depleted that the producer will seek locations where more expensive, harder to extract resource is available. Thus, over time, the inflation adjusted cost of extracting a resource tends to increase.

In terms of the triangle shown in Figure 3 (see above left), producers tend to start at the top, with the “best” of the resource, and work their way toward the bottom. One result of this approach is that the cost per unit of production tends to rise, even as there are technology advances and efficiency gains, because the quality of the resource is declining.

Reserves tend to increase over time with this approach, because as producers work their way down the triangle in the diagram, they always see an increasing quantity of lower quality resources. The new reserves are increasingly expensive to extract, in inflation adjusted terms. There is no flashing light that says, “Above this price, customers won’t be able to afford to purchase this resource any more,” though. As a result, the increasingly low quality reserves get added to reported amounts, even though in some cases, the cost of products made with these reserves (say gasoline or diesel) will send economies into recession.

It should be noted that the issue of diminishing returns exists for almost any kind of resource. It exists for uranium extraction, since there is always more available, just harder to reach, or in lower concentration. Diminishing returns exists for gold, copper, and for nearly any other kind of metal. This means we often need more oil for metal extraction and processing, as we dig deeper or find ore that is mixed with a higher proportion of waste product.

The problem of diminishing returns also seems to hold for renewables. The first biofuel developed was ethanol from corn, since the process of making alcohol from corn has been known for ages. Newer approaches, such as ethanol from biomass and biofuel from algae, tend to be much more expensive. As a result, when we add new biofuel production, it is likely to be more expensive, and thus harder for the customer to afford. If we want it, we will need increasingly high subsidies.

Wind energy is also subject to diminishing returns. Onshore wind was developed first, and it is far less expensive than offshore wind, which was developed later. Early units of wind added to an electric grid do not disturb the electric grid to too great an extent. Later units of wind energy add increasingly large costs: long distance transmission lines, electrical storage, and other balancing–something that is generally overlooked in making early cost analyses.

Diminishing returns seem even to happen for energy efficiency. We have been working on energy efficiency a very long time. We have a tendency to pick the low-hanging fruit first. Later expenditure for efficiency may be less cost-effective.

Why Light Tight Oil Won’t Increase as in Figure 1

Tight oil, also referred to as “shale oil,” is supposed to be the United States’ oil savior, if we believe the IEA. The Bakken and Eagle Ford plays are the best known examples.

Rune Likvern of The Oil Drum has shown that drilling wells in the Bakken already seems to be reaching diminishing returns. The choicest locations appear to have been drilled first, and the locations being drilled now give poorer yields. He has also shown that the average well in the Bakken now requires a price of $80 to $90 barrel, which is close to the recent selling price. If increased production is desired, the price of oil will need to start increasing (and keep increasing) to provide the incentive needed to drill wells in less-choice location.

There are other issues as well. If there is a need to drill an increasing number of wells just to stay even, or an even larger number, to increase the amount of oil produced, we start to reach limits on many kinds: number of rigs available, number of workers available, miles driven for water to be used for fracking. Perhaps the issue that will limit production first, though, is limits on debt available to producers. Rune Likvern has also shown that cash flows from tight oil extraction tend to run “in the red,” so an increasing amount of debt financing is needed as operations ramp up. At some point, companies hit their credit limit and have to stop adding new wells until cash flow catches up.

Evidence Regarding Rate of Growth of Oil Extraction Costs

Bernstein Research recently published information showing that the marginal cost of oil production was $92 barrel in 2011 for non-OPEC, non Former Soviet Union oil producers at the 90th percentile of production. This cost is increasing at 14% per year (or about 12% a year in inflation adjusted terms). Even at the median marginal cost level, costs appear to be increasing at a compound annual growth rate of 9% (or about 7% in inflation adjusted terms). See also this FTAlphaville post.

If we take the $92 barrel cost in 2011 at the 90th percentile of production and increase it by 7% a year (arguably we should be using 12% per year), the real cost will be $169 barrel in 2020, and $467 a barrel in 2035. These are far in excess of the IEA oil price estimates shown on Figure 2. There is no reason to believe that Bakken and other tight oil production costs would be substantially cheaper.

Other Issues That Appear Not to be Handled Well by IEA WEO 2012

There are three other issues that the IEA has not handled well, in my opinion.

1. Rising Real Need for Fuels of Some Sort

WEO 2012 shows falling “demand” for fuel. Demand, as economists define demand, has to do with how much customers can afford. It is quite possible that demand will fall because people can’t afford the fuel.

It seems to me would be better to start by analyzing how the real need for fuels is changing. Once this is determined, adjustments can be made to reflect other ways the same benefits can be provided, assuming this is possible.

Regarding the real need for fuel, if we look at species that are in some ways similar to humans, such as chimpanzees and gorillas, we find that these animals have no need for fuels, because they live in the way that they are biologically adapted: There are only a relatively small number of them (less than 1,000,000 per species) living in territory which is restricted to their biological adaptation. They do not need their food cooked, or spears or other tools to keep away predators, or shelter from the elements.

Humans don’t live in the way that we are biologically adapted. Because there are so many of us, we need to grow our own food, and gather water from natural sources. Because we do not have big heavy jaws because there is little easy-to-chew food available, we need to cook much of our food. Because we live in diverse areas of the world, we need shelter and adaptive clothing. As humans move to cities, we have even greater needs. We need antibiotics and immunizations to prevent epidemics. We need fuel for commuting, unless we sleep on the floor of the factory where we work. We need fossil fuel for cooking, because traditional fuels such as dung or twigs are not available in sufficient quantities in urban areas.

Another need for fuel, besides directly responding to human needs, is to offset the continued degradation (entropy) of built infrastructure. As the number of humans expands, so do the miles of roads, the number of bridges, the miles of pipelines, the number of homes and schools, and many other kinds infrastructure. All of this infrastructure wears out. Roads need to be repaired almost every year, especially in cold climates. Electrical transmission lines need to be put back in place after every major storm.

Population is also, of course, rising. When we put these issues together (rising fuel need with urbanization, rising population, and increasing entropy), it is clear that the services humans need from fuels will continue to rise, whether or not “demand” as economists measure it appears to rise.

Most of these fuel services will need to come from fossil fuels, rather than renewables, for two reasons: (1) This is the way our infrastructure now is built, and it is expensive and time-consuming to change it. (2) Biological sources are quite limited compared to the needs of 7 billion humans. According to Chew in The Recurring Dark Ages, deforestation started to occur in multiple locations 6,000 years ago, when the world population was about 20 million people.

2. Substitution for Oil

The IEA seems to err in the direction of assuming that substitution can be made more quickly than it really can be. In general, whenever substitution is done, new devices need to be created that use the new fuel, or new plants need to be developed that transform one type of fuel to another type of fuel. Doing either of these things will temporarily add to demand for fossil fuels. There is also a cost involved.

Only the heavier portion of natural gas liquids can be added directly to gasoline supply. Most natural gas liquidsare used for other purposes, such as making plastics, or propane for home heating, or making liquid petroleum gas (LPG). LPG is used for cooking in some parts of the world and for operating vehicles that have been designed to use it.

The IEA seems to assume that efficiency gain can have a big impact on the need for oil. The issue it seems to lose sight of is that efficiency gains are a two-edged sword. When a device is made more efficient, the usual effect is that it can be operated more cheaply. This means that more people can afford it, and demand may increase. In the early days, electricity was very expensive. As its cost came down with efficiency gains, its use went up dramatically.

Putting All of These Issues Together

It is very clear to me that the IEA oil estimates are way too high, unless prices are much higher. Of course, prices can’t really be much higher, or the economy will go into recession. As a result, production both for the US and the rest of the world is likely to be much lower than forecast by the IEA.

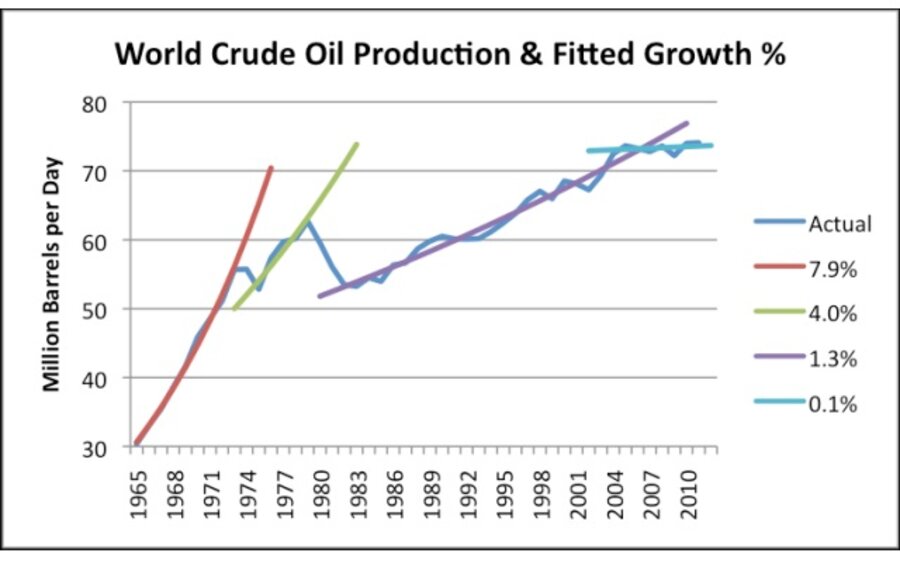

It would be useful to have a better estimate of exactly where the world is headed. One way this might be done is by adapting the indications of a new IMF working paper called Oil and the World Economy: Some Possible Futures. The working paper considers some unknown time, between now and 2020, when the rate of increase in oil supply is assumed to decrease by 1%. While it is not stated in the report, it appears to me that this is similar to what actually happened about 2005, when the rate of oil production increase dropped from 1.3%” annual increase to 0.1%, a 1.2% decrease. (Figure 4, above left).

I have a few observations regarding such an adaption:

(a) The model could be adjusted to consider the fact that a drop in the trend rate of about 1.2% actually took place in 2005, rather than simply assuming that a 1% decrease will happen at some unspecified point in the future. It appears to me that shift in the oil extraction trend line underlies many of the world’s problems in the last several years.

(b) The treatment in the model of diminishing returns should be adjusted. It is my understanding that this is currently handled assuming a 2% annual increase in real costs of production. The model could be adjusted to reflect a more realistic (higher) annual cost in oil production, and indirectly, required selling price.

(c) The authors of the IMF report suggest building a more resource-based model, and I would agree that this would be helpful. There are many interlinkages that the current model cannot adequately capture. A more resource-driven model, especially one that considers balance sheets of world governments, would appear to be better.

My View of What is Happening Now

As noted above, world crude oil production seems to have hit a plateau, starting about 2005. This is working its way through the economy with varying effects over time. The major effect at this point of time seems to be on the finances of governments that import oil, although it started earlier, with different aspects more apparent.

In general, what happens as we reach a situation of diminishing returns, and thus rising real oil prices, seems to be as follows:

As the price of oil rises, the price of food and commuting tend to rise. Both of these are considered essential by most consumers, so consumers cut back in discretionary spending, to have sufficient funds for the essentials. This leads to layoffs in discretionary industries, such as vacation travel and restaurant eating. The rise in laid off workers leads to an increase in debt defaults, and problems for banks. Housing and commercial real estate prices tend to fall, because of reduced demand, further adding to debt default problems.

Governments of oil importers get drawn into this in many ways: (1) Their revenues are reduced, because they receive less tax revenue from people who are laid off from work and from businesses with fewer sales. (2) They are asked to prop up failing banks, and to stimulate the economy. (3) They are also asked to pay workers who have been laid off from work. The net of all of this is that the governments of many oil importers find themselves with huge budget deficits, and declining ability to fix these deficits. This pattern is precisely what we are seeing today in many of Eurozone countries, the United States, Japan.

The statements about rising oil production in the US are just a distraction. Diminishing returns mean that US oil production will never increase very much. Oil costs will remain high, and this will be the real issue disturbing economies around the world.