Gas prices: Can the economy weather another rise to $4 gas?

Loading...

Prof. James Hamilton of University of California recently wrote a post called Thresholds in the economic effects of oil prices. In it, he concludes

As U.S. retail gasoline prices once again near $4.00 a gallon, does this pose a threat to the economy and President Obama’s prospects for re-election? My answer is no.

EDIT - I originally wrote this post thinking that Prof. Hamilton was looking at a broader question: Can an economy learn to live with increasingly high oil prices? After looking again at his article again, I realize that he is talking about a narrow question: Using the figures he was looking at (average gasoline prices across all grades), prices were then near $4 a gallon, as they had been several times in the past, as they bounced up and down.

In that context, what he says is far closer to right than what my analysis of the broader question of whether an economy can learn to live with increasingly high oil prices, below, would suggest. There is a difference, because gasoline prices are not too closely tied to oil prices in short term fluctuations, and because the issue is likely to be as much one of consumer sentiment as anything else, as long as the issue is simply one of gasoline prices in a not-too-wide range. But I think there are some longer-term, more general issues we should be concerned about.

My Analysis of the More General Question: Can an Economy Learn to Live with Increasingly High Oil Prices?

As I see it, increasingly high oil prices weaken an economy because they reduce discretionary spending and indirectly cause people to be laid-off from work. They have many other adverse effects as well–they tend to raise food prices, with similar effect. The laid-off workers require unemployment compensation payments, and the same time they are contributing less tax revenue. All of this creates a huge imbalance between revenue collected by governments and expenditures paid out. If oil prices rise again, it will tend to make the imbalance worse.

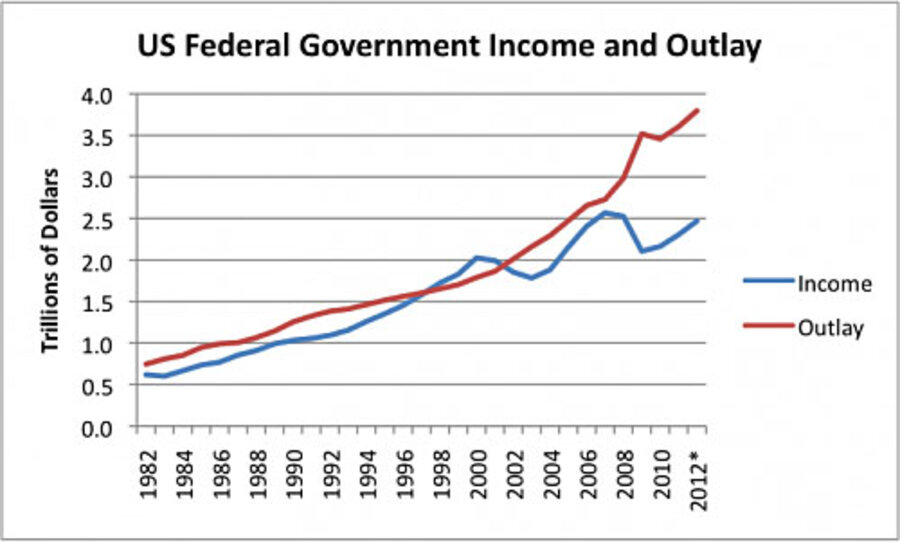

An economy such as the United States can cover up the problems caused by high oil prices with variety of financial techniques. In my view, high consumer confidence measures the success of those cover-ups, more than it measures the actual underlying situation. One way the US government has managed to cover up how badly the economy is being hurt by high oil prices is by spending far more than the government takes in as revenue. This has happened continuously since late 2008, with outgo exceeding income by more than 50% each year, even though the country is supposedly not in recession.

The amount consumers have available to spend on cars and gasoline is very much affected by deficit spending. With deficit spending, government employment can remain high and transfer payments can continue, without anyone really “paying” for these costs, putting more money into the economy to spend on oil and cars.

There are other government programs as well. Interest rates on homes and new cars are being kept at record lows, leaving consumers with more money to spend on cars and gasoline. Low interest rates and low taxes also stimulate employers to hire more employees. Quantitative easing helps contribute to higher stock market prices, and makes it easier for the federal government to keep adding large amount of debt.

To me, the fact that the economy is not currently completely “in the tank” speaks more to the success of stimulus programs than having anything to do with adaptation to higher price levels. Countries such as Greece, Spain and Italy do not have the luxury of being able to hide the impacts of their high cost of oil. They are doing less well financially, but were not included in Hamilton’s analysis.

Easy to Overestimate Impact of Recent Changes in Vehicles

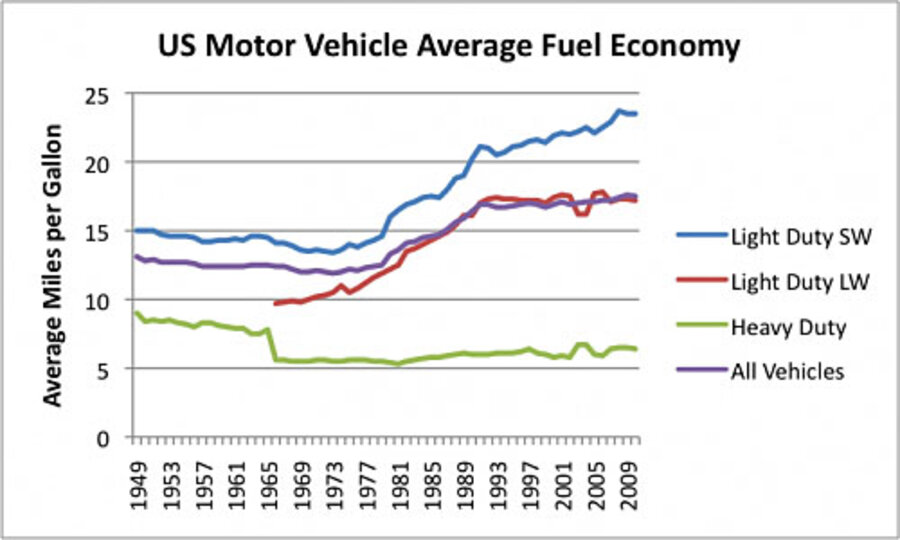

With vehicles, we are dealing with a mixture of vehicles of all ages. The average age of automobiles is now estimated to be 10.8 years. The average age of trucks is no doubt greater. The EIA provides a summary of average fuel economy by type of vehicle based on US Federal Highway Administration Data, summarized in Figure 2.

This data is only through 2010. While it shows some improvement in efficiency of light duty short wheelbase vehicles, it shows little improvement in efficiency overall. The big increases in efficiency were in the period between 1973 and 1991.

The mix of cars by type is concerning.

The percentage of automobiles has been dropping, as the number of SUV and trucks has been rising. The change between 2008 and 2010 reflects the fact that the number of “automobile” registrations dropped by 4.5% in that time-period, while the number of other (larger) vehicles rose slightly. Thus, the long-term trend to relatively more of the larger vehicles continued. Obviously, this data doesn’t show carpooling and other adaptations, but it is difficult to see any recent big trend toward efficiency.

Can the Economy Weather another Rise to $4.00 Gasoline?

The question of whether the economy can weather $4.00 gasoline, to me, depends on the issue of whether the US government can keep coming up with more manipulations to hide its financial problems.

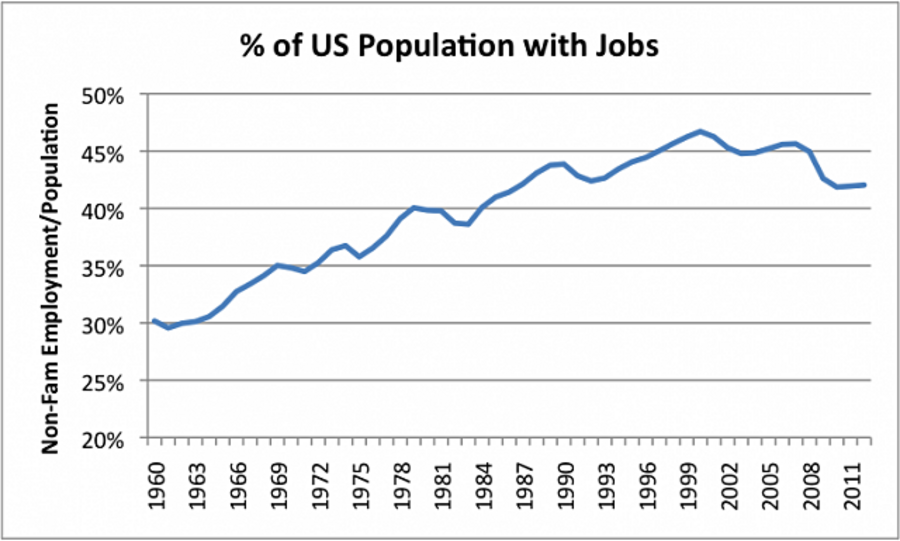

The US economy started to run into severe headwinds about the year 2001. This is when the percentage of Americans with jobs started falling.

While economists don’t seem to attribute past economic growth to increasing employment percentages, it seems logical to believe they played a role in the long-term growth in the 1960 to 2000 period. The economic growth came not just from the work these employees did themselves, but from the fossil fuels they used on the job. The wages the employees obtained for doing the work allowed the workers to buy products others had made. The long-term growth in non-farm employment between 1960 and 2000 was enabled by increased productivity in the agricultural sector, which was also fueled by increasing use of fossil fuels.

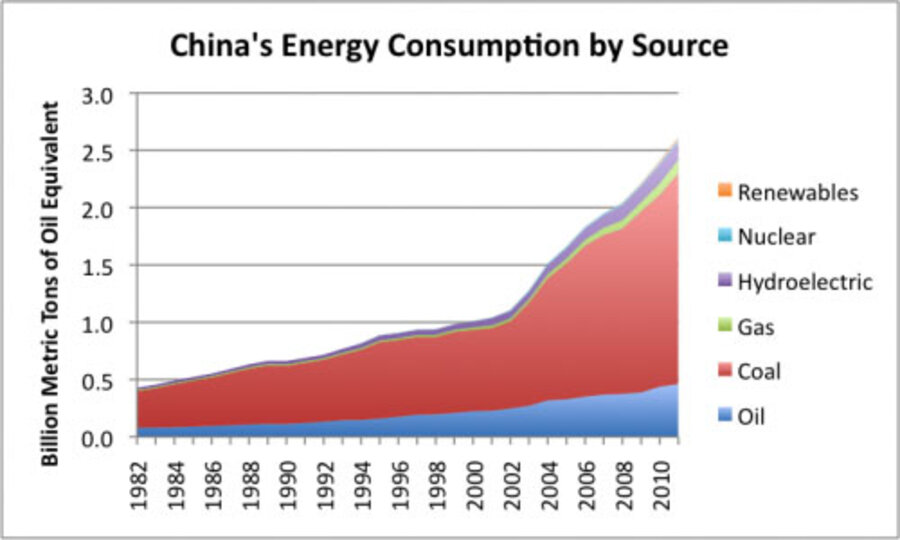

The percentage of the US population with jobs started falling starting in 2001. This is very close to the time when the US started importing far more goods from China, India, and the rest of Asia. If we look at energy consumption for China, we see a sharp increase in energy consumption about 2002:

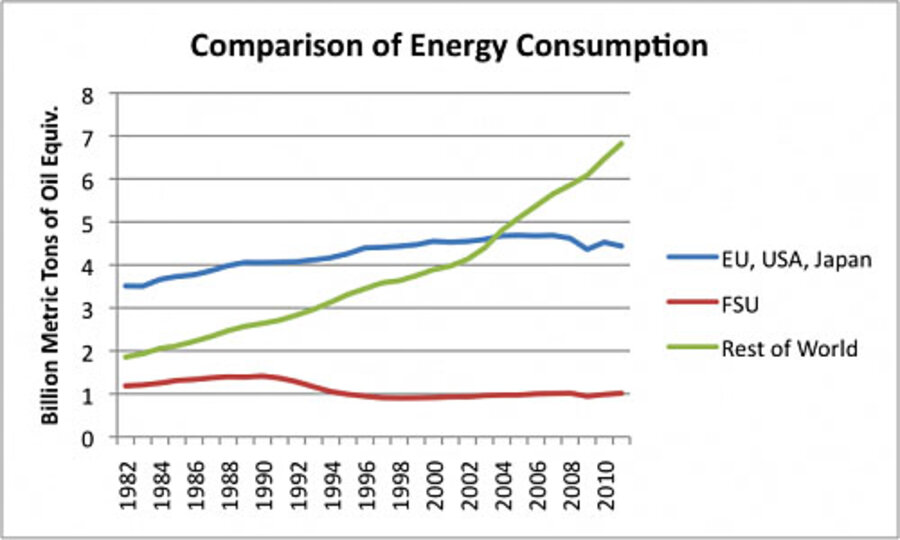

We can also look at broader groupings of energy consumption, and see a similar pattern:

The cost of goods produced in Asia is cheaper for two reasons:

(1) They tend to use a lot of coal in their energy mix, keeping energy costs down.

(2) Wages are far lower. One reason wages can be lower is because of the warmer climate.

It seems to be an article of faith of economists today that the US economy and the European economies will return to growth. Then the stimulus can be removed, and everyone can live happily ever after. But is this really something we should be expecting? We really have two kinds of headwinds: (1) higher oil prices, and (2) cheaper competition for jobs from Asia and other developing countries.

As far back as 2001, we read about Greenspan stimulating the economy by lowering interest rates. Various other approaches were used as well, including encouraging more home ownership through subprime loans in the 2002 to 2006 period. The greater demand for homes helped create jobs in the construction industry and helped raise home prices. By refinancing their homes, consumers were able to have funds for purchases they could not otherwise afford. In recent years, we have added a whole list of new stimulus approaches.

I would ask: Aren’t we kidding ourselves if we think a small increase in miles per gallons on new cars is going to fix the problem of another upward bounce in oil prices? Aren’t there some much more basic issues “out there” that need to be fixed as well? Aren’t we fighting two kinds of downside risks to the economy with increasing stimulus, and only marginal success? If oil prices rise some more, aren’t we likely to need “more stimulus”? Where would it possibly come from?