We could use a little economic disaster

Loading...

More Disasters, Please!

Whoa. Tuesday’s gains had disappeared before traders’ coffee had gone cold, yesterday morning. The Dow ended the day down 173 points…signaling what looks like a 7th straight week of losses. Stay tuned.

Oil ended the down at $95. The dollar went up.

The trouble with the financial catastrophe of ’07-’09 was that there wasn’t enough of it.

“What recovery?” asks TIME Magazine this week.

There is no recovery. Of course, you knew that, dear reader.

But what no one seems to know is ‘why’. So we’d like to make a small contribution to the intellectual life of the economics profession and the popular understanding of the events before, during and after the crisis of ’07-’09. That is, we’d like to explain.

How come the economy is so listless? How come there are so few jobs? How come house prices are falling?

We’ll tell you. Because the dopes running economic policy didn’t give catastrophe a chance! Instead of letting disaster wipe out all the bad investments, bad investors, bad bankers, and bad businesses, the feds pumped in money to keep them going. Well, guess what. They’re still going!

Four years after the crack up in the US subprime debt market, there is still no sign that things are getting back to ‘normal.’ Growth rates are low or negative – 1.8%, 0.5% and minus 3.5% in the US, Britain and Japan, respectively. Decent jobs are hard to find. Household earnings and balance sheets are sinking.

The only positive thing that can be said is that we dodged a worse disaster. In Japan, for instance, economist Richard Koo credits financial officials. Through 20 years of on-again, off-again deflation, they avoided a big loss in GDP and kept everyone working. Yes, stocks and real estate fell 80%…but by bailing out big business and the banks, catastrophe was averted.

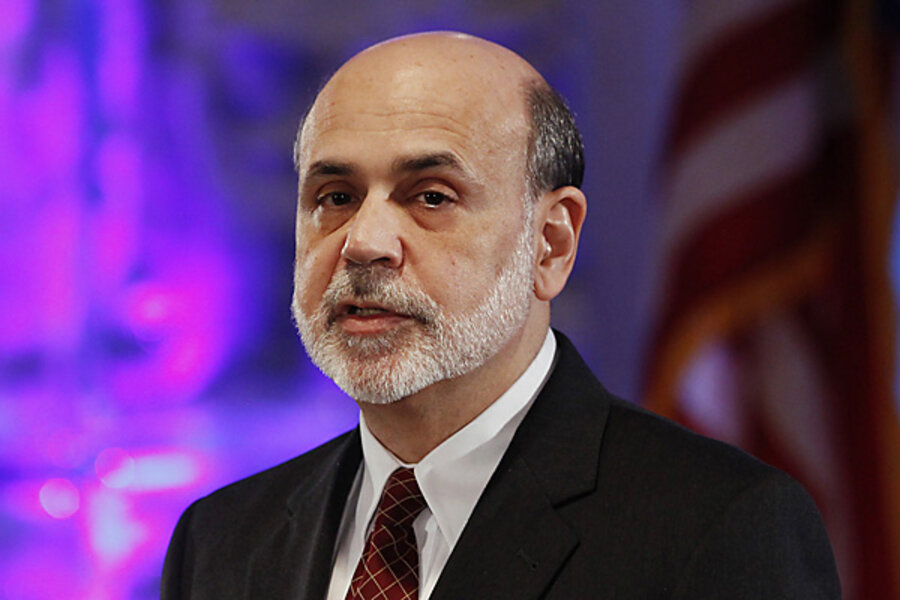

Then, in ’08-’09, it was the West’s turn to duck. Says former US Treasury Secretary Laurence Summers: “We averted Depression in 2008/2009 by acting decisively.” In America, Ben Bernanke, Barack Obama, Tim Geithner and everybody else rushed to save the economy, just as the Japanese had done before them. Bernanke warned Congress that if they didn’t pass the TARP legislation immediately, “we might not have an economy on Monday.”

He should have shut up.

Then, he levered the Fed’s balance sheet so that it acted like a dike. The floodwaters passed; the US economy was spared.

In Europe, Britain bailed out its banks. Europe rushed money to Ireland, Spain and Portugal. And Ireland guaranteed every Mick and Paddy’s savings.

These efforts too were successful. Every economy in Europe is still afloat. Barely.

“Traditionally, the US economy has recovered robustly from recession,” continues Mr. Summers in The Financial Times on Monday, “…within a couple of years after the only two deep recessions of the post first world war period, the economy grew in the range of 6% or more – that seems inconceivable today.”

We’re not even close. Since the crisis, growth in the US has averaged less than 1% a year. Properly adjusted for inflation and population growth, per capita GDP has declined and is now almost certainly negative by more than 2%. This explains why millions of people remain jobless 2 years after the recession supposedly ended. Ten million fewer people have jobs now than 5 years ago. The official unemployment rate is back over 9%, with 25 million who lack full time work.

And while Americans’ earnings slip, so do their balance sheets. The Fed’s latest dose of QE medicine revived the stock market, but not the housing market, which is where most people have most of their money. The latest figures show house prices off by 40% in real terms, and still falling.

In Britain, according to one estimate published in The Financial Times this week, the typical middle-class working household will be 720 pounds worse off in real terms in 2012 than in 2009.

Japan, meanwhile, is in such a funk it looks like it may never get out. And Europe is still bailing out the bankers whose loans hurt everyone but themselves.

In all four economies, the rescue strategy is basically the same. Look at the European situation, for example. Greece has just been downgraded; default (as predicted here at The Daily Reckoning) now appears unavoidable. But here’s the good news: default also could be catastrophic.

Who’s the Greeks’ major creditor? The European Central Bank. As of the end of the first quarter, Greece had borrowed 90 billion euros from the ECB. Against this, the ECB has all of 5.3 billion euros in capital. In other words, if the Greek debt loses just 6% of its value, Europe’s central bank is underwater.

But wait, it gets worse. The Europeans have used the ECB as a small town uses a landfill. Everything gets dumped there. In addition to the Greek debt, the ECB holds dubious paper from 17 member central banks, totaling some $1.9 trillion of assets. Against these assets, the ECB lends to Ireland, Portugal, Spain and other needy states, taking their paper in return. If the debtors don’t make their payments, the ECB’s ‘assets’ lose their value and the ECB will go broke. The next critical challenge comes in July, when Greece will need more money. Commentators, economists, and meddlers have already warned that if the Greeks aren’t taken care of, there will be a disaster.

Great! Avoiding disaster didn’t work. Let’s try another approach.

“The contagious impact on the rest of South Europe and Ireland would, as [Mr. Trichet] has said, be all too similar to the aftermath of the Lehman collapse,” writes John Plender.

So, the ECB will lend in order to keep Greece, and itself, in business. But by lending more, it doesn’t improve the quality of its credits; au contraire, it makes them even worse.

The Japanese are in the same general predicament. There, the government must borrow to meet its expenses. At 210% of GDP, it no longer has a hope of ‘growing its way out of debt.’ Instead, the best it can hope for is to grow its way deeper into debt for as long as possible.

Likewise, in America the critical moment comes in August. That is when the statutory debt limit will be breached. Ben Bernanke has already issued another warning. If members of Congress don’t get their act together and allow the federal government to borrow more, all hell could break loose.

Based on these facts, we have a modest insight: perhaps its time to let the calamity happen. There are several brick walls approaching. Let’s aim for one of them and see what happens.

Add/view comments on this post.

--------------------------

The Christian Science Monitor has assembled a diverse group of the best economy-related bloggers out there. Our guest bloggers are not employed or directed by the Monitor and the views expressed are the bloggers' own, as is responsibility for the content of their blogs. To contact us about a blogger, click here. To add or view a comment on a guest blog, please go to the blogger's own site by clicking on the link above.