Is the Fed using phony numbers?

Loading...

Ouzilly, France – Remember our discussion of prices yesterday? Here at The Daily Reckoning, we have nothing against higher prices…and nothing against lower prices. It’s dishonest, misleading, and treacherously false prices that we don’t like. They send the wrong information. They may tell us that an item is plentiful, for example, when it is actually in short supply. They may cause us to invest our money in the belief that profit margins are increasing when they are actually shrinking. They may also induce us to expand production, when the world already has far too much of what we have to offer.

And unfortunately for the market system, we live in a world of phony prices. Nobody knows what anything is really worth… Let’s take a simple concept like consumer price levels, generally. According to the feds’ calculation they’re barely rising at all. But if you computed them the same way the Europeans do, you’d find the US price level moving up at 3.5% per year.

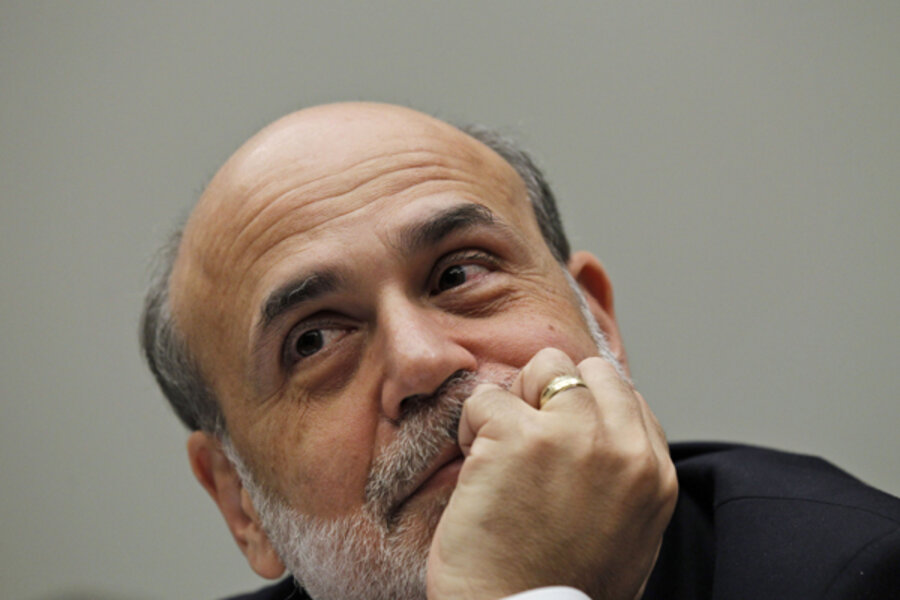

So, then you’d have to wonder whether Bernanke and company should be concerned at all. If it’s inflation they want, inflation is what they’ve got. Maybe. We don’t know. We can’t trust prices…or the calculation of price levels.

But the Bernanke team probably has to trust its own numbers. After all, if you can’t trust numbers you twisted yourself, what is the world coming to?

Besides, whether the inflation rate is 0.5% or 3.5% hardly matters. People don’t have jobs. They don’t have incomes. They don’t have much desire to vote for sitting politicians. And Ben Bernanke is going to lose his reputation – such as it is – if he allows this Japanese-like slump to continue.

So, what’s he going to do. He has to “do something”…but what? Well, there aren’t many choices. About the only thing he has left is “quantitative easing.” Yes, maybe stock market investors are right. Maybe they don’t really think stock prices are going to rise. Maybe what they’re really worried about is that cash will turn out to be a bigger trap that stocks. After all, if there is one thing a central bank ought to be able to do – if it puts its mind to it – is create ‘positive’ inflation. And it looks as though the Bernanke Fed will go all out to do it.

The Fed’s Open Market Committee meets next week. Most likely, they’re going to threaten to buy more treasury bonds. That’s the way they hope to get more dollars in circulation and raise consumer prices – thus encouraging both “positive” inflation and consumer spending. If that doesn’t work, they’ll have to resort to even more radical solutions – such as dropping money from helicopters.

They’ll keep at it, most likely, until they get the job done. Whether that will take 6 months or 6 years – we don’t know.

In the meantime, the sensible investor may figure he’d rather be in, say, Exxon or Intel or Johnson & Johnson rather than in the US dollar. Many of the blue chips are cheap. They will probably get cheaper. But then, once the Bernanke inflation machine begins to get some traction, they will probably be a much better place for you money than cash.

Add/view comments on this post.

------------------------------

The Christian Science Monitor has assembled a diverse group of the best economy-related bloggers out there. Our guest bloggers are not employed or directed by the Monitor and the views expressed are the bloggers' own, as is responsibility for the content of their blogs. To contact us about a blogger, click here. To add or view a comment on a guest blog, please go to the blogger's own site by clicking on the link above.