Ryan's mystery meat budget

Loading...

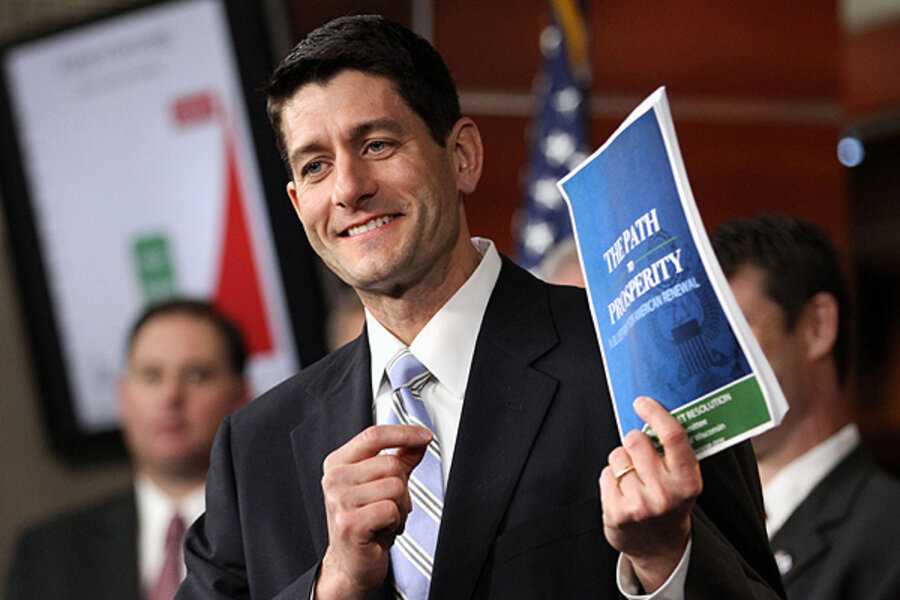

I am weary of mystery meat. The latest serving was dished out yesterday by House Budget Committee Chairman Paul Ryan (R-WI), who released a fiscal plan that airily promises both trillions of dollars in tax cuts and a nearly balanced budget within a decade, but never says how he’d get there.

Ryan isn’t saying that his budget implies cuts of $4.6 trillion in popular tax deductions, credits, and exclusions over 10 years, according to new estimates by the Tax Policy Center. And that ignores the $5.4 trillion in revenue lost from permanently extending the 2001/2003 tax cuts.

Ryan proposes big, specific spending reductions such as cutting Medicaid in half and slashing other federal spending (except for Social Security, Medicare, and Medicaid) by nearly 75 percent from current levels by 2050. But his budget still can’t add up without eliminating or sharply scaling back those popular tax preferences. Which ones, it seems, remain a state secret.

Ryan rolled out a 2013 budget that promises to replace the current individual rate structure with just two rates– 10 percent and 25 percent. He’d repeal the Alternative Minimum Tax and abolish the tax increases included in the 2010 health law. For business, he’d lower the corporate tax rate from 35 percent to 25 percent and shift to a territorial tax system, where multinationals would owe no U.S. tax on foreign earnings.

All of this would reduce tax revenues by trillions of dollars over 10 years. The Tax Policy Center estimates that a similar corporate rate cut, AMT repeal, and a two-rate individual system would reduce revenues by about $4.5 trillion through 2022, even after accounting for the $5.4 trillion cost of extending the 2001/2003 tax cuts. In 2022 alone, a Ryan-like plan would reduce revenues by about $600 billion.

To put it another way, TPC figures such a tax package would generate revenues of about 15.8 percent of Gross Domestic Product in 2022. His budget aims to collect about 18.7 percent. That means he’d have to find about $700 billion in new revenues by cutting tax preferences.

Keep in mind that TPC did not model the actual Ryan plan, since it is not specific enough to estimate. Instead, we looked at a plan with the elements of his proposal.

But the rough numbers are stark. And Ryan, who knows better, studiously avoids naming names when it comes to eliminating tax preferences. Oh, his budget includes a convincing and articulate explanation about what’s wrong with a tax system with high rates and a narrow base. He just doesn’t say what he’d do about it.

There is a disquieting echo here of President Obama, who so recently did such a great job explaining what’s wrong with our corporate tax system. The president happily proposed a politically popular cut in corporate rates to 28 percent, but identified offsetting tax increases that would cover only a fraction of the cost.

All of the major GOP presidential candidates have played the same black box game—promising huge rate cuts without ever saying how they’d pay for them.

Ryan asserts there is “an emerging bipartisan consensus for tax reform that lowers rates, broadens the tax base, and promotes growth and job creation.” Actually, he’s wrong. There is an emerging bipartisan consensus to embrace lower rates without ever saying how to pay for them.