How likely is another US recession?

Loading...

While it is well know that “all good things must come to an end”, on “mediocre things”, we are totally in the dark, adrift without any wise or memorable turn of phrase to help lend a guide.

To that end, and given the current state of affairs, I think now is about as good a time as any to start directly tracking the probability of recession.

First, let’s remember that while the NBER makes the official call of both the “peak” of a business cycle expansion and the “trough” of the subsequent recession, their officiating is delayed to say the least.

For a more “real time” assessment of the prospects of recession, various methods of number crunching have been formulated to distill out a basic probability assessment from several underlying macro series data sets.

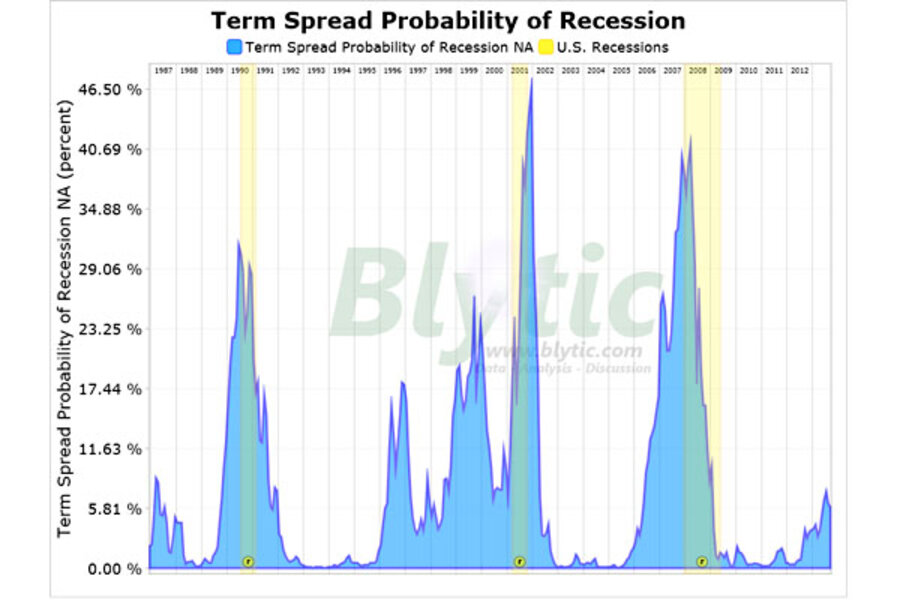

First, there is the popular yield-curve based “Term Spread” probability method.

Spearheaded by economist Professor Arturo Estrella of the Rensselaer Polytechnic Institute, this method derives a probability of recession from the spread between long and short yields (10-year and 3-month) and is by all accounts the standard for recession probability forecasting.

The latest data indicates that the probability for recession is starting to rise with a September 2013 probability (the probability that there will be a recession by that date) of 5.9%.

Keep in mind that a positive indication using this method would require this probability to reach 30% so while the probability is clearly rising, the current probability is still quite low.

In 2008, Marcelle Chauvet of the University of California and Jeremy Piger of the University of Oregon published a paper titled “A Comparison of the Real-Time Performance of Business Cycle Dating Methods” which outlined two novel statistical methods (most notably the markov-switching method) for distilling recessionary turning points out of the very same macro data series that the NBER uses to make it’s cycle assessments.

As of August (the latest data… there is a lag), the markov-switching method is indicating a 19.6% chance of recession, a notable finding to say the least.

In fact, a probability this high has positively indicated every recession since 1967, (the extent of this probability series) an ominous harbinger for sure, but before you head for the window, remember that this probability series is HIGHLY revised as a result of the revisions made to the underlying macro series.

As always, it will take more time to determine for sure whether the current mediocre “expansion” is drawing to a close, but looking at both of these sensitive indicators, one could clearly argue that the probability of that prospect is on the rise.