Why Romney can pay a 15 percent tax rate

Loading...

Republican candidate Mitt Romney believes his effective tax rate—the share of his income he pays in federal taxes is around 15%, or, as he put it, “probably closer to the 15 percent rate than anything.”

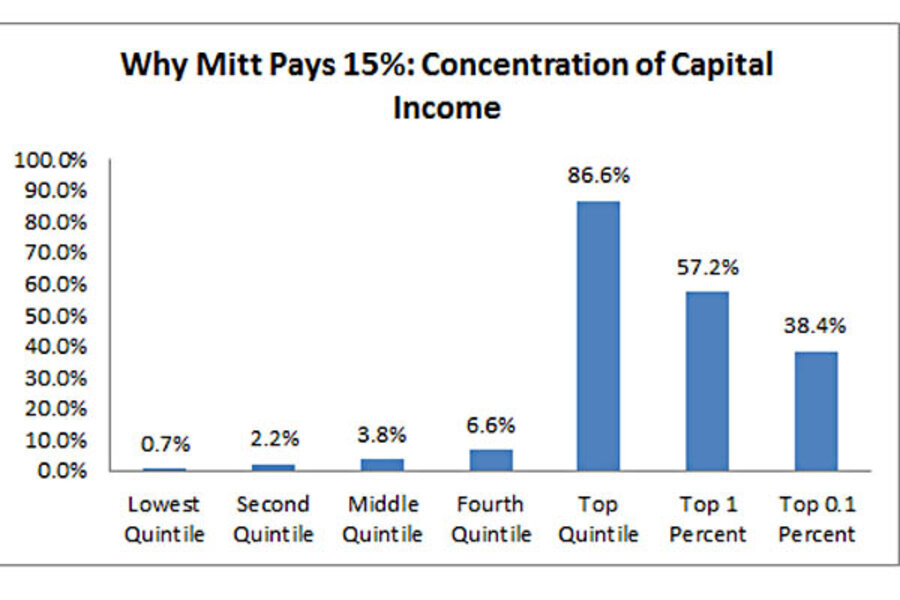

15% is the current rate on capital gains and dividends, which presumably comprise most of his income. The figure below, using data recently released by the Tax Policy Center, shows who mostly gets this type of income. To be clear, this is not yet the “bitter politics of envy”…so far, it’s just numbers.

Ordinary income, like paychecks, is taxed at a top rate of 35%, going to about 40% if the sun should ever set on the highend Bush cuts. The average effective rate for federal taxes these days is around 20%, about five points higher than Mitt’s. Basically, he’s paying what a middle class family—average income, around $65K, pays in federal taxes.

Is this a problem? Well, the fact that our tax code favors assets over wages is one factor behind the rise in income inequality. It’s also one reason we’re starved for revenues—this new report from the Joint Committee on Taxation shows that the favorable treatment of cap gains and dividends will cost the Treasury about $450 billion between 2011 and 2015 (that’s the whole American Jobs Act, right there!). Then there’s basic fairness…(whoops, straying from the numbers!)

And for what? The evidence doesn’t support the view that favoring asset-based income raises investment, productivity, or job growth.

Frankly, I doubt many people are envious about the above. I suspect few begrudge the wealth. What I think bothers people is the tax breaks on the wealth. And that’s more anger and disgust than envy. Just to be clear.