Dems fight over 3 percent of the tax deal

Loading...

The Senate is about to pass the full tax cut “compromise,” but House Democrats are trying to hold out for a more fiscally responsible option. From the Washington Post’s Lori Montgomery (emphasis added):

The strong Senate vote also appeared to have weakened resolve among House Democrats to block the measure when it comes to the floor this week. After meeting for two hours with rank-and-file lawmakers late Tuesday, senior Democrats said the House is likely to stage votes to change the terms of a revived estate tax that many Democrats view as overly generous to the wealthy.

Outraged by the agreement to exempt individual estates worth as much as $5 million from taxation, senior Democrats said they would press to lower the threshold to $3.5 million. They also want to impose a stiffer tax on larger estates, by setting the rate at 45 percent rather than the 35 percent demanded by Republicans and agreed to by Obama.

Those are the same terms that were in effect in 2009. The estate tax expired for the 2010 tax year but is set to spring back to life next month with much tougher provisions. House Democrats said their alternative would hit only about 6,600 of the nation’s wealthiest households while raising an additional $26 billion over the next two years compared with the Obama-GOP compromise - money that could be used to reduce the soaring national debt.

“There’s a real debate here between Republican proponents of tax cuts for the very richest Americans and our argument that that’s fiscally irresponsible and unfair to future generations,” said Rep. Peter Welch (D-Vt.), who was leading an effort to strip the tax package of what he called “indiscriminate giveaways” for the wealthy.

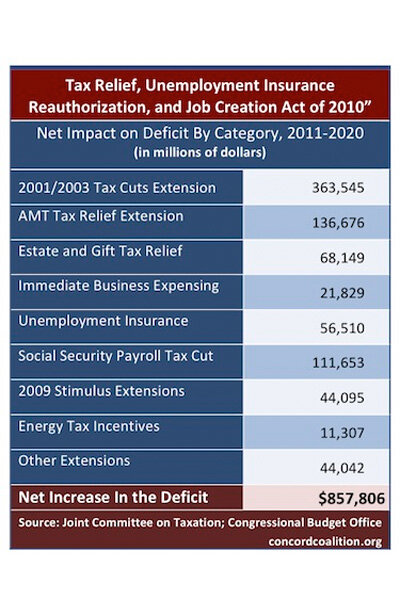

I agree that we shouldn’t need to deficit spend that additional $26 billion, which would benefit such a tiny fraction of the richest Americans who don’t exactly need any help–to spend or to save or to do whatever. But this is an even more perverse version of President Obama’s wish to “save” the $700 billion 10-year cost of extending the high-end Bush tax cuts while urging the deficit spending of the $2.2 trillion 10-year cost of extending all the rest of the Bush tax cuts. Note that the $26 billion House Democrats wish to shave from the estate tax cut, for fiscal responsibility’s sake, is just 3 percent of the cost of the ($858 billion) tax cut deal. It’s really more about House Dems trying to avoid getting completely shut out from the deal than about them saving the whole deal from fiscal irresponsibility.

What might really make this $858 billion tax cut “compromise” nevertheless “fiscally responsible”? From the policy piece the Concord Coalition issued a few days ago (emphasis added):

Two points are worth stressing.

First, there should be no professed “sticker shock” regarding the deficit impact of this agreement. Policymakers have always known, or should have known, that continuing current policies would substantially increase projected deficits. This would be true regardless of whether the tax cut extensions were limited to the “middle class” or applied more broadly. If fundamental tax reform is not undertaken soon, the $850 billion price tag of this agreement will be just a small sample of things to come.

Second, the extension of many narrow tax preferences in the Senate’s legislative version of the agreement runs directly counter to the widely praised recommendations of the President’s fiscal commission and the Rivlin-Domenici Task Force. Both groups made a strong case that scaling back or eliminating such “tax expenditures” could be used to build a more efficient system for revenue collection, lower rates and also raise needed revenue. Ignoring this advice, as the agreement clearly does, is a discouraging signal that business-as-usual in Washington has not yet been altered.

Whether this deal is fiscally responsible will ultimately be determined by what Congress does prior to the expiration dates of its main components. Ideally, these short-term policies will give Congress and the President time to consider fundamental tax reform along with the bi-partisan suggestions from the President’s fiscal commission for long-term spending restraint.

The sooner we can break out of the box from our current patchwork of tax-cut sunsets and tax expenditures and replace these policies with a more efficient, more permanent, and more responsible tax policy, the easier it will be to break out of the short-termism affecting the rest of the nation’s fiscal policy.

The outpouring of credible plans from partisans and policy wonks in response to the work of the President’s commission has made clear that nearly everyone in Washington longs to fundamentally transform the tax code — making it the most sensible area for the nation’s leaders to immediately begin our long march towards responsible budget policy.

I remain optimistic that a temporary extension of all of the Bush/Obama tax cuts is better than a permanent extension of any part of them, in increasing our chances that we will “trade up” to a better and more fiscally responsible federal tax system in the next couple years.

Add/view comments on this post.

------------------------------

The Christian Science Monitor has assembled a diverse group of the best economy-related bloggers out there. Our guest bloggers are not employed or directed by the Monitor and the views expressed are the bloggers' own, as is responsibility for the content of their blogs. To contact us about a blogger, click here. To add or view a comment on a guest blog, please go to the blogger's own site by clicking on the link above.