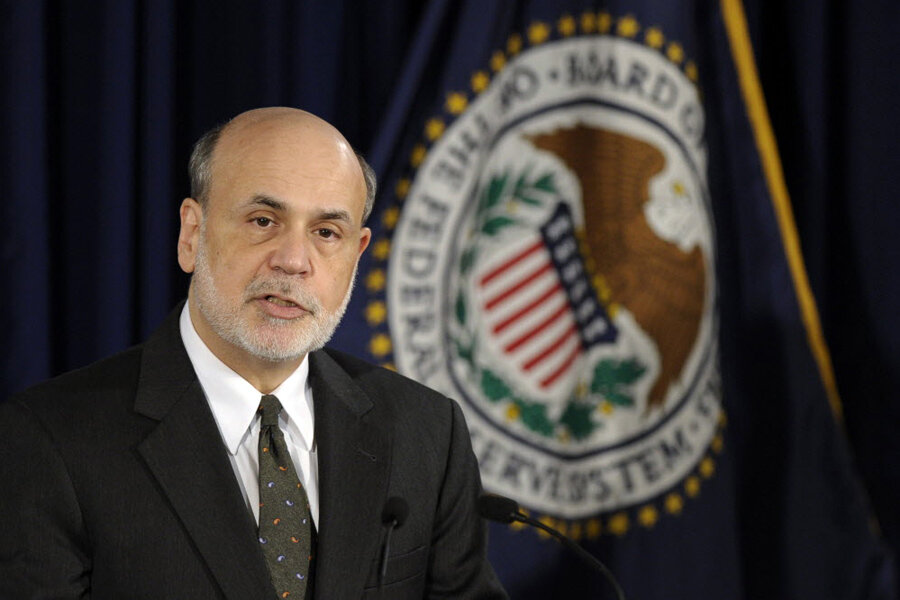

Bernanke lets Wall Street down easy: Stimulus to end, but not yet

Loading...

When stock prices fall 1 percent in a single day, that’s a move that’s sizable but not too unusual. So perhaps Ben Bernanke should feel pretty good about his latest effort to communicate Federal Reserve policy and manage investor expectations.

Investors around the world were anxiously awaiting clarification of how long the Fed will continue its programs of monetary stimulus for the economy.

On Wednesday Fed Chairman Bernanke said one of those supports – a policy of buying about $85 billion in bonds each month – could start phasing out later this year.

But he characterized this as easing up on the accelerator, not applying the economy’s monetary brakes.

US stock prices took a dive of about 1 percent as he spoke. Bernanke wasn’t announcing a change of policy, but he had a delicate task of explaining the Fed’s looming decision more clearly – while not boxing the central bank into any future action.

Investors have been strongly influenced by Fed policy ever since the financial crisis of 2008-2009, so a market swing of 1 percent isn’t that big a deal on a day that the Fed chairman is speaking.

Bernanke said the Fed might slow the pace of its bond-buying program, known as quantitative easing (QE), later this year if the economy keeps improving. And the Fed might stop expanding its portfolio of Treasury and mortgage bonds altogether when the unemployment rate falls to 7 percent.

That could come in 2014. Currently the US jobless rate is 7.6 percent. Bernanke likened this to simply removing pressure from a car’s accelerator when it reaches “cruising speed,” rather than to an outright tightening of monetary policy – which would be akin to applying the brakes.

“Our policy is in no way predetermined,” he added, in one of several reminders during his press conference that the Fed’s policymaking committee won’t be bound to a timetable if economic conditions change.

On interest rates, another key Fed policy, Bernanke said the Fed’s outlook currently envisions no policy change before 2015. That is, most members of the policy committee don’t expect to raise the Fed’s short-term lending rate for banks from its current low level of zero to 0.25 percent.

When the rate does start to rise, it is “likely to be gradual,” Bernanke said.

The Fed chairman refused to comment on another issue of hot speculation: Whether he wants to leave his job when the current four-year-term expires early next year.

“I don't have anything for you on my personal plans,” he said.

President Obama, who would be responsible for nominating a new Fed chairman, said this week that Bernanke has “already stayed a lot longer than he wanted.”

Despite a lot of “taper talk,” speculation about when the Fed might taper off its purchases of assets like mortgage bonds, the Dow Jones Industrial Average has held pretty steady over the past month, generally a bit above the 15000 level. The index closed Wednesday at 15,112.19, about 1.5 percent below its month-ago level.

That said, investors still feel lots of uncertainty about how the Fed’s potential policy changes will shake out.

Among the questions affecting investors:

• How much will a tapering of bond purchases by the Fed affect mortgage rates? And would rising interest rates for home buyers slow the housing market recovery in a meaningful way?

• Similarly, would a tapering of QE affect global financial conditions, raising borrowing costs in emerging-market nations, for example?

• Is the Fed being too optimistic about the US economic recovery? The tapering of QE is predicated on the notion of an improving economy, yet some independent forecasters see the Fed as being overly rosy in its expectation of the gross domestic product growing by 2.3 to 2.6 percent this year.

• If the Fed outlook is too rosy, what gives? Does that mean the bond purchases will remain in place longer than expected, or could the Fed’s policy committee still downshift on stimulus even if economic growth is tepid and the inflation rate isn’t hitting the Fed’s 2-percent target?

Bernanke spoke Wednesday after the Fed committee he chairs released a policy statement and a set of economic forecasts.

The forecasts showed that top Fed officials expect an inflation rate of about 1 percent this year (as measured by the government’s “personal consumption expenditures” data). That compares with the 2 percent rate the Fed considers desirable.

In response to a question, Bernanke acknowledged that this is a source of worry. The Fed wants relatively stable prices, but if inflation dips too low it leaves little cushion against the risk of deflation (or falling consumer prices), which is viewed as a tougher challenge than inflation for the economy.

“Inflation that's too low is a problem,” Bernanke said.

In his press conference, Bernanke reiterated that short-term interest rates are likely to stay near zero until the unemployment rate drops to 6.5 percent (as long as the inflation outlook remains tame).

And even when the jobless rate reaches that level, Bernanke said that would be the threshold for considering the short-term interest rate, not an automatic trigger for changing it.

The Fed’s “dual mandate,” he noted, is to keep inflation controlled while allowing for maximum employment in the economy.